The global cross-border payments market was valued at $212.55 billion in 2024 and is projected to reach $320.73 billion by 2030, expanding at a 7.1% CAGR. Yet sending money internationally remains expensive. According to the World Bank, the average cost of transferring $200 across borders still exceeds 6%, more than double the UN’s 3% affordability target.

This gap has accelerated interest in crypto-enabled settlement, where digital assets may reduce intermediaries, shorten settlement times, and lower friction. As a result, searches for Revolut alternatives are rising, particularly among users who move money frequently across currencies and jurisdictions.

Three services commonly discussed as alternatives to Revolut include:

- Digital ($TAP) – a crypto-fiat app the project describes as built for global money movement

- Wise – Cost-Efficient Fiat Transfers With Clear Pricing

- Transak – Fiat-to-Crypto Infrastructure for Web3 Payments

How Digitap Connects Crypto, Cash, And Cross-Border Use

Digitap is built around a simple assumption: modern cross-border payments are no longer strictly fiat. Freelancers, merchants, and remote teams may receive income in crypto, convert part of it to cash, and spend globally.

Most financial apps still separate these actions across multiple platforms. Digitap aims to consolidate them.

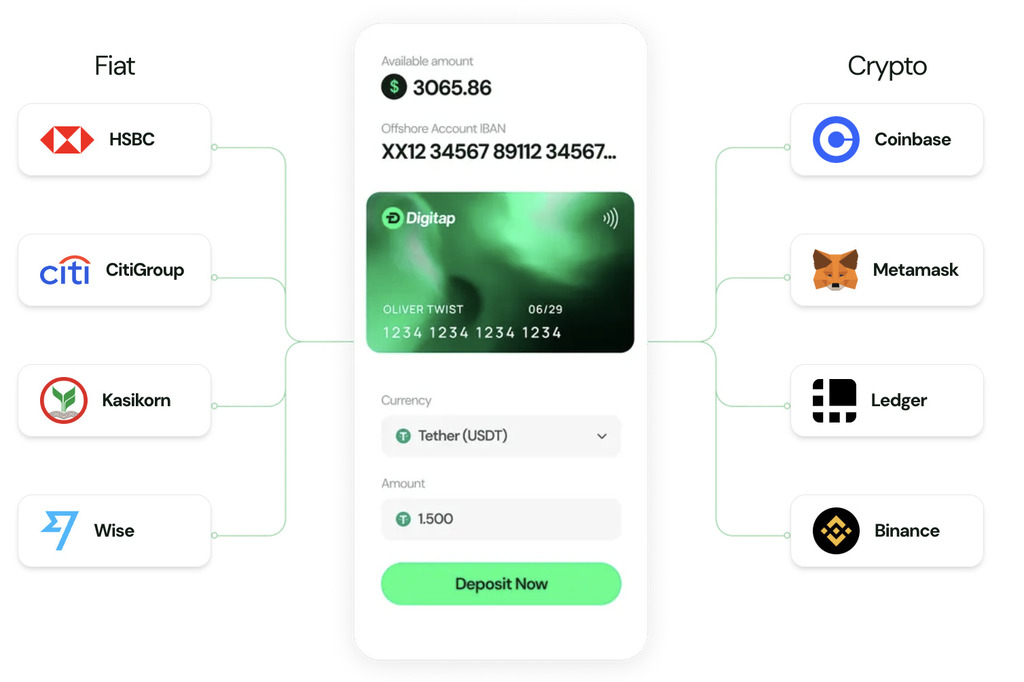

The platform is described as a crypto-fiat omni-bank, combining multi-currency fiat accounts, a multi-chain crypto wallet, in-app swapping, and Visa card spending in one application.

Crypto can be received, converted to cash, and spent globally without leaving the app. The company says Digitap is live, with 100,000+ connected wallets and more than 5 million transactions processed across 100+ countries.

This positioning presents crypto primarily as a settlement rail rather than a stand-alone asset class, aligning the platform with payment and treasury use cases rather than trading-focused activity.

$TAP Token Utility Within The App

Digitap is positioned as a financial app, and the project states that the $TAP token is designed to be used within the product for rewards and account features.

According to project materials, the token supply is fixed at 2 billion and the project plans to allocate some platform revenue toward buybacks and token burns, which would reduce circulating supply over time. These mechanics and any potential effects are not independently verified.

The project says holding $TAP can unlock in-app benefits, such as cashback on spending, lower transaction fees, access to premium account tiers, and staking rewards. Terms, eligibility, and reward rates can change and may differ by jurisdiction.

The project also states it is running a token sale; readers should treat any token-sale figures, timelines, or marketing incentives as project-reported and subject to change.

Wise Focuses On Transparent Fees For Global Fiat Transfers

Wise remains one of the most established Revolut alternatives for users focused exclusively on fiat. The platform supports 40+ currencies, transfers to 80+ countries, and global spending via its debit card.

Its core focus is fee transparency. Wise uses mid-market exchange rates and discloses fees that may vary by corridor and payment method. For users sending salaries, invoices, or personal transfers internationally, Wise can offer predictability and consistency.

However, Wise does not support cryptocurrencies, blockchain settlement, or tokenized rewards. As crypto increasingly plays a role in cross-border payments, Wise remains a fiat-only solution by design.

Transak Powers Fiat-To-Crypto Payments Inside Web3 Apps

Transak serves a different function. Rather than acting as a consumer banking app, it operates as fiat-to-crypto infrastructure for Web3 platforms.

Founded in 2019, Transak supports 136+ cryptocurrencies across 64+ countries and is integrated into 450+ applications, enabling users to purchase crypto directly inside wallets, dApps, and marketplaces. It manages payments, compliance, and regional coverage for its partners.

For individuals, Transak is typically encountered as a transaction layer rather than a financial hub. It does not provide unified balances, spending cards, or long-term asset management tools.

What These Alternatives Cover

Wise focuses on fiat transfers. Transak supports fiat-to-crypto onboarding. Digitap aims to bring both fiat accounts and crypto features into one interface.

As crypto’s role in cross-border settlement evolves, services that connect on-chain and off-chain payments may be relevant to some users. Any token-related features and supply mechanics should be evaluated as project claims, and users should consider regulatory, custody, and volatility risks.

For reference, the project’s official links are below:

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.