Theta Network (THETA), once one of the most talked-about blockchain-based video streaming solutions, is entering a pivotal phase. With the 2024 launch of its EdgeCloud system and a recent integration with NTU Singapore for AI research, THETA has signaled a commitment to innovation. Analysts forecast that, if the blockchain regains traction, Theta could rebound from its current $1.35 valuation to anywhere between $3.50 and $6 by 2026.

But the path is far from guaranteed. Theta’s EdgeCloud ecosystem, while promising in theory, hasn’t yet seen widespread commercial adoption. Despite hosting 1 billion tokens in circulation and scoring a 47.3 on the CCN strength index, its Relative Strength Index (RSI) hovering near 31 reveals bearish pressure. Should Theta clear its $1.50 resistance and break Fibonacci levels near $1.90, it could enter a bullish cycle. Yet, with its MCap-to-TVL ratio at 862, many analysts warn of overvaluation.

Is Theta Undervalued or Losing Momentum?

Theta’s market capitalization currently stands at $1.33 billion, positioning it as the 66th-largest crypto project. This status reflects its ongoing relevance in the blockchain space, particularly among content creators and streamers. However, this valuation has come under scrutiny. With THETA failing to hold above key technical thresholds, questions loom about its ability to sustain long-term upward movement.

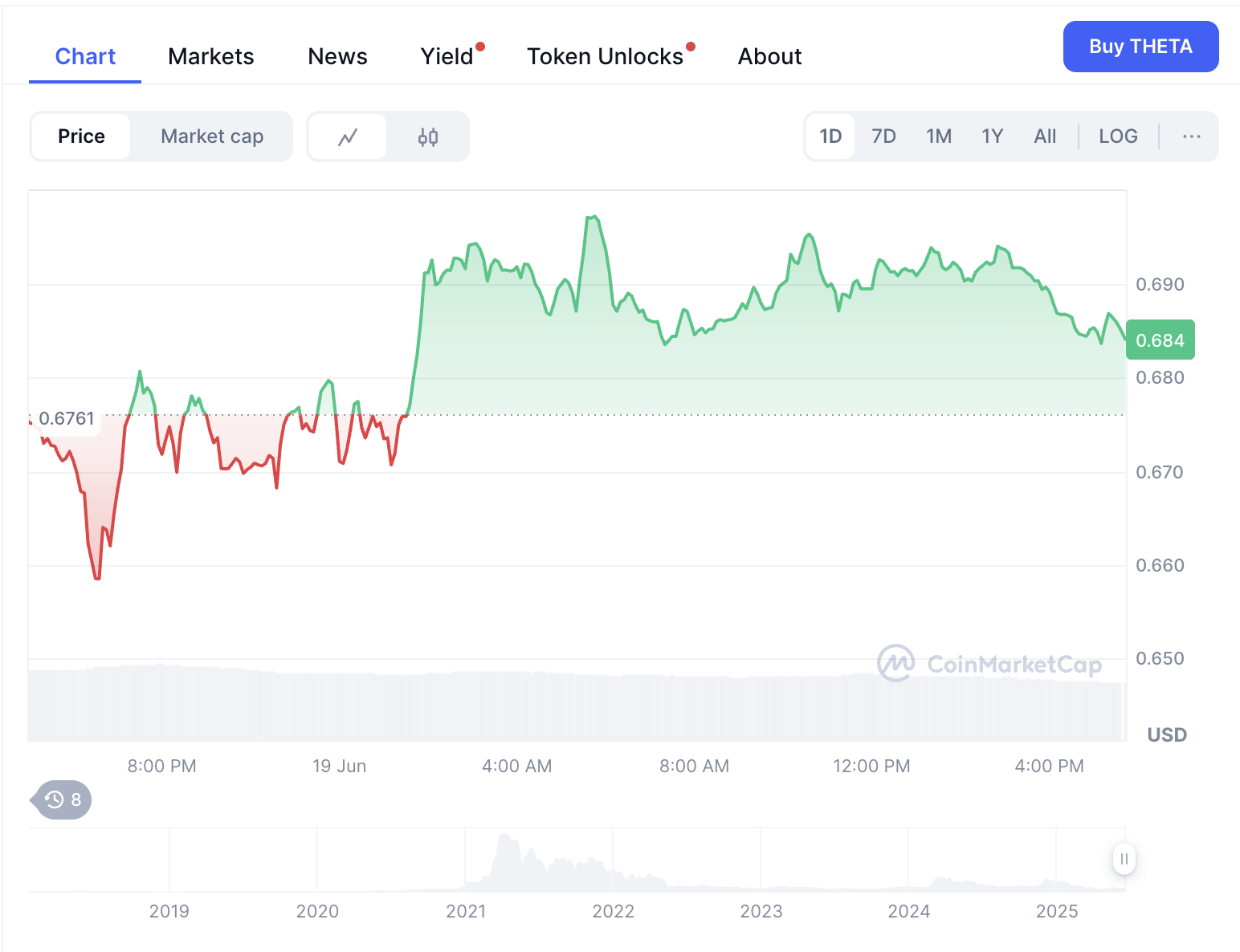

Moreover, historical trends reveal a volatile landscape. From a peak near $15.90 in 2021 to current lows, Theta has experienced one of the more dramatic retracements in the sector. While EdgeCloud might eventually become a key asset for decentralised video processing, its present lack of mass usage is holding the token back.

Some short-term projections are hopeful, predicting wave formations that could push the token near $2.18 if current support levels hold. Still, others caution that failing to stay above $1.20 could trigger a return to the $1 mark. In such a high-risk environment, Theta remains a watchlist coin, but not necessarily a frontrunner.

Qubetics’ Real-World Use Case: A Tokenization Powerhouse

While Theta targets the streaming niche, Qubetics ($TICS) is carving a broader, more foundational path through real-world asset tokenization. As the world’s first Layer 1 Web3 aggregator, Qubetics is not only interoperable with major blockchains but also uniquely capable of digitizing tangible assets, from real estate and commodities to fine art, on-chain.

What makes Qubetics especially attractive is its Real World Asset Tokenization Marketplace. In this environment, businesses and individuals can mint digital twins of real-world assets, trade them, fractionalize ownership, and conduct cross-border settlements in minutes instead of days. For instance, a property management firm in Chicago could tokenize a commercial real estate portfolio and attract fractional co-owners globally, all in compliance with smart contract protocols.

Moreover, for small business owners, Qubetics enables access to liquidity by allowing them to tokenize equipment or inventory without relying on traditional bank loans. The system bridges the gap between decentralised finance (DeFi) and the real economy in a way few others can, turning tangible assets into liquid, tradable tokens. It’s the sort of solution that appeals to early adopters focused not on trends, but on utility and longevity.

This application focus aligns with global regulatory pushes for asset-backed digital infrastructure. As a result, Qubetics has earned attention from finance professionals seeking compliance-ready tokenization tools, pushing the project toward mainstream financial integration.

Qubetics Presale Metrics Signal Long-Term Strength

The crypto presale numbers don’t lie. Qubetics has already raised over $18.1 million across 37 stages, with more than 516 million $TICS tokens sold. The current price per token sits at $0.3370, with only 10 million tokens left before the presale ends. After that, the only access to $TICS will be on public exchanges, likely at a higher entry point.

At the current rate, a $2,500 commitment would return approximately 7,419 tokens. If Qubetics hits $1 post-launch, that stake would be worth $7,419. If the token rises to $5 or $10, returns would scale to $37,095 and $74,190, respectively.

Consider a $4,000 allocation instead. That would buy around 11,871 tokens. If the token climbs to $10, the return could exceed $118,000. Notably, Qubetics’ supply has been reduced from 4 billion to 1.36 billion tokens, with only 38.55% available to the public, a scarcity model designed to reinforce long-term value.

As Qubetics confirms its forthcoming listing on a top-tier global exchange, the market is preparing for what analysts predict could be a 20% price increase at launch. This is more than a technical development; it’s a signal of institutional alignment and broader capital flow. With over $18.1 million already raised in presale, and only 10 million tokens remaining at the current price, the project has been identified by leading analysts as a 100x-capable asset backed by scarcity, scalability, and infrastructure-grade interoperability. The window for acquiring $TICS prior to public exchange availability is narrowing, and strategic participants are already positioning accordingly.

Conclusion: Qubetics or Theta, Which Holds More Weight in 2026?

While Theta has shown signs of life with EdgeCloud and retains potential in the decentralised streaming sector, its recovery depends on market sentiment and enterprise traction that has yet to solidify. THETA might reach $6 by 2026, but only under optimal conditions.

Qubetics, on the other hand, is solving systemic financial inefficiencies now. Its real-world asset tokenization model, reduced token supply, and powerful presale traction position it as a smarter and more future-proof opportunity. In a market where speculative noise often drowns out substance, Qubetics is quietly setting the groundwork to lead the next cycle.

For More Information:

Qubetics: https://qubetics.com

Presale: https://buy.qubetics.com/

Twitter: https://x.com/qubetics

Summary

Theta’s 2026 price forecast suggests potential highs between $3.50 and $6, contingent on widespread EdgeCloud adoption and improved technical momentum. However, weak RSI levels, overvaluation warnings, and limited commercial traction raise doubts about sustainable growth. In contrast, Qubetics is already proving real-world utility through its Real World Asset Tokenization Marketplace. With $18.1 million raised, 516 million tokens sold, and only 10 million $TICS tokens left in presale at $0.3370, Qubetics offers scarcity-backed, high-upside entry. A $4,000 investment could yield over $118,000 at $10/token. Its infrastructure-first model bridges DeFi and traditional finance, appealing to compliance-conscious institutions. In the race to 2026, Qubetics emerges as the stronger, smarter investment for those focused on real use cases and long-term utility. Only a limited supply remains, and with a global exchange listing approaching, timing may be everything for $TICS.

Press releases or guest posts published by Crypto Economy have been submitted by companies or their representatives. Crypto Economy is not part of any of these agencies, projects or platforms. At Crypto Economy we do not give investment advice, if you are going to invest in any of the promoted projects you should do your own research.