TL;DR

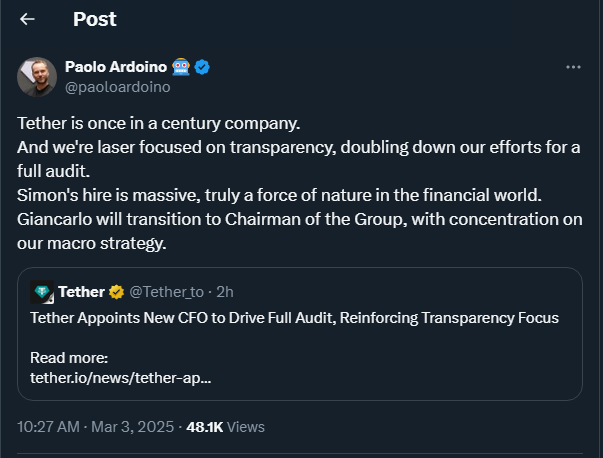

- Giancarlo Devasini, CFO and controlling shareholder of Tether, will transition into the role of Chairman of the company.

- Simon McWilliams has been appointed the new CFO to lead the transition towards a full financial audit of the company.

- Tether reaffirms its commitment to transparency by announcing a full audit in addition to its current quarterly attestations.

Tether, the issuer of the world’s largest stablecoin, has taken a significant step by announcing key changes in its leadership structure. Giancarlo Devasini, who has served as the company’s Chief Financial Officer and controlling shareholder since its inception, will now assume the role of Chairman. This strategic move will allow Devasini to focus on macroeconomic strategy, guiding Tether as it continues to support the U.S. financial system while advancing global digital asset adoption.

The New CFO and the Commitment to Transparency

Tether’s new CFO, Simon McWilliams, will take the financial reins with an impressive track record of over 20 years in finance, particularly in rigorous audits of major investment firms. McWilliams will oversee the implementation of a full financial audit, a crucial step that will strengthen Tether’s transparency and its commitment to regulatory compliance. This initiative complements the quarterly reserve attestations conducted by independent accounting firm BDO, which showcases the company’s financial integrity.

One of Tether’s primary objectives with this transition is to build greater trust within the cryptocurrency ecosystem, demonstrating that they are committed to high standards of transparency and regulatory preparedness. At a time when stablecoins, such as USD₮, are becoming increasingly relevant in global financial markets, this move is pivotal in cementing Tether’s role as a reliable partner, particularly in emerging markets and for the unbanked population that benefits from the digitalization of the dollar.

In addition to its efforts to improve transparency, Tether has also strengthened its international presence by relocating to El Salvador, where it obtained a Digital Asset Service Provider (DASP) license. This move is part of a broader strategy to expand its institutional presence worldwide, benefiting both individual users and financial institutions.

With over $113 billion in U.S. government debt holdings, Tether has become the 18th largest holder of U.S. debt, surpassing economies such as Germany and the United Arab Emirates. This highlights Tether’s importance not only as a leader in the cryptocurrency world but also as a strategic player in global financial markets.

Devasini’s transition and McWilliams’ appointment represent a shift towards greater transparency and financial strength, promising to further solidify Tether’s position in the cryptocurrency industry.