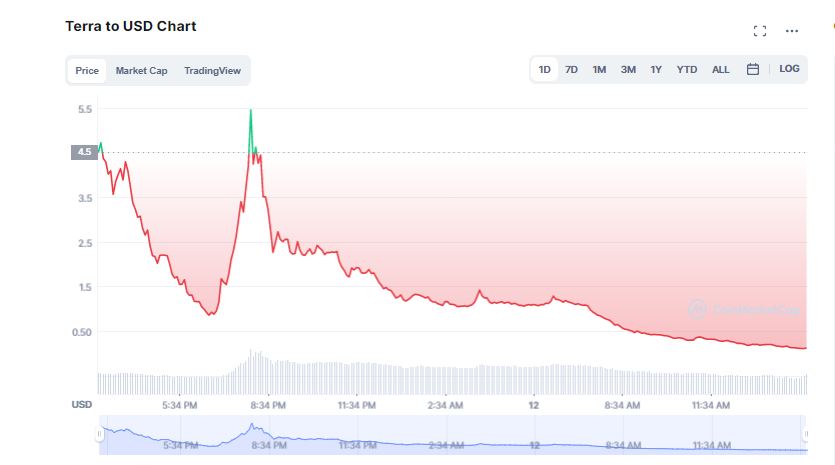

Terra (LUNA) mayhem continues amid Terra USD ‘de-pegging’ debacle with LUNA plunging into the abyss depreciating more than 96 per cent over the past 24 hours.

On May 11, Do Kwon, the CEO of Terra creator Terraform Labs, announced a recovery plan for the Terra tokens amid the cryptocurrency’s downfall. He tweeted that Terra’s return to form will be a sight to behold. However, unfortunately, Kwon’s word of assurance has done little to stop Terra’s bloodbath.

6/ Before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it.

We propose several remedial measures to aid the peg mechanism to absorb supply:

— Do Kwon 🌕 (@stablekwon) May 11, 2022

What Is The Contingency Plan?

Kwon shared a 14 part tweet outlining a proposal to resolve the crisis by pumping massive amounts of crypto assets into the market. He seems to be seeking additional funding from investors to serve as collateral to ensure the solvency of the project going forward. Kwon emphasized that the only path forward will be to absorb the stablecoin supply that wants to exit before UST can start to repeg.

1/ Dear Terra Community:

— Do Kwon 🌕 (@stablekwon) May 11, 2022

The rescue plan included to increase the BasePool from 50 million to 100 million special drwing rights (SDR) along with decreasing the PoolRecoveryBlock from 36 to 18 Blocks. He exclaimed assertion by saying that the Luna Foundation Guard (LFG) is doing everything possible to recover from the crisis. Kwon said,

“It is applauded that Luna Foundation Guard (LFG) is making an effort to engage with trading firms to bring back the peg, and is working towards buying more BTC. Nevertheless, the market have its own way of working.”

Do Kwon affirmed that short term hurdles can never affect long term gains. Terra will overcome this crisis and will make a come back very soon. He assured that during the extended period of time when UST losses peg, more-than-necessary amount of LUNA will be minted to restore UST peg. Kwon concluded by saying,

“Terra’s focus has always oriented itself around a long-term time horizon, and another setback this May, similar to last year, will not deter the the LUNA community. Short-term stumbles do not define what you can accomplish.”

14/ Terra’s focus has always oriented itself around a long-term time horizon, and another setback this May, similar to last year, will not deter the #LUNAtics. Short-term stumbles do not define what you can accomplish.

It’s how you respond that matters.

— Do Kwon 🌕 (@stablekwon) May 11, 2022

Terra Bleeds Further Into Abyss

However, Kwon’s consolation could not stop Terra from bleeding further. According to CoinMarketCap, Terra (LUNA) declined by a whopping 96.11 per cent over the past 24 hours to currently float at $0.1849. However, interestingly, TerraUSD (UST) has risen by 25.64 per cent in the same time frame to $0.62.

Jennifer Lu, Cofounder at Coinstore, said that the recent incident of UST losing its dollar peg has sent shockwaves across the crypto market as it has exposed the weakness of algorithm backed stable coins.