TL;DR

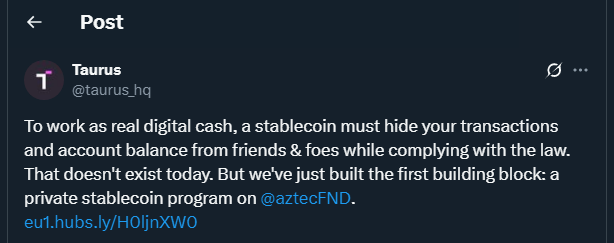

- Taurus, the Swiss digital asset infrastructure firm, has launched a zero-knowledge proof (ZKP) privacy layer for stablecoins, starting with USDC.

- Built atop the Aztec Network, this open-source technology encrypts stablecoin balances and transfers, granting access only to authorized parties like regulators and issuers.

- The innovation aims to offer financial institutions a privacy-preserving yet compliant solution for stablecoin issuance and management.

Taurus SA has released a powerful new privacy-focused smart contract for Circle’s USDC, applying zero-knowledge proof (ZKP) cryptography to bring transaction confidentiality to stablecoin activity. Unlike conventional stablecoins, this implementation ensures encrypted balances and transfers visible only to verified parties, reinforcing both privacy and compliance in tightly regulated environments and high-value financial transactions.

The smart contract was built on the Aztec Network, a layer-2 Ethereum solution known for enabling programmable privacy. This development follows Taurus’ earlier open-source release of ZKP privacy tools for tokenized securities tailored for banks and financial entities. The company positions this latest solution as a natural evolution—one that bridges stablecoin functionality with institutional-grade privacy requirements for real-world financial use cases and regulatory standards.

Encrypted Transfers, Compliance-Friendly Control

The private USDC contract includes features like minting and burning controls, address blacklisting, emergency transfer halts, and verifiable logging. These tools make it attractive to banks and asset managers who want secure on-chain functionality without exposing transactional data to the public. Taurus emphasizes that while user data remains encrypted, regulators and issuers can still access necessary information, satisfying compliance obligations and minimizing operational risks.

Jean-Philippe Aumasson, Taurus’ Chief Security Officer, stated that the solution proves privacy can coexist with industry-standard features, addressing persistent concerns raised by institutions considering stablecoin issuance. As more central banks and regulated entities explore tokenized payment systems, Taurus’ innovation could serve as a key building block for compliant and private financial infrastructure.

The launch also aligns with a broader global trend. Following the U.S. Senate’s approval of the “Genius Act”, which creates regulatory clarity around stablecoins, the total supply of dollar-backed stablecoins has surged past $250 billion, a 12x increase since 2020. Privacy is quickly emerging as the next competitive layer in the stablecoin ecosystem, particularly as blockchain adoption expands into traditional finance and cross-border payments.

Founded in Switzerland in 2018, Taurus provides end-to-end infrastructure for digital asset issuance, custody, and trading. Its client base includes several tier-1 banks and regulated firms, making its move into private stablecoin contracts a notable development for institutions seeking privacy without sacrificing control, security, performance or regulatory trust.