The AI-crypto segment has been active in recent sessions, with Bittensor (TAO) and Pi Network (PI) showing renewed price and development attention. TAO rose about 11% amid discussion of its upcoming halving, a supply schedule event that may affect emissions over time. Meanwhile, Pi Network drew attention after describing an “Android for Robots” initiative aimed at real-world AI applications.

Separately, BlockDAG has promoted an ongoing token sale and reported fundraising totals and remaining allocation. The project says it has raised more than $435 million and lists Batch 32 at $0.005, with a stated cutoff date of February 10, 2026.

TAO Surges 11% Ahead of Halving

The price of Bittensor (TAO) rose by more than 11% within 24 hours, moving back into the $400 range. With roughly 44 days left until the network’s first halving—when daily TAO emissions are expected to drop from about 7,200 to about 3,600—market participants are watching how changing emissions could affect supply dynamics. On-chain data also indicated that transfers recently reached a peak of more than 4 million, suggesting elevated network activity.

Bittensor is often discussed as a project combining blockchain incentives with AI-related compute and model markets. Its token supply and halving schedule are defined in its protocol, and any ecosystem growth remains dependent on adoption and broader market conditions.

Pi Network Enters Robotics Sector

Pi Network has said it is entering the robotics sector through an investment in OpenMind, a startup developing an open-source operating system for intelligent machines. The initiative has been described as building an “Android for Robots,” with the stated goal of connecting devices using blockchain-based components.

The project has also stated that more than 350,000 Pi Node operators participated in early AI model tests. Following the announcement, PI’s price was reported to have risen by roughly 30% to around $0.25 after months of limited movement. As with other tokens, short-term price changes do not confirm long-term outcomes.

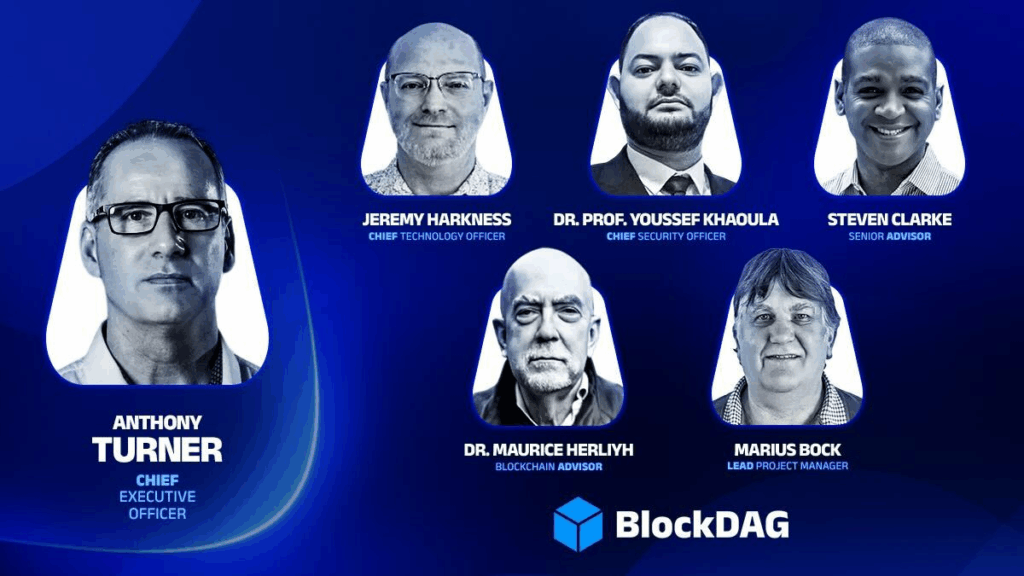

BlockDAG reports remaining token-sale allocation

BlockDAG’s project materials describe an ongoing token sale with a fixed allocation. The project says that out of a 50 billion total BDAG coin supply, more than 45.4 billion have been sold, leaving around 4.5 billion coins before the sale’s stated end date of February 10, 2026.

The project lists Batch 32 at $0.005. Any discussion of “scarcity” or potential price effects remains speculative, and token-sale participation can involve significant risk.

BlockDAG also reports having about 3.5 million X1 mining app users, a BWT Alpine Formula 1® partnership, and an upcoming “Awakening Testnet.” These claims are based on project statements and should be independently verified where possible.

The project further claims it has raised more than $435 million and has more than 312,000 holders. Any future market pricing after a token sale ends is uncertain and can move in either direction.

The Bottom Line

TAO’s recent move and Pi Network’s robotics-related announcement highlight how quickly sentiment can shift around AI-linked crypto narratives. However, developments and token prices depend on execution, adoption, and broader market conditions.

BlockDAG, for its part, is marketing a time-limited token sale and reporting progress against its stated allocation and schedule. Readers should treat project-reported figures as claims unless confirmed by independent sources.

Project website (for reference): https://blockdag.network

Telegram (for reference): https://t.me/blockDAGnetworkOfficial

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.