Circle Under Fire for $3M USDC Freeze Failure

Circle is facing heavy criticism for failing to immediately block stolen funds. Over $3 million in USDC, taken from SwapNet users, remain in a Basescan address

Circle is facing heavy criticism for failing to immediately block stolen funds. Over $3 million in USDC, taken from SwapNet users, remain in a Basescan address

TL;DR Coinbase lets eligible customers borrow up to $1 million in USDC using cbETH collateral, without unstaking, in the U.S. excluding New York today. Loans run

TL;DR Circle CEO Jeremy Allaire dismissed concerns that stablecoin yields could trigger bank runs, calling such worries “totally absurd.” Allaire compared stablecoins to dollar money market

TL;DR Stablecoin funding: Interactive Brokers now lets clients deposit USDC around the clock through a ZeroHash integration, with Ripple USD and PayPal USD support coming soon.

TL;DR Stablecoin market share hit a record high of 10.19% of total crypto. Growth is driven by investor caution and clearer U.S. regulations. Tether (USDT) and

TLDR The Sei network issued an urgent communication to its community this Thursday. They reported that with the SIP-3 upgrade, scheduled for March 2026, the blockchain

Circle reduced the USDC supply after burning 51,168,791 tokens on Solana, bringing the total supply to about 76.26 billion coins. The burn is part of a

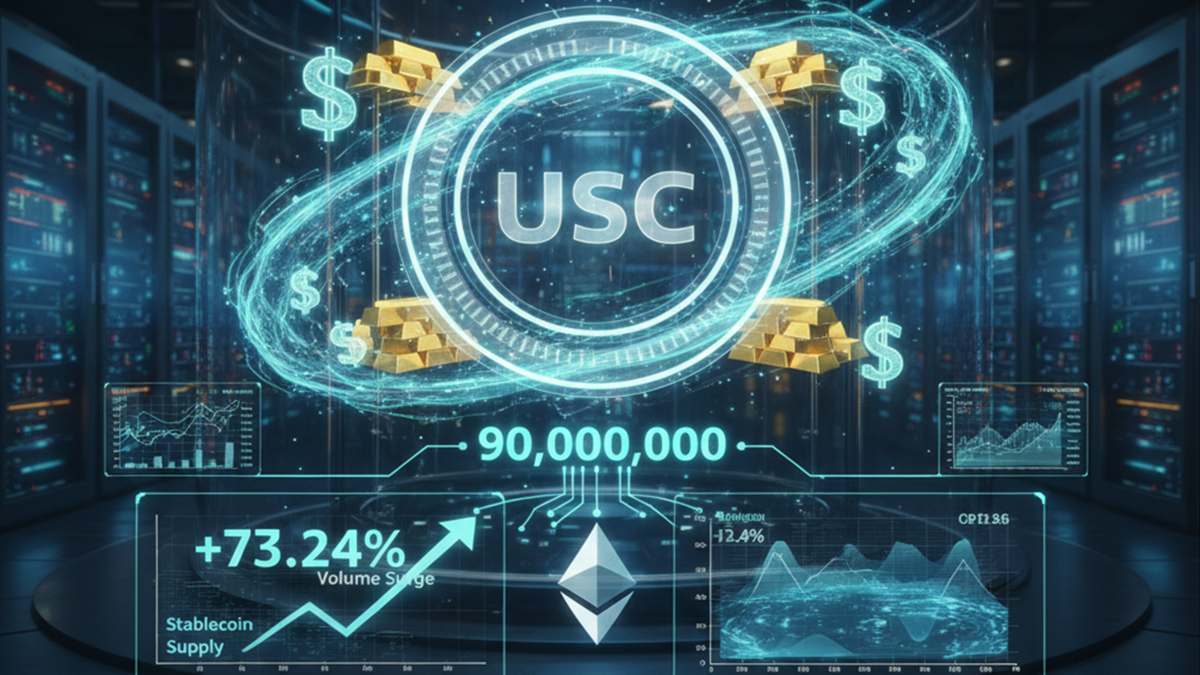

TLDR Whale Alert reported the creation of 90 million USDC, although Circle has yet to issue an official confirmation. USDC trading volume skyrocketed by 73.24% in

TL;DR Stablecoins are moving from trading tools to financial infrastructure in 2026, with revenue opportunities in routing, coordination, and settlement across on-chain and off-chain systems. Nick

Intuit announced a multi-year strategic partnership with Circle to integrate USDC as a payment infrastructure across TurboTax, QuickBooks, and Credit Karma. The agreement aims to enable

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy