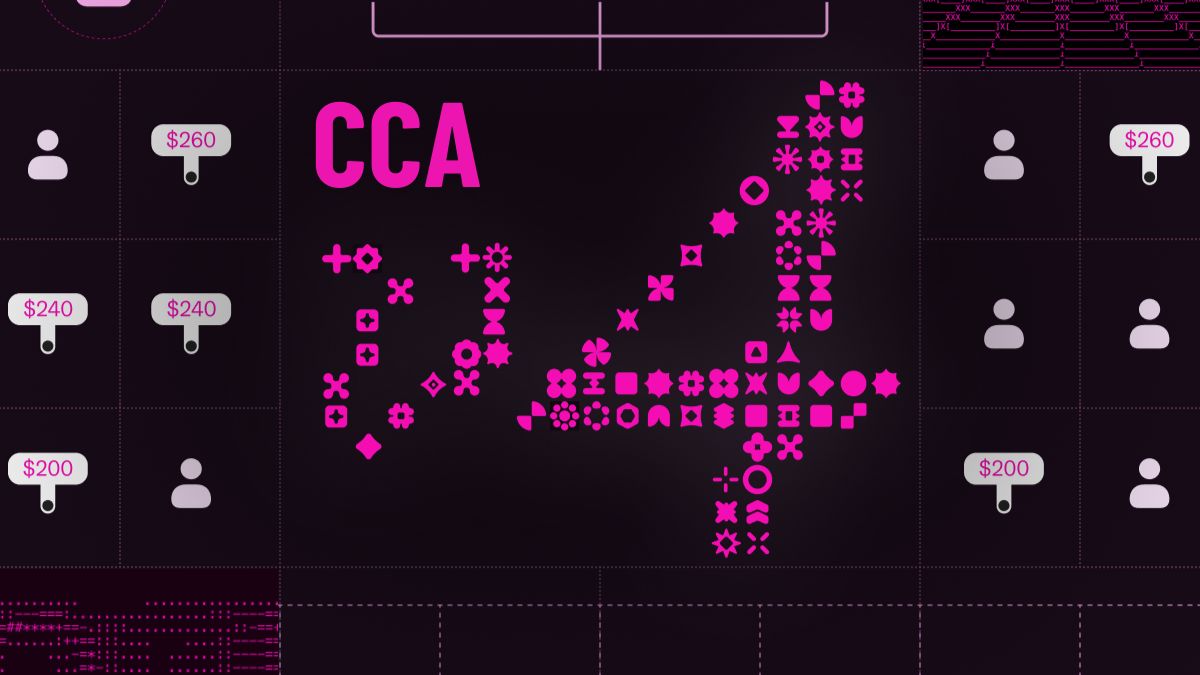

Uniswap CCA Brings Token Auctions and Price Discovery Tools to Base Blockchain

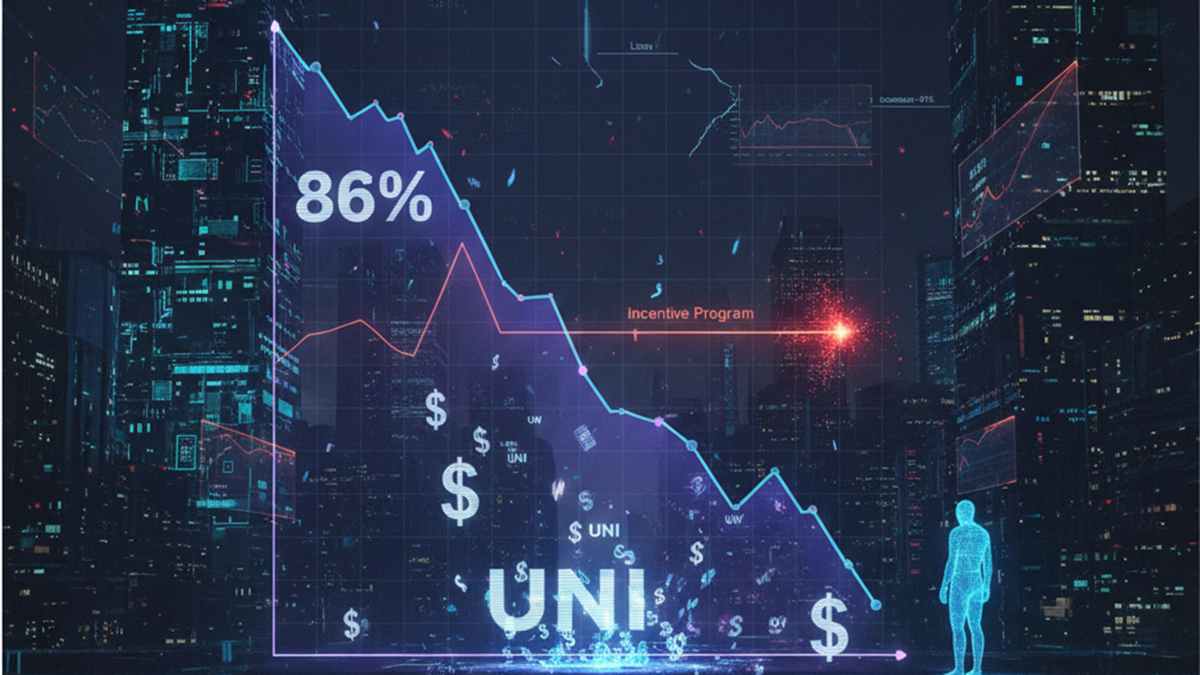

TL;DR Uniswap deployed Continuous Clearing Auctions on the Base network, offering fully on-chain token launches through auctions. The CCA model sells tokens block by block and