Ethereum falls 1.6% but remains above the $2,000 mark

Ethereum is currently maintaining its position above the psychological support of $2,000, trading at $2,065 following a period of consolidation. Recent market data reveals that the

Ethereum is currently maintaining its position above the psychological support of $2,000, trading at $2,065 following a period of consolidation. Recent market data reveals that the

TL;DR: On-chain data reveals that nearly half of the circulating BTC supply was acquired at prices higher than the current market value. Every recovery attempt is

TLDR Ether’s price has fallen below its realized price, a historical signal of market capitulation. President Trump’s tariffs and low institutional demand are creating strong selling

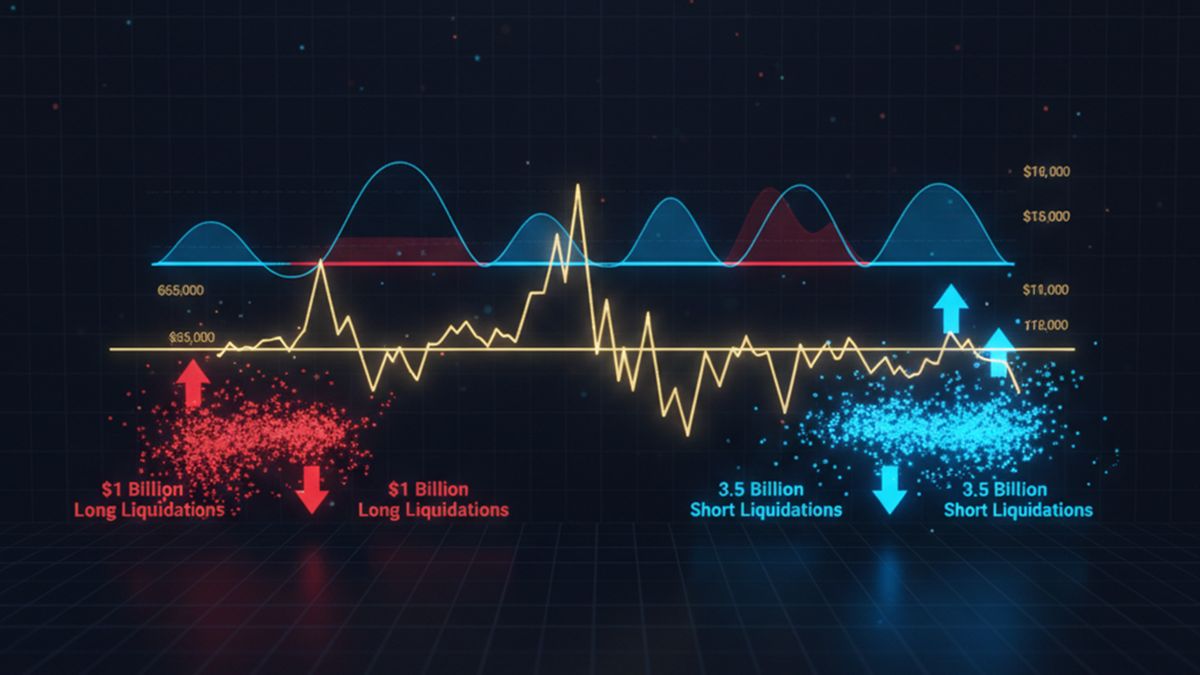

TL;DR: BTC price retraced to $64,111, liquidating approximately $240 million in long positions. Derivatives data shows liquidity asymmetry, with $3.5 billion vulnerable on the upside. Technical

TL;DR Ecosystem Growth: INIT benefits from rising interoperability, expanding modular infrastructure, and increasing developer participation across sovereign Layer‑2 networks. Price Outlook: Forecasts from 2026–2032 show progressive

TL;DR: AVAX trading volume surged 25%, reaching $248.87 million in the last 24 hours. Technical indicators show a bullish MACD crossover, suggesting a shift in short-term

TL;DR: A 4.3% surge toward $69,600 would trigger a massive closure of bearish positions worth $600 million. Stagnant US GDP and persistent inflation could push investors

The United States Supreme Court invalidated the controversial trade levies imposed by the Trump administration, ruling the use of emergency powers for this purpose illegal. Following

TL;DR: On Friday, two main topics captured investors’ attention: Ethereum’s price and BitMine’s predictions. Currently, the asset is struggling to hold below the psychological barrier of

TL;DR: Coinbase adds Dogecoin as collateral for loans up to $100,000 in USDC. DOGE’s price fails to reclaim the $0.10 level after a week of selling

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy