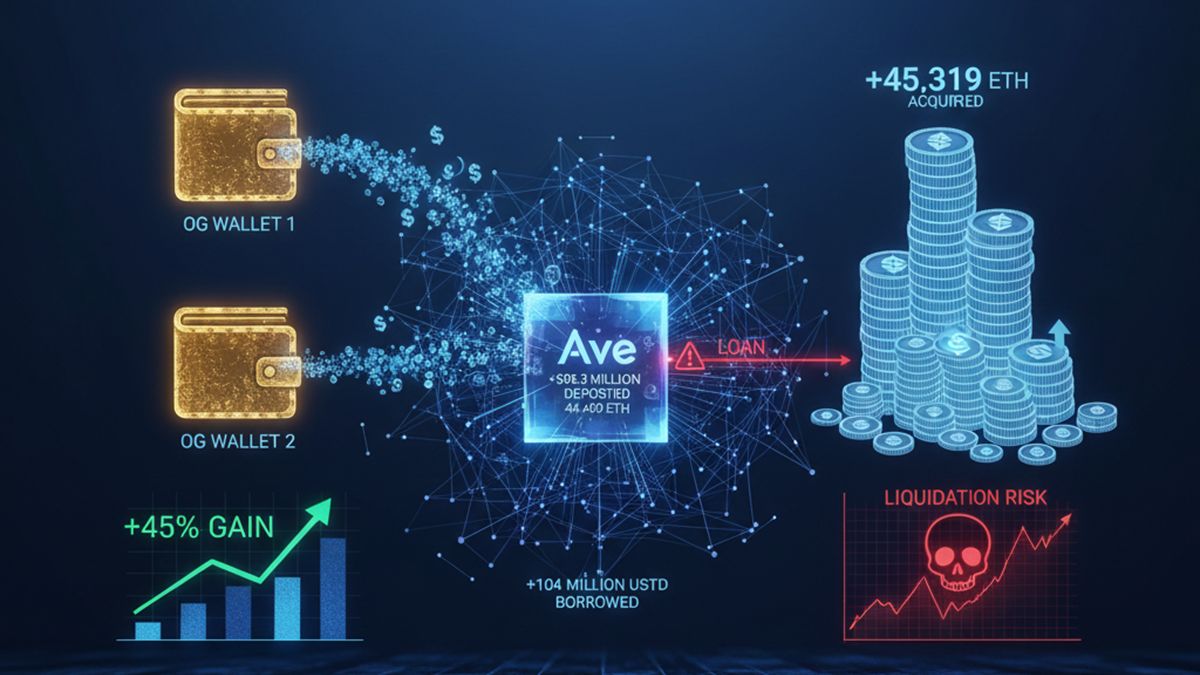

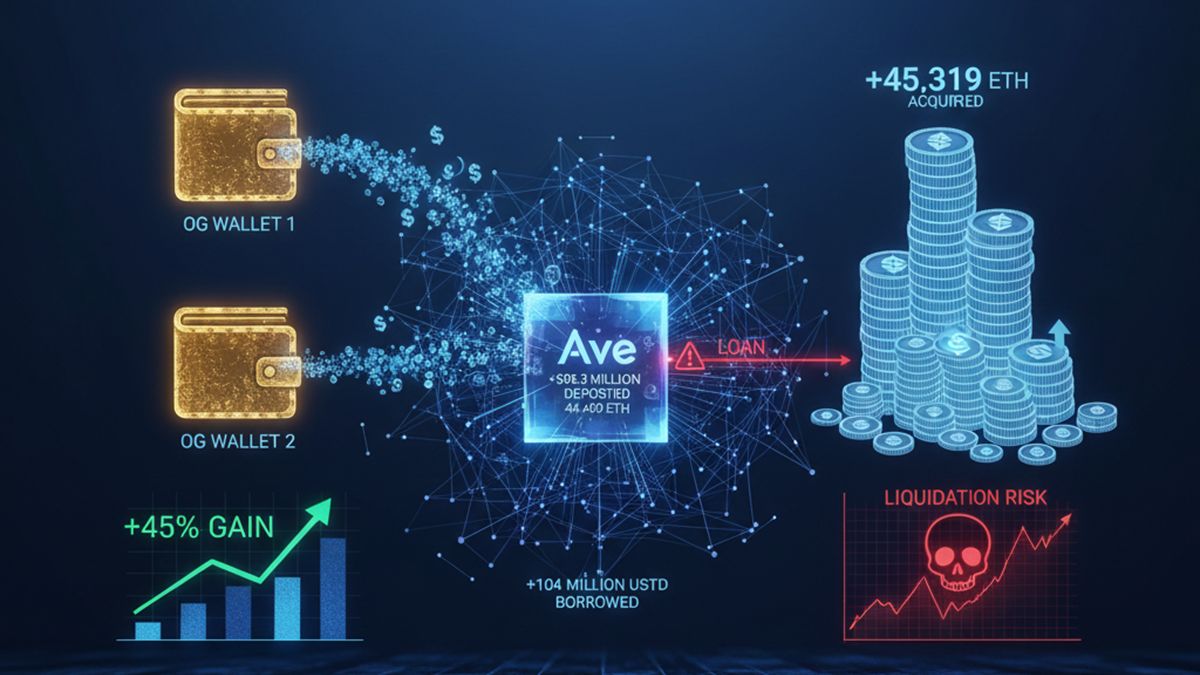

Ethereum OGs Deploy $98M Strategy Using Looped Borrowing on Aave

TL;DR: After five years of inactivity, two historical wallets, known in the sector as “OGs,” have returned to the fray. At the beginning of the month

Ethereum is a decentralized, open-source blockchain platform that enables the creation of smart contracts and decentralized applications (dApps). It was created by Vitalik Buterin in 2013 as a way to expand the functionality of blockchain technology.

Ethereum’s native cryptocurrency, Ether (ETH), is used to pay for transaction fees and computational services on the network. Ethereum’s smart contract functionality allows developers to create self-executing contracts that can automate complex transactions and operations, such as the transfer of assets, voting systems, and more. Ethereum’s flexibility and community support have made it a popular choice for building decentralized applications and other blockchain-based projects.

TL;DR: After five years of inactivity, two historical wallets, known in the sector as “OGs,” have returned to the fray. At the beginning of the month

BitMine Immersion Technologies (BMNR) deepened its Ethereum accumulation despite the market downturn, purchasing 41,788 ETH last week. The operation, valued at $96 million, raised its total

TL;DR: Open-source cryptography company Zama has just released the ZAMA token launch. By doing so, it establishes itself as the new privacy standard for the onchain

TL;DR @ETH_Daily questions whether to buy or sell ETH after a ~20% drop and approach toward recent lows. It highlights the current price is 30-40% below

TL;DR: ZKP launches a massive rewards program linked to participation and the use of its AI infrastructure. The PENGU memecoin records a drop of over 30%

TL;DR: Bybit and Mantle launch the “Mantle Super Portal” to connect EVM networks with the Solana ecosystem. The integration enables native MNT deposits and withdrawals on

TL;DR U.S.-listed spot Bitcoin and Ethereum ETFs saw nearly $1 billion in outflows in a single session. BTC dropped below $85,000 and ETH to $2,700. The

This Thursday, shares of crypto-focused treasury companies, such as BitMine Immersion Technologies (BMNR) and Strategy (MSTR), suffered declines of nearly 10%. Nasdaq and Yahoo Finance reported

TL;DR: Ethereum’s price is headed toward $10,000, driven by technical setups that evoke previous bull cycles. The asset is currently trading near $2,850, but analysts point

TL;DR: Veteran commodities trader Peter Brandt has shared insights that are sending shockwaves through the digital asset market. His analysis has sounded the alarm by presenting

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy