BNP Paribas Brings Money Market Fund Pilot to Ethereum

This Friday, BNP Paribas Asset Management unveiled a pilot project to issue tokenized shares of a French-domiciled money market fund directly on the Ethereum network. Edouard

Ethereum is a decentralized, open-source blockchain platform that enables the creation of smart contracts and decentralized applications (dApps). It was created by Vitalik Buterin in 2013 as a way to expand the functionality of blockchain technology.

Ethereum’s native cryptocurrency, Ether (ETH), is used to pay for transaction fees and computational services on the network. Ethereum’s smart contract functionality allows developers to create self-executing contracts that can automate complex transactions and operations, such as the transfer of assets, voting systems, and more. Ethereum’s flexibility and community support have made it a popular choice for building decentralized applications and other blockchain-based projects.

This Friday, BNP Paribas Asset Management unveiled a pilot project to issue tokenized shares of a French-domiciled money market fund directly on the Ethereum network. Edouard

Ethereum co-founder Vitalik Buterin has flatly rejected the idea of abandoning the current protocol to start from scratch, taking the opportunity to present a new strategy.

TL;DR Fusaka fee reduction triggers explosion in address poisoning attacks. Attackers send millions of dust transactions at negligible cost. Daily transactions jump from 30,000 to 167,000

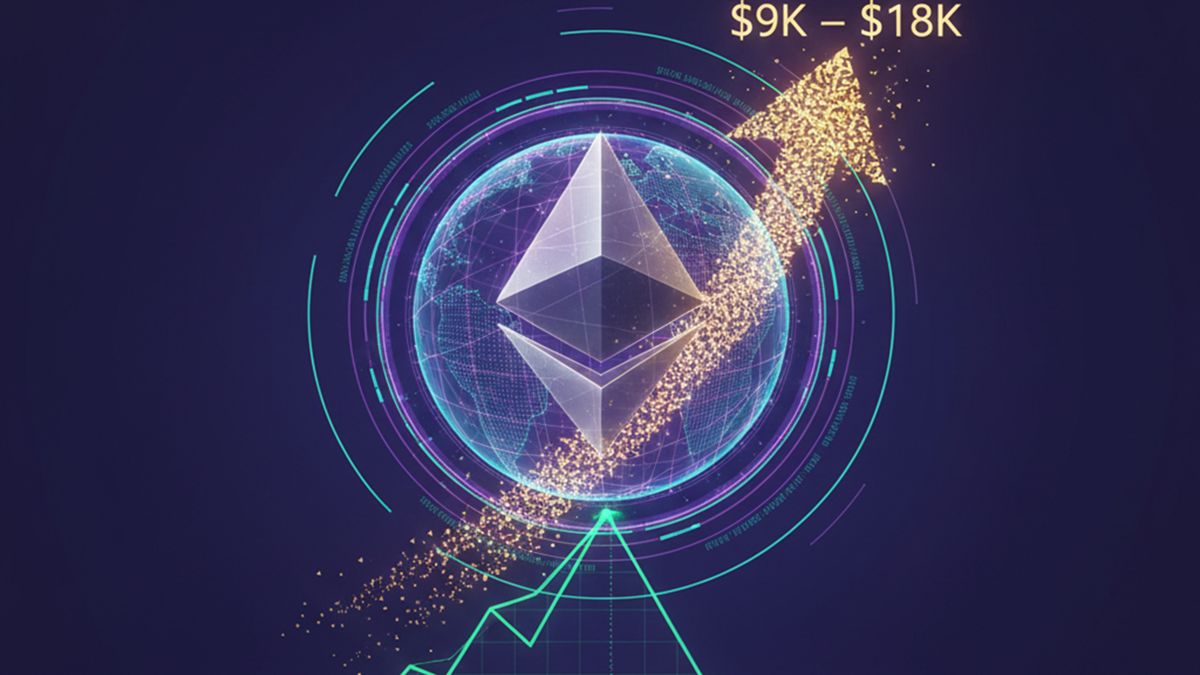

TL;DR: On Friday, two main topics captured investors’ attention: Ethereum’s price and BitMine’s predictions. Currently, the asset is struggling to hold below the psychological barrier of

TL;DR Vitalik unveils FOCIL and EIP-8141 to guarantee censorship resistance at consensus layer. FOCIL randomly selects 16 includers and one proposer per block slot. EIP-8141 grants

TL;DR: Ether consolidates in a technical triangle pattern following a severe market correction. Analysts identify an “Expanding Diagonal” structure with long-term price targets. Support at $1,800

TL;DR Sharplink reaches 46% institutional ownership, the highest among Ethereum treasuries. The firm added 60 new institutional investors in the fourth quarter of 2025. Its treasury

TL;DR: BitMine acquired 35,000 additional ETH in a single day, bringing its total reserves to 4.37 million ETH valued at approximately $9.6 billion. BMNR shares fell

OpenAI, led by Sam Altman, has unveiled EVMbench, a new testing framework designed to evaluate whether modern artificial intelligence systems can effectively understand and help secure

TL;DR Peter Thiel’s Founders Fund sold its entire stake in ETHZilla after disclosing a 7.5% position in 2025, valued at around $40 million. The company raised

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy