Crypto Market Turns Cautious Amid Surging JGB Yields and Renewed Tariff Risks

TL;DR: The 10-year Japanese government bond yield reached 2.29%, its highest level since 1999. Bitcoin has fallen more than 6% in the last week, currently trading

Bitcoin (BTC) is a digital currency created in 2009 by an unknown person using the alias Satoshi Nakamoto. It is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer Bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a publicly distributed ledger called a blockchain

TL;DR: The 10-year Japanese government bond yield reached 2.29%, its highest level since 1999. Bitcoin has fallen more than 6% in the last week, currently trading

The crypto market posted a sharp drop, losing roughly $150 billion in market capitalization over a 24-hour period. The pullback was concentrated in Bitcoin and major

TL;DR: President Donald Trump’s intervention at the World Economic Forum in Davos brought relief to the cryptocurrency market. Consequently, the Bitcoin price and Trump’s crypto regulations

TL;DR Control of the Bitcoin market has shifted to new whales, who hold the marginal supply after buying near the $120,000 highs. Large holders aged 6–12

TL;DR: The insurer will use BlackRock’s iShares Bitcoin Trust ETF to provide indirect exposure to the crypto asset. The new index combines U.S. equities with BTC

TL;DR Tether and Bitqik launched a national education program on Bitcoin and stablecoins in Laos, with deployment planned throughout 2026. The program aims to reach more

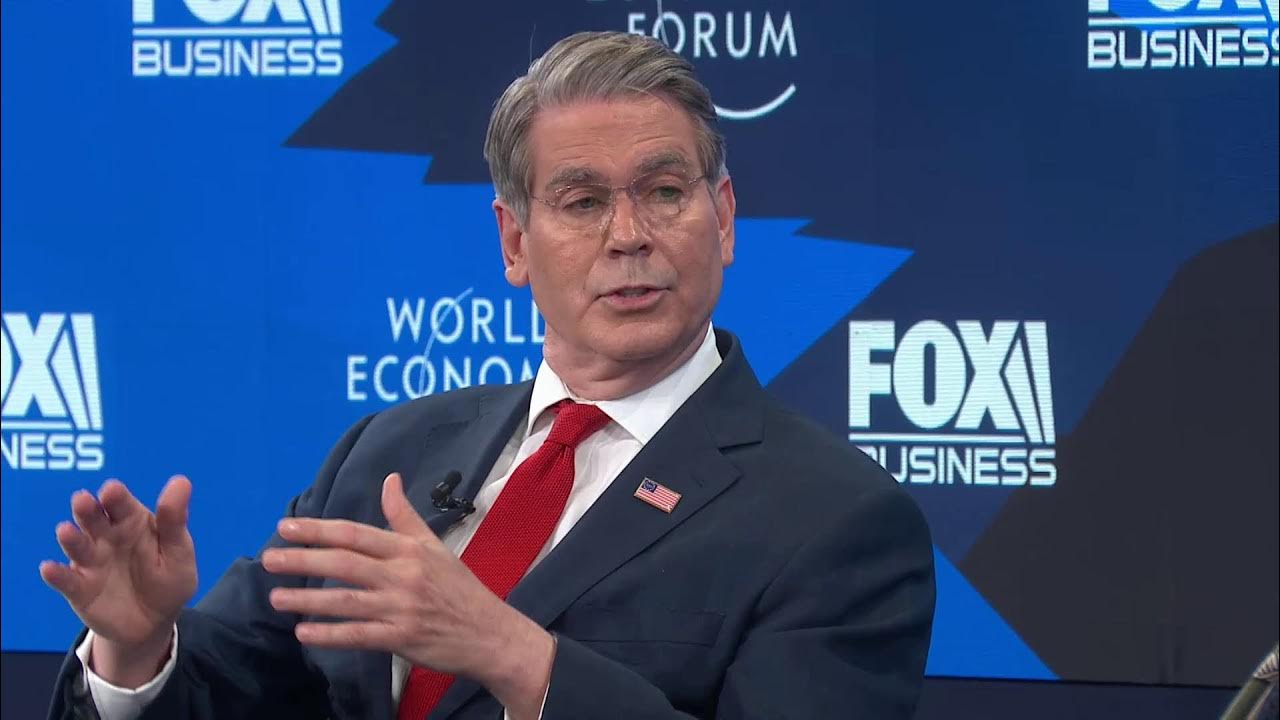

TL;DR Scott Bessent confirmed in Davos that Donald Trump’s administration continues to uphold U.S. crypto policy and the strategic bitcoin reserve as official government guidelines. The

TL;DR Large custody wallets accumulated $53B in Bitcoin over the past year. Institutional buying remains steady despite cooling retail sentiment. Corporate treasuries and spot ETFs are

TL;DR Louisiana’s pension fund bought $3.2M in shares of Bitcoin company Strategy. The investment provides indirect exposure to Bitcoin without direct ownership. This follows a trend

Tether and Bitqik partner for educational purposes. Both firms aim for financial literacy regarding Bitcoin and stablecoins. According to Paolo Ardoino, CEO of Tether, and Virasack

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy