Bit Digital Expands ETH Staking, Adds WhiteFiber Position in Latest Treasury Update

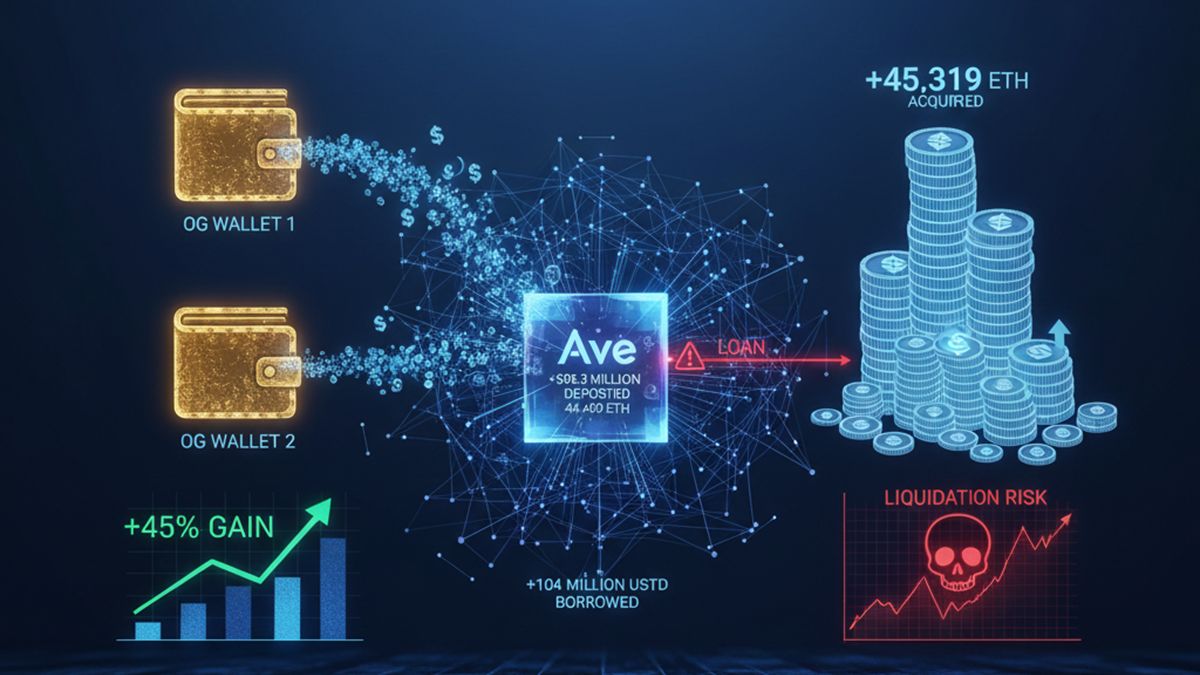

Bit Digital released its January 2026 report on its Ethereum treasury, staking activity, and strategic equity holdings. As of month-end, the company reported total holdings of