TL;DR

- Synthetix’s sUSD stablecoin briefly fell to $0.83, its lowest level in five years, sparking renewed concerns about its long-term stability.

- While it shares design similarities with Terra’s failed UST, sUSD is backed by a $30 million treasury that could help mitigate extreme risks.

- The Synthetix team says new mechanisms are being introduced to restore the peg and reinforce ecosystem confidence.

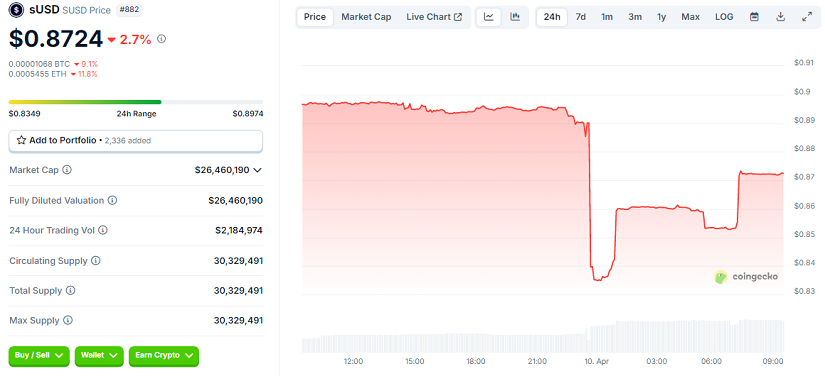

Synthetix USD (sUSD), one of the core assets within the Synthetix ecosystem, once again lost its dollar peg on April 10, dipping to a five-year low of $0.83, according to data from CoinGecko. While the drop raised concerns across the crypto space, sUSD has since begun a slow recovery, currently trading at approximately $0.8724. Although it hasn’t fully regained parity, the slight rebound has been seen as a sign of resilience by some within the DeFi community. The event has reignited debates about the viability of crypto-collateralized stablecoins, especially among those who continue to champion decentralized finance over centralized alternatives.

Structural Risks And Unsettling Comparisons

Rob Schmitt, co-founder of the risk tokenization platform Cork Protocol, highlighted the inherent design vulnerabilities of sUSD. While he pointed out meaningful differences from Terra’s collapsed UST, he emphasized that both systems are vulnerable to a “death spiral” scenario if the collateral token SNX experiences a sharp price drop. In such a situation, users may rush to redeem sUSD for SNX and sell off their tokens, further accelerating the downward pressure and triggering a cascade effect.

However, Schmitt also made it clear that Synthetix is better equipped to handle this type of situation than Terra was. The protocol’s treasury currently holds roughly $30 million in sUSD, about half of the outstanding debt, which could be strategically deployed to absorb market pressure and prevent a liquidity crisis. Furthermore, Synthetix’s architecture, which relies on audited smart contracts and decentralized governance, provides a more flexible and transparent framework to manage unexpected volatility and maintain operational integrity.

Synthetix Fights Back: Stability Tools In Progress

Synthetix founder Kain Warwick responded to the recent volatility with calm, noting that the peg drift is due to the removal of previous buy incentives. He explained that new mechanisms are being introduced to maintain peg stability, though the transition period may involve some temporary price fluctuations. According to Warwick, since sUSD is a fully crypto-collateralized stablecoin, short-term deviations are possible, but active tools exist to realign the peg when necessary.

The case of sUSD is not isolated. Other stablecoins, such as syUSD, have also recently deviated from their pegs. Nonetheless, for many crypto supporters, these challenges are not failures but rather growing pains—part of the ongoing evolution toward more resilient and decentralized financial systems.