TL;DR

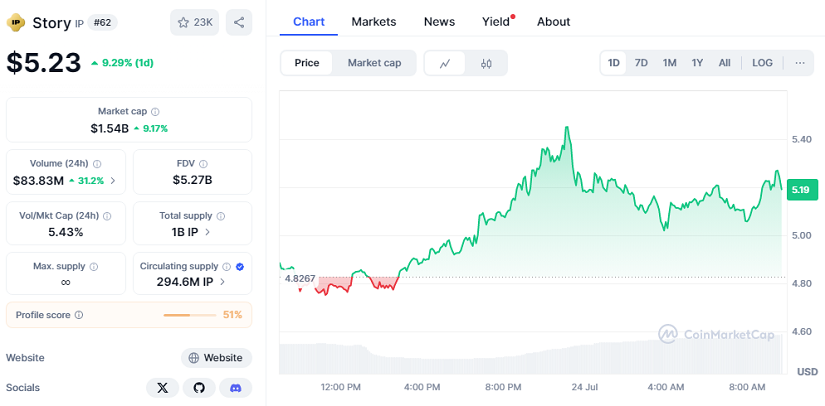

- Story’s IP token defies a sluggish market, posting a 9.29% daily gain and securing a solid spot above $5.20.

- With a $1.54 billion market cap and daily volume jumping 31% to $83.83 million, IP shows strong investor conviction.

- Spot inflows above $5 million and positive funding rates point to growing momentum that could push the token toward March’s highs.

Story’s IP token continues to capture attention as one of the few bright spots in an otherwise struggling crypto market. While major altcoins tread water, IP has added over 20% in a week and jumped another 9.29% in the last 24 hours, now trading at $5.23. This move cements its position above a level that traders have been watching closely since March.

Market watchers have noted that IP’s daily trading volume rose to $83.83 million in the past 24 hours, marking a 31.2% surge. Combined with consistent spot inflows topping $5 million this week, it’s clear that fresh capital keeps pouring in despite profit-taking across the board.

Spot Inflows And Technicals Keep Bulls Confident

The IP/USD chart shows the token firmly holding an ascending trendline that began forming on July 11. This structure reflects a clear pattern of higher lows, encouraging buyers to stay in play. For traders, the next hurdle sits near the March peak of $5.59, which could come into focus if IP keeps defending the crucial $4.92 level it just broke.

Futures traders have backed this up with a steady positive funding rate since July 20. A positive funding rate means traders are paying extra to maintain long positions, a sign they expect further upside. It’s an encouraging signal that momentum may not fade just yet.

While some wallets took profits with a modest $157,000 net outflow today, broader sentiment remains upbeat. Bulls see any pullback toward $4.92 as an opportunity to reload before the next leg up.

Futures Traders Push For March High As Market Cap Climbs

Story’s IP now sits on a market cap of $1.54 billion, a level that strengthens its status among mid-cap altcoins attracting fresh interest. For many investors, the recent rally is evidence that solid fundamentals, paired with disciplined accumulation, can keep a token moving against broader market tides.

If buying pressure holds and fresh inflows keep pace, IP’s next big test will be reclaiming its March high of $5.59. Traders and investors alike will watch whether spot inflows remain steady and futures funding stays positive in the days ahead.