TL;DR

- Vision & Innovation: Story Protocol revolutionizes IP management (art, music, AI) via blockchain tokenization, programmable licenses, and DAO governance. It tackles traditional inefficiencies and positions itself as essential AI-era infrastructure.

- Token Utility: The $IP token powers the ecosystem, used for fees, IP registration/licensing, DAO governance, and staking. Its utility and early 195% returns are key drivers for future value.

- Price Volatility & Target: Predictions show high volatility (2025: $4-$12; 2030: $10-$52+). Hitting $50 by 2030 depends on AI integration success, partnerships, and broader crypto adoption.

Story Protocol (IP) is a purpose-built Layer-1 blockchain transforming how intellectual property (IP) is managed. It tackles the costly, slow, and opaque processes of traditional IP systems by leveraging blockchain technology. Story allows creators to seamlessly register, license, trade, and monetize their IP assets, from art and music to AI-generated content.

The platform views IP as the world’s largest asset class and positions itself as foundational, especially for the AI era, arguing that AI cannot thrive without robust IP solutions. By making IP programmable and accessible through NFTs and smart contracts, Story Protocol aims to democratize and streamline the entire IP lifecycle.

Core Innovations: Tokenization, Programmable Rights & Governance

Story Protocol’s power lies in three key innovations. First, it enables the tokenization of IP into digital assets (NFTs), ensuring transparent ownership and usage tracking. Second, it introduces programmable IP licenses. These smart contracts automatically enforce terms of use, royalty distribution, and other licensing conditions, offering unprecedented flexibility and control.

Third, governance is decentralized through a DAO (Decentralized Autonomous Organization), combining on-chain voting with off-chain legal frameworks. This structure directly addresses the inefficiencies of traditional IP management, creating a transparent and efficient global platform. A critical focus is facilitating AI integration, providing the essential licensing infrastructure needed for AI training and development.

The Role of the $IP Token

Fueling this ecosystem is the native $IP token. It serves multiple vital functions: paying network gas fees, registering and licensing IP assets (IPAs), participating in the DAO’s governance decisions, and staking. Its impressive all-time returns of 195.23% highlight significant early market interest.

Understanding $IP’s utility and market dynamics is crucial for assessing its future value. Now, let’s delve into the potential price trajectory of the Story Protocol ($IP) token from 2025 through 2030.

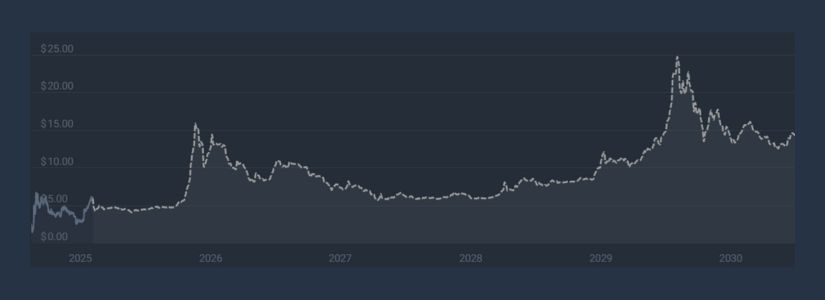

Story (IP) 2025 to 2030 Price Prediction

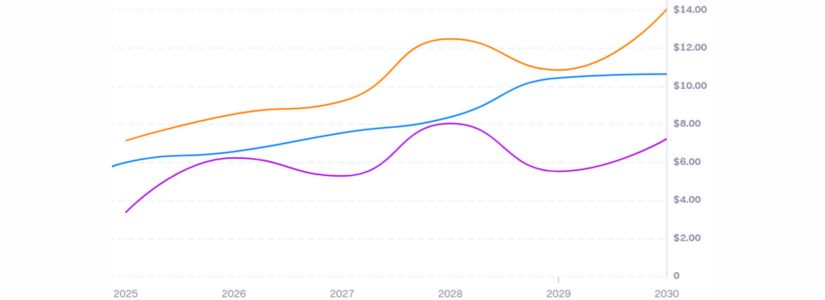

2025 Price Outlook: Bullish vs. Bearish Scenarios for IP

CoinCodex forecasts that by 2025, IP is expected to be priced between $4.12 and $6.00, leading to an average yearly price of $4.59. This range implies a marginal negative return of -0.08%. Given the anticipated downward pressure, traders could leverage short positions to profit from potential price declines.

Contrastingly, CoinDataFlow’s analysis suggests a significantly bullish outlook, forecasting a 2025 price range of $5.41 to $12.07. If IP achieves the upper target, it would generate a 101.25% return from today’s levels, highlighting substantial growth potential driven by optimistic market dynamics.

Youtubers Price Prediction

YouTube channel, Crypto Aarav, shared a video analyzing IP market performance, on-chain metrics, and trading volume to discuss the potential price targets the token could reach in 2025.

2026 Price Targets: Breaking Resistance Barriers

Based on historical trends, Gate.io projects IP could reach a high of $8.53 and a low of $6.23 in 2026, averaging around $6.56. Could yield a +9.00% return by 2026, suggesting moderate growth potential. Investors may consider strategic accumulation during price dips to capitalize on this upside.

DigitalCoinPrice offers a significantly more bullish outlook, forecasting that IP could breach the $15.56 barrier by late 2026. The token is expected to trade between $12.91 and $15.56, stabilizing near $14.27 by year-end. This trajectory implies a potential 137% surge from current levels, reflecting strong confidence in the Protocol’s long-term adoption.

Story (IP) 2027 Price Forecast: Technical Outlook & Targets

By 2027, sustained momentum could propel IP into a mid-cycle expansion phase targeting the $11.00 region. Technical indicators suggest the ascending price channel may transition into a steeper parabolic rally, contingent on periodic RSI cooldowns to reset bullish energy. Critical support is expected between $6.00 and $7.00, creating strategic accumulation zones for traders during pullbacks.

Bullish sentiment dominates 2027 projections, with IP predicted to peak at $11.02 in January before retracing to an October low of $5.67. Despite this volatility, IP is forecasted to maintain an annual average price of $8.10. This trajectory implies significant trading opportunities, leveraging seasonal swings while aligning with long-term growth trends.

Risk Assessment: Challenges Impacting IP’s 2028 Trajectory

An experimental forecast model suggests IP could achieve 45.94% growth in 2028, potentially reaching $8.75 under optimal market conditions. This forecast shows a broad trading range from $3.17 to $8.75, indicating high volatility expectations. Investors should monitor macroeconomic catalysts and protocol adoption rates to validate this growth trajectory.

Historical price analysis presents a more bullish scenario, predicting Story could hit $12.48 at its peak while maintaining a strong support level at $8.04. An average 2028 price target of $8.38 translates to a +39.00% ROI. This projection suggests steady accumulation could be profitable ahead of anticipated network growth phases.

Critical Support Zones: Accumulation Strategies for 2029

Story (IP) is poised for explosive growth in 2029, with predictions indicating it could achieve unprecedented price levels and market capitalization. Analysts project a potential surge beyond $27.25, establishing this as the year’s peak, while robust support is expected near $23.15. This trajectory implies a staggering 354% return, positioning IP as a high-growth asset for long-term portfolios.

A more conservative technical outlook suggests Story may target $16.50 as its 2029 high, contingent on broader crypto market cycles and sentiment shifts. Following consolidation, renewed momentum could trigger RSI resets and Bollinger Band expansions. Critical support remains above $8.50, with a healthy base-forming range between $12.00–$14.00 offering optimal accumulation opportunities before the next rally phase.

Long-Term Floor Analysis: $10.00 Support Zone in 2030

2030 could mark a transformative year for Story (IP), with analysts projecting peak valuations amid broader crypto market maturation. Strategic blockchain partnerships and ecosystem initiatives may propel IP to a maximum of $52.34, while bearish contingencies could see it stabilize near $38.35. This optimistic scenario hinges on expanded platform utility and would deliver a staggering 772% ROI, positioning IP among the decade’s high-potential assets.

A conservative technical perspective suggests IP could challenge the $19.90 threshold in 2030, contingent on sustained ecosystem growth and crypto adoption rates. The average price would likely consolidate near $14.80, with $10.00 serving as a robust long-term floor, reinforced by historical pivot levels and prior breakout zones. This trajectory implies a 146% return from today’s price, emphasizing steady accumulation during retracements.

Conclusion

Story Protocol (IP) presents transformative potential but high volatility across 2025-2030. Conservative targets suggest steady growth (+146% by 2030), while bullish catalysts like partnerships could propel gains beyond 770%. Strategic accumulation at key supports ($6-$10) and monitoring AI integration remain critical for capitalizing on IP’s role in the digital IP revolution.

The Price Predictions published in this article are based on estimates made by industry professionals, they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.