TL;DR

- Bitwise Asset Management has submitted an S-1 filing to the SEC for the first-ever U.S. spot Chainlink (LINK) ETF.

- The fund would hold LINK directly in custody with Coinbase Custody and track the CME CF Chainlink-Dollar Reference Rate.

- This move follows the successful launch of Bitcoin and Ethereum ETFs and reflects growing institutional interest in altcoins through regulated financial products.

Bitwise Asset Management is preparing to launch a Chainlink ETF that would allow U.S. investors to access LINK through a regulated structure. The filing, dated August 26, 2025, outlines plans for the fund to hold LINK tokens directly while tracking the CME CF Chainlink-Dollar Reference Rate. By partnering with Coinbase Custody Trust Company, Bitwise ensures secure storage for the underlying assets, reinforcing trust in institutional-grade custody solutions.

Investors may benefit from reduced counterparty risk and simplified exposure to Chainlink without navigating crypto exchanges directly. This structure may also attract pension funds and insurance companies seeking compliant crypto exposure.

Institutional Appetite Expands Beyond Bitcoin and Ethereum

Following the successful approvals of Bitcoin and Ethereum ETFs, asset managers are now exploring altcoins like Solana, NEAR, and Chainlink for regulated investment products. Data from Blockworks shows Bitcoin ETFs have accumulated nearly $78 billion in flows and Ethereum ETFs $23 billion. Chainlink, as the leading oracle network for DeFi applications, is positioned to capture institutional demand for high-quality infrastructure tokens. Its adoption by major protocols and enterprises underscores the growing relevance of oracles in modern blockchain ecosystems. Growing partnerships with decentralized finance platforms further validate its long-term institutional appeal.

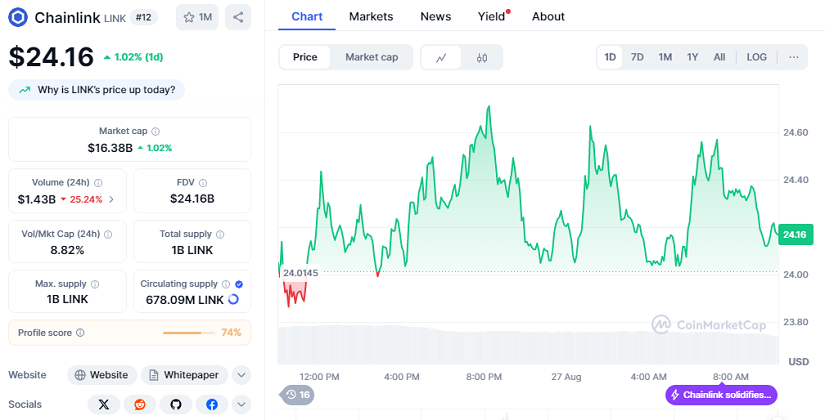

Launched in 2019, Chainlink provides decentralized oracles that connect blockchains to external data, supporting smart contracts, gaming, NFTs, and cross-chain functionality. LINK, the native token, has become a major digital asset with a current price of $24.16, a 24-hour gain of 1.02%, and a market capitalization of $16.38 billion.

The proposed ETF could make LINK one of the first oracle network tokens accessible via U.S. regulated markets. Increased awareness among institutional investors may drive further liquidity and market adoption. Analysts suggest that enhanced transparency and reporting standards could also help attract new investors.

Next Steps for the SEC and Bitwise

Bitwise is currently awaiting SEC approval for multiple crypto ETFs, including LINK, Solana, XRP, Dogecoin, and Aptos. If the Chainlink ETF receives approval, it would expand the firm’s lineup of single-token crypto ETFs and provide investors with a secure, regulated option for exposure to one of the most widely used tokens in DeFi infrastructure.