Solana (SOL) has been volatile in recent sessions. After rallying earlier this year, the token is under pressure, trading around $210 following a 4% daily drop and 11% weekly losses. Even so, some market commentators continue to discuss scenarios in which SOL could revisit higher levels over time, including a $500 target in 2025, though outcomes are uncertain.

While large-cap assets like Solana move through corrections, some market participants are also looking at early-stage token sales. One project in particular, Digitap ($TAP), says it has raised roughly $190,000 in an opening sale stage at a quoted price of $0.0125 per token.

As with any token sale, fundraising figures and token pricing should be interpreted cautiously and do not indicate future market performance.

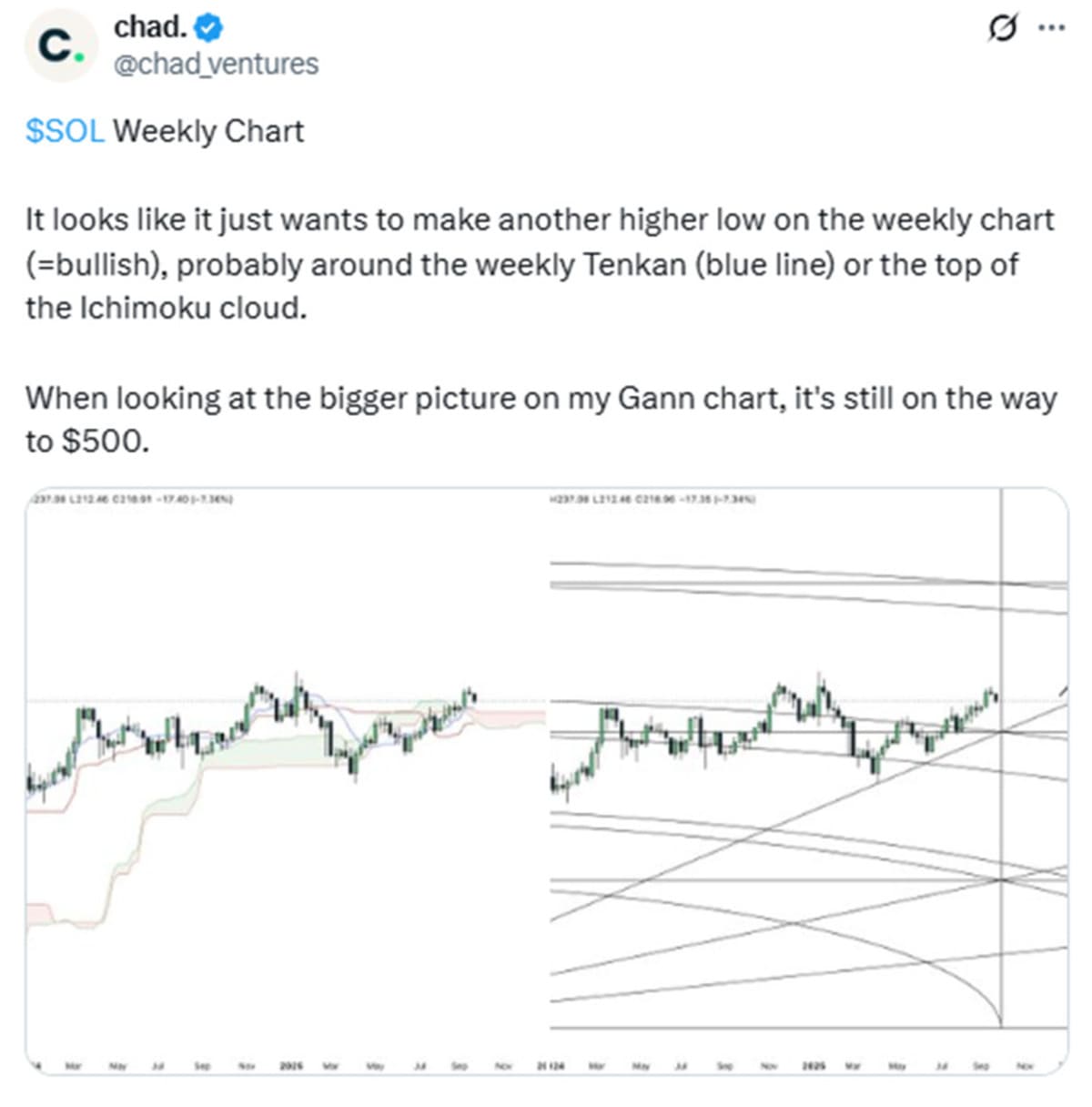

Prediction Setup: Solana’s Path to $500

In the short term, Solana has been under selling pressure, trading below two technical reference levels cited by some traders: the $218.73 30-day average and the $227.55 Fibonacci support. The MACD histogram was reported at -3.12 and the RSI at 44.9 in the cited analysis. These indicators are commonly used for technical analysis, but they are not predictive on their own and can change quickly.

Some market commentary has highlighted $210 as a key near-term level, with $200 often referenced as a psychological support area if weakness continues. In context, SOL was still up 11% year-to-date in the figures cited, and it has risen significantly from 2020 lows, reflecting both long-term growth and the sector’s volatility.

Separately, some reports have pointed to inflows into Solana-related exchange-traded products, including a cited $127 million for the prior week and total assets under management of $4.3 billion. Such figures can influence sentiment, but they do not guarantee future price direction.

Against that backdrop, a $500 target is discussed by some analysts as a possible long-term scenario rather than a certainty. Another view cited is that as long as Solana holds the $188–$190 zone, its broader chart structure could remain constructive.

Analyst Views: Mixed Near-Term, Long-Term Scenarios

Market analysts cited in this discussion have presented differing near-term views while outlining possible longer-term outcomes:

- MarketMaestro said the current dip could form an inverse head-and-shoulders pattern on the weekly chart, a setup that some traders interpret as a potential reversal signal.

- Chad, another analyst cited, pointed to Solana’s weekly Ichimoku cloud as a sign of relative strength and discussed a scenario in which a higher low around $188 could precede a move toward $500.

These are opinions based on technical analysis rather than guarantees. Separately, the market continues to see attention on early-stage projects, including token sales, which typically carry higher risk and less available information than established assets.

Digitap ($TAP): Early-Stage Token Sale

Digitap ($TAP) is being marketed as an early-stage project currently conducting a token sale. The project says it has raised more than $192,000 and sold 15.44 million tokens in the initial period, with a quoted token price of $0.0125. Note that token unit price is not directly comparable to established assets such as SOL without additional context (for example, circulating supply and market capitalization).

According to project materials, Digitap highlights the following features:

- Unified wallet: Described as supporting cross-chain transactions.

- Digitap Card: Marketed as a Visa-powered debit card; the project also describes it as “no-KYC.” Requirements and availability can vary by jurisdiction and provider.

- Tokenomics: The project describes a capped 2 billion supply and buy-and-burn mechanics.

- Staking (project-reported): Materials associated with the sale reference staking rewards up to 124% APR. Such rates, if offered, are typically variable, can change, and are not guaranteed.

As with other early-stage token offerings, readers may want to review independently verifiable documentation and risks, including smart-contract, liquidity, and regulatory considerations.

Bull, Base, Bear for $TAP

Crypto assets can be highly volatile, and outcomes for both established tokens and early-stage projects can differ materially from expectations. Market participants often frame discussions in scenarios such as the following:

- Bull case: Broader market conditions improve, benefiting large-cap tokens and increasing interest in smaller projects.

- Base case: Major assets trade in a range while early-stage projects develop products and attempt to build user adoption.

- Bear case: Risk-off conditions persist, liquidity tightens, and early-stage projects face heightened execution and funding risks.

Digitap’s materials also state that it has a live app available on the Apple App Store and Google Play Store.

Context: Large-Cap vs. Early-Stage Risk

Solana is widely followed, including for institutional product flows and long-term technical discussions. At the same time, early-stage token sales represent a different risk profile, with higher uncertainty around product execution, liquidity, disclosures, and regulatory status.

For reference, Digitap maintains the following links:

Project website (token sale page): https://presale.digitap.app

Social: https://linktr.ee/digitap.app

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.