On December 22, 2025, Solana (SOL), a public blockchain ranked seventh by market capitalization, was trading at $126.33, with a market cap of $71.02 billion and a 24-hour trading volume of $3.23 billion. In the second half of 2025, SOL experienced periods of significant price volatility; market trends can be identified from technical charts and on-chain data.

This article is for informational purposes only and does not constitute financial or investment advice.

Price Performance Analysis for the Second Half of 2025

Below is the monthly price trend of SOL from June to December 2025:

| Month | Close(USD) | MoM | Cum.(Since Jun) | Market Stage |

|---|---|---|---|---|

| Jun | 154.74 | — | Base | Bottoming |

| Jul | 172.42 | +11.4% | +11.4% | Uptrend |

| Aug | 200.86 | +16.5% | +29.8% | Acceleration |

| Sep | 208.74 | +3.9% | +34.9% | Cycle Peak |

| Oct | 187.21 | -10.3% | +21.0% | Pullback |

| Nov | 137.16 | -26.7% | -11.4% | Deep Correction |

| Dec | 126.31 | -7.9% | -18.4% | Consolidation |

Technical Analysis:

Uptrend (June-September): SOL rose from $154 to a peak near $209 in September, an increase of roughly 35%, moving past several commonly watched moving averages over that period.

Correction (October-December): Prices declined after the September peak and reached a lower level around $117.62 on December 19th, representing a notable retracement from the peak.

Current Status: The price is fluctuating near $126. The weekly RSI is 37, a level some analysts interpret as closer to oversold, while the daily MACD has moved into positive territory (+0.24). Market participants may interpret these indicators in different ways; they do not guarantee any particular price movement.

Key Technical Levels:

Support Levels: $120 (Lower Bollinger Band), $117 (Weekly Donchian Channel Lower Limit)

Resistance Levels: $131 (Daily Middle Bollinger Band), $147 (Daily Donchian Channel Upper Limit), $178 (Weekly Middle Bollinger Band)

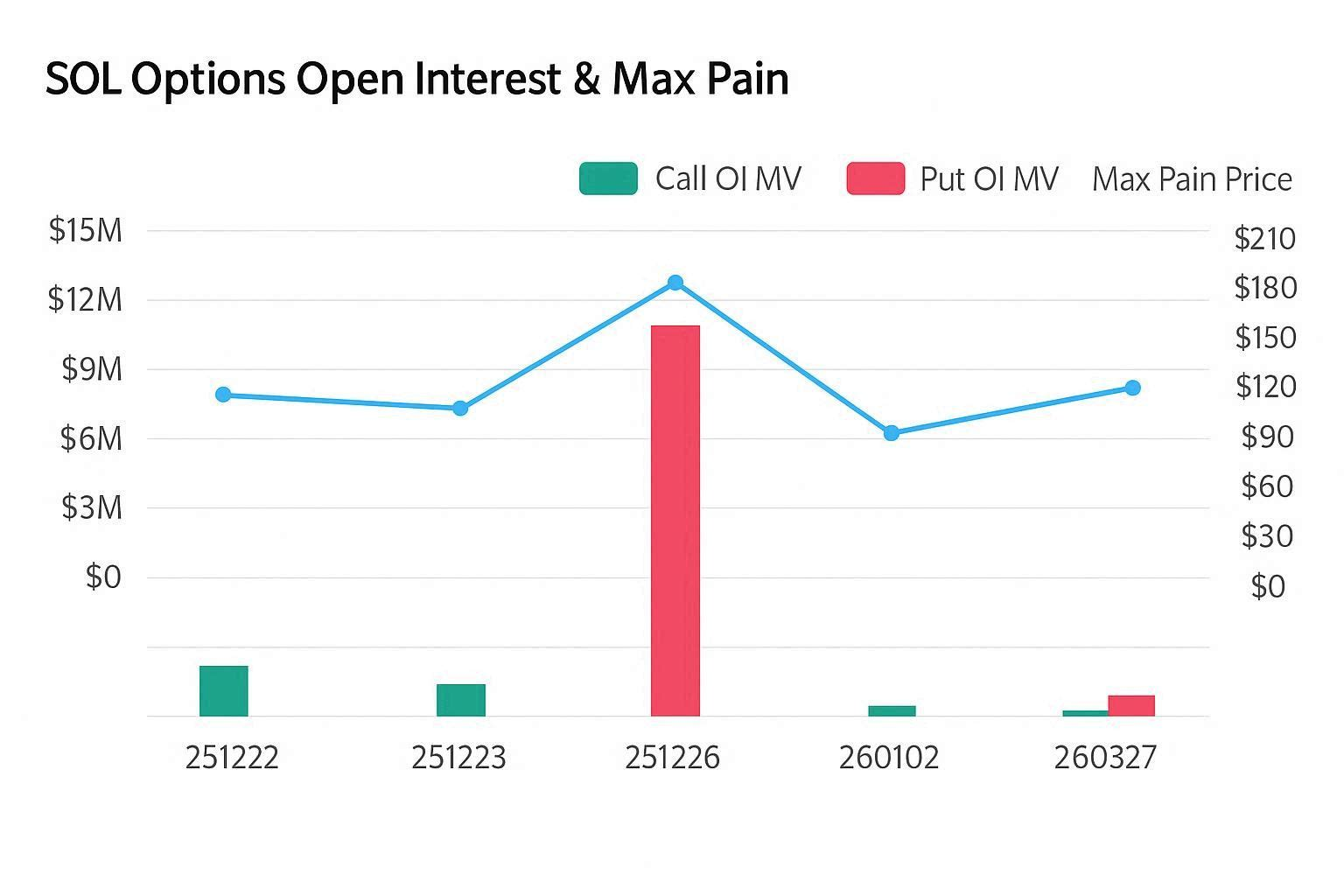

Derivatives Market: According to exchange-reported data, total open interest stood at $6.98 billion. The largest options open interest (often referred to as max pain) was reported at $126 for options expiring on December 25th, close to the spot price. Twenty-four hour liquidation figures show $4.5 million in short positions liquidated versus $3.1 million in long positions; some market observers interpret such flows as one of several short-term indicators, but they are not definitive signals of future direction.

Open interest and max pain SOL options data by exchange and expiration date

2026 Outlook: Analyst Estimates and Institutional Commentary

After a downtrend in the last quarter of the year, Bitwise Research described a bullish institutional view for Solana in 2026. The report includes analyst estimates that range widely; some estimates cited in the coverage range between $300 and $400 on average, while other forecasts mentioned in the same context extend higher. These are analyst projections and should be treated as estimates rather than predictions.

The report highlights factors cited by proponents, including the launch of SOL staking ETFs by REX-Osprey and Bitwise and reported inflows, increases in total value locked (TVL) in DeFi, and protocol-level developments such as the Firedancer validator client and Alpenglow consensus work. The significance and impact of these items are subject to interpretation and market conditions.

According to project-reported on-chain metrics, the Solana ecosystem has a reported developer count and transaction throughput figures; the project materials cited in coverage indicate around 17,708 developers and reported network performance metrics such as transactions per second and low average fees. These figures are reported by project sources and are not independently verified here.

Project-reported tokenomics data indicate a large proportion of circulating SOL has been staked and report an annualized staking yield near 6.38%. These figures are descriptive of reported staking conditions and are not a recommendation.

Poain Stablecoin Staking: company claims and service description

Poain (https://poaintoken.com) describes itself as an AI-powered staking platform offering stablecoin staking services alongside staking on other crypto assets. The company describes diversified staking options for assets such as USDT and USDC and states it supports a range of other cryptocurrencies.

Poain’s materials describe an AI-based monitoring system that the company says assesses market conditions and allocates staking activity. The platform’s website and promotional materials state that staking plans are available with various contract durations and that returns are distributed according to plan terms. These operational and performance claims are reported by the company and are not independently verified in this article.

In its public materials, Poain states plans for a Phase 2 token sale, subsequent token distribution, and secondary market listing in 2026. These plans are reported by the company and are subject to change.

Combining Staking Strategies: potential approaches and risks

Some market participants discuss combining native SOL staking with third-party stablecoin staking products as a way to diversify exposure between potential token appreciation and yield-generating activities. Discussions of potential returns in this piece refer to reported figures and analyst estimates and do not constitute investment advice.

From a technical perspective, a weekly RSI near 37 is often interpreted as nearer to oversold by some analysts, while a positive daily MACD can be read as a short-term momentum indicator by others. Historical patterns do not guarantee future outcomes. Option expiry concentrations and on-chain flows are additional indicators that some traders use; interpretations vary and involve uncertainty.

Proponents of protocol upgrades and institutional products argue these developments could influence future market conditions. However, the size and direction of any impact are uncertain and depend on many factors, including macroeconomic conditions, regulatory developments, and broader market sentiment.

Company: Poain BlockEnergy Inc. (as listed in company materials)

Website: https://poaintoken.com

Email: [email protected]

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.