The crypto market drew attention after U.S.-listed Solana ETFs recorded $23.57 million in net daily inflows, their strongest showing in roughly four weeks. These inflows arrived during a period of broader market stabilization, helping SOL trade near the $145 level and extend its weekly gains.

Despite this, the ETF activity represented less than 1% of Solana’s daily spot trading volume. As a result, analysts noted that while sentiment improved, the inflows alone were unlikely to drive a decisive change in price direction over the short term.

At the same time, market discussion has increasingly focused on Zero Knowledge Proof (ZKP) from a structural perspective rather than price movement. Instead of reacting to capital flows, attention is shifting toward how ZKP integrates verification directly into smart contract execution. This contrast is shaping how some observers reassess which projects stand out as the best crypto to buy now in 2026.

Solana ETF Inflows Increase While Broader Momentum Remains Unclear

The recent ETF data has helped improve sentiment around Solana, but analysts remain cautious about its longer-term impact.

Key observations from the ETF figures include:

- Daily inflows of $23.57 million, the highest in four weeks

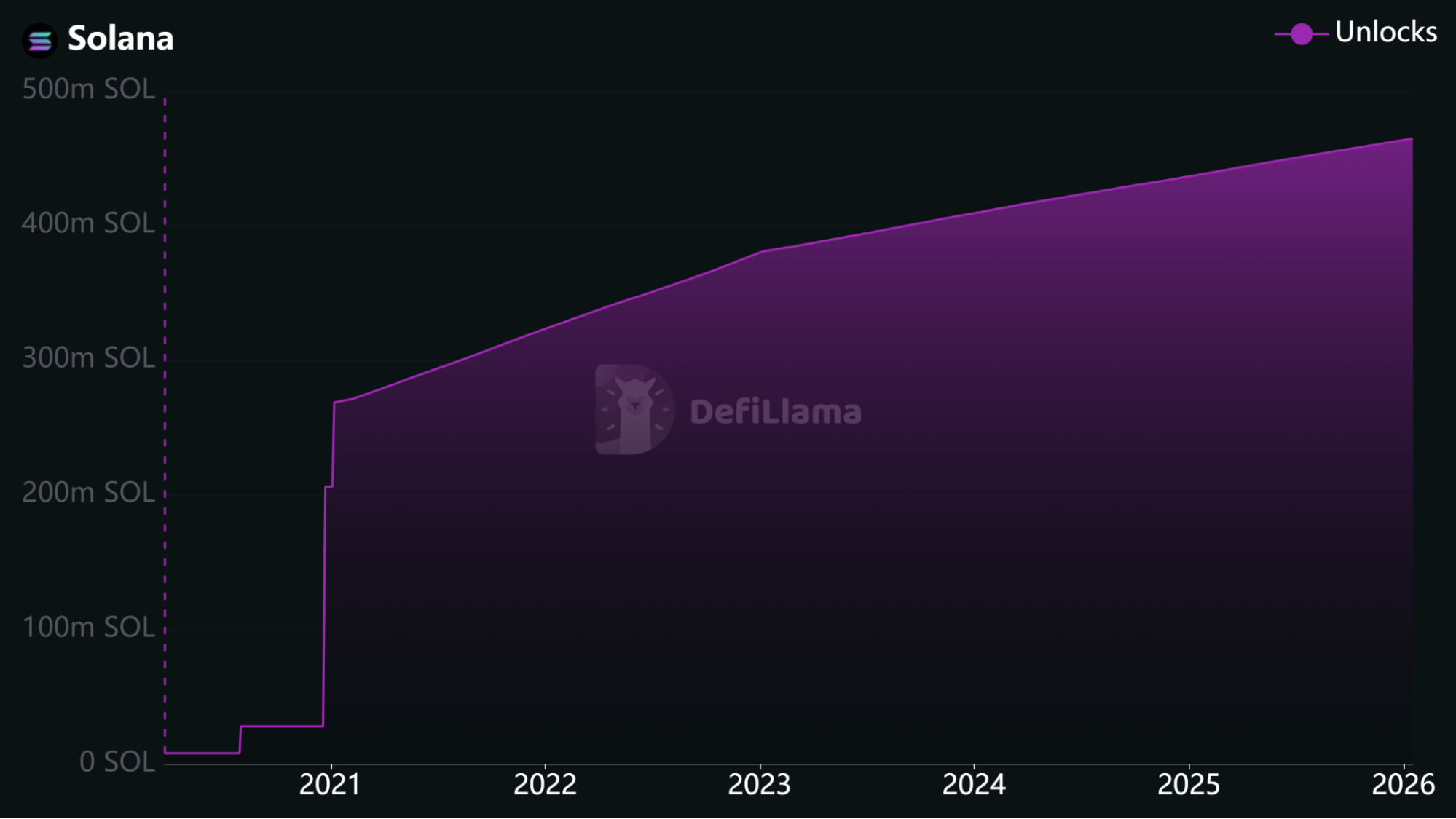

- ETF holdings representing roughly 1.5% of Solana’s total market capitalization

- ETF trading volume remaining below 1% of overall SOL spot market activity

Market commentary suggests that while continued inflows could support a move toward the $150 level, current demand does not yet confirm a sustained trend reversal for Solana or the broader altcoin market.

On-Chain Metrics Point to Uneven Network Conditions

Beyond ETF flows, on-chain indicators for Solana continue to show mixed signals. Recent data highlights several areas of pressure across the network.

Notable trends include:

- Declines in decentralized exchange trading volume

- Lower overall transaction counts

- Softening application-level revenue across the ecosystem

While certain applications continue to attract users, growth appears concentrated rather than network-wide. This divergence between institutional ETF interest and on-chain activity complicates near-term outlooks, suggesting that ETF inflows alone may not be sufficient to drive sustained expansion without stronger usage metrics.

What Is ZKP Crypto?

ZKP crypto is designed as an execution-focused blockchain layer where computational correctness can be verified without exposing the underlying data. Rather than revealing inputs or internal logic, the network relies on cryptographic proofs to confirm that operations were performed accurately.

This approach enables smart contracts, data exchanges, and marketplace transactions to be validated on-chain while sensitive information remains private by default. The design emphasizes controlled execution, positioning ZKP for use cases involving data privacy, AI workflows, and verifiable computation.

How ZKP Crypto Integrates Smart Contracts and Verification

ZKP crypto manages its core marketplace and execution processes through smart contracts designed for efficiency, verification, and privacy.

Key aspects of its architecture include:

- Smart contracts implemented through an EVM-compatible pallet

- Weight-efficient zero-knowledge proof verification embedded directly into execution

- Each proof designed to operate at an execution cost equivalent to roughly 200,000 gas

This structure allows cryptographic validation to occur without excessive computational overhead, supporting scalable contract activity within a Substrate-based environment.

Rather than treating verification as a separate or external step, ZKP integrates proof checks directly into smart contract logic.

Transparency Without Data Exposure

ZKP crypto’s smart contract framework is built to balance transparency with privacy. Instead of exposing sensitive data, the network relies on structured event tracking.

Design features include:

- Event logging for all marketplace interactions

- Indexed logs that record outcomes and contract behavior

- Storage within Substrate’s event system for traceability

This setup allows activity to be monitored and audited while preserving confidentiality. Observers can verify what occurred on-chain without access to private inputs or execution details.

The framework emphasizes:

- Verification embedded at the execution layer

- Reduced overhead through efficient proof validation

- Privacy preservation alongside on-chain accountability

- Marketplace activity without reliance on trusted intermediaries

Conclusion

Solana’s recent ETF inflows demonstrate continued institutional interest, but slowing network metrics highlight the limitations of flow-driven narratives. Without broader acceleration in on-chain usage, price stability remains sensitive to shifts in sentiment.

ZKP crypto reflects a different development path. By embedding weight-efficient zero-knowledge proof verification directly into smart contract execution, the project aligns privacy, transparency, and execution discipline at the protocol level.

Explore Zero Knowledge Proof

Website: https://zkp.com/

Auction: http://buy.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.