TL;DR

- Solana’s daily transactions have plunged by nearly 50%, falling from 125 million in late July to roughly 64 million, even as SOL price rallied 24% over the past 60 days.

- The US SEC is reviewing multiple spot Solana ETF filings from major issuers, including VanEck, Fidelity, Grayscale, and Franklin Templeton.

- Analysts see approval odds at 99–100%, which could trigger significant institutional interest and further price momentum.

Solana’s recent price rally is facing scrutiny as on-chain activity shows a sharp decline. Daily transactions on the blockchain have dropped from approximately 125 million to about 64 million currently. Despite this, SOL has climbed over 24% in the past two months, raising questions about whether the surge is supported by actual network usage or driven primarily by speculation. The slowdown in transaction growth has drawn attention from analysts, traders, and developers who closely monitor Solana’s network health and long-term sustainability.

Market Movement Vs Transaction Activity

CryptoQuant data indicates that SOL rose from late September lows of $191 to trade near $230 this week. Analysts point out that in a sustainable uptrend, network activity typically grows alongside price. However, Solana presents the opposite scenario, with declining transactions coinciding with rising prices. Around 80–90% of these transactions are “voting” related to the network’s consensus. If the decline is mostly from voting, it may not signal major concern, but drops in DeFi, NFT, or transfer activity could indicate fragility in the current price level. Several smaller projects built on Solana are also reporting reduced activity, adding nuance to the broader picture.

Regulatory Catalysts Could Shift Dynamics

This week is crucial for Solana as the US SEC reviews multiple spot SOL ETF applications, including filings from VanEck, Fidelity, Grayscale, and Franklin Templeton. Applications from Bitwise and 21Shares are expected by mid-October. Traders on Polymarket assign more than 99% probability to approval this year, with Bloomberg analysts Eric Balchunas and James Seyffart citing a 100% chance following clearer SEC guidance and leadership changes. Analysts predict that ETF approval could unlock major institutional demand, potentially propelling SOL to new highs, similar to previous BTC and ETH rallies.

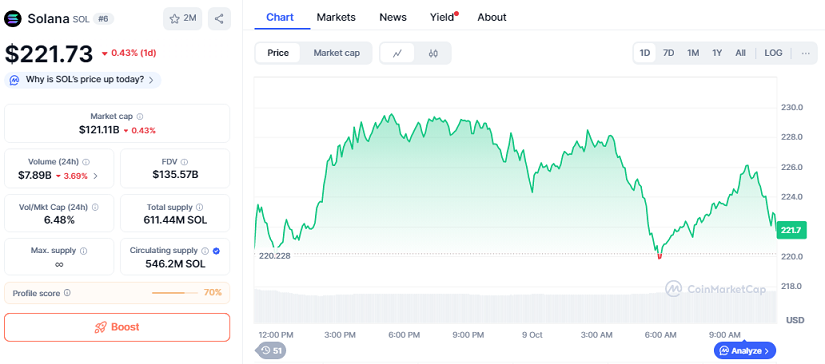

Currently, Solana trades at $221.73, down 0.43% in the last 24 hours, with a market capitalization of $121.11 billion. Its 24-hour trading volume is around $8 billion, while the year-to-date performance remains positive at 18%. Meanwhile, Bitwise has amended its ETF filing, introducing a 0.20% annual management fee and a staking feature, which may intensify competition among issuers and further enhance investor interest. Long-term investors are closely watching how these developments might influence network adoption and broader market confidence.