TL;DR

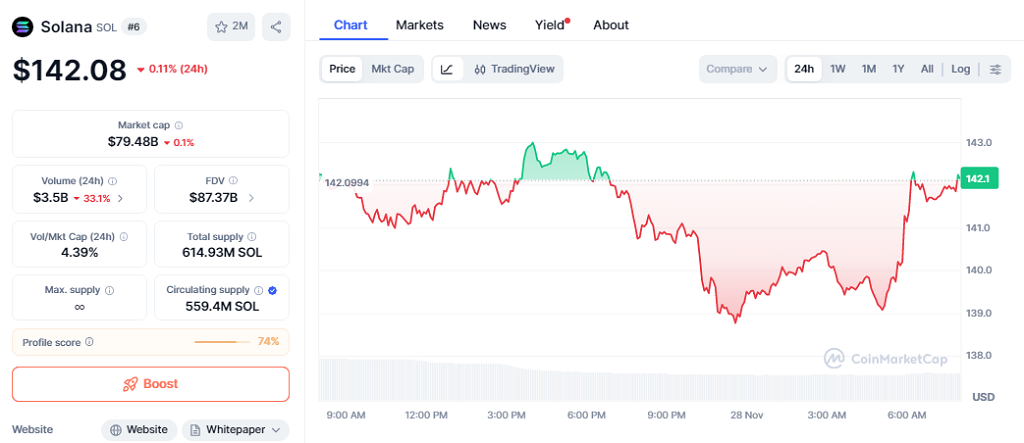

- Solana trades at $142.08 after reclaiming a key technical zone that analysts view as decisive for confirming a short-term bullish shift.

- Despite recording its first ETF outflow, the network continues to show solid institutional backing.

- Markets now watch whether this recovery can hold above the critical resistance and set up a stronger December rebound.

Solana shows resilience during a mixed day for the crypto market. With a price of $142.08 and a -0.11% move in the past 24 hours, the asset recovers a level closely tracked by traders, even as ETF data signals mild cooling. Recent trading data shows mild volatility across major exchanges, reflecting cautious positioning from short-term participants while longer-term holders remain steady.

Solana $SOL usually bottoms when investors capitulate…

— Ali (@ali_charts) November 26, 2025

And for the past two weeks, that’s exactly what’s been happening. pic.twitter.com/UhhK7awBUQ

Solana Price Holds Key Resistance

Recent activity reflects steady improvement. SOL has stabilized near the upper band of its weekly range, supported by broader market strength and rising interest in high-throughput blockchain infrastructure. Several analysts note that the $140 to $146 zone has historically defined meaningful breakouts or corrections, giving the recent move added relevance.

On-chain metrics also show rising engagement, including higher transaction activity and expanding participation in liquid staking protocols. These trends suggest that organic demand could sustain the price if institutional flows keep a reasonable pace. Developers within the ecosystem report increased throughput and new address creation, reinforcing the view that participation remains stable.

The latest session, however, brought the first outflow in SOL-linked ETFs since their launch. The 21Shares product recorded nearly $34 million in redemptions, while funds from other issuers posted smaller inflows that partially offset the decline. Even so, asset managers emphasize that the scale does not alter the broader pattern of steady demand observed in recent weeks.

ETF Outflows And Market Reaction

Despite the outflows, analysts highlight continued interest in regulated SOL-based vehicles. Digital-asset firms report that investors maintain significant exposure relative to other altcoins, signaling ongoing confidence in Solana’s fundamentals.

Market technicians also observe that SOL is approaching a decision zone. The $144 to $146 range has triggered previous rejections, though current momentum appears more stable. If the price holds above the recently reclaimed resistance, several strategists anticipate follow-through toward $157 as December progresses.

The combination of recovered support, expanding network activity, and consistent institutional presence places Solana at a decisive stage. The coming sessions will show whether the asset can convert this advance into a confirmed breakout and strengthen its trajectory into year-end.