TL;DR

- SOL Strategies launched $STKESOL, a liquid staking token for Solana.

- The company manages over 3.3 million SOL through acquired validators.

- Liquid staking tokens now represent 14% of all staked SOL.

SOL Strategies Inc. introduced $STKESOL, a liquid staking token designed to combine staking rewards with continued usability across decentralized finance platforms. Holders receive yield from staking $SOL while retaining the ability to deploy tokens in lending, trading, or yield products. The launch reflects a gradual expansion of services built around Solana infrastructure rather than a sudden shift in direction.

At release, the company plans to stake more than 500,000 SOL through $STKESOL. Integration work already connects the token with established DeFi venues such as Kamino and Loopscale, allowing early participants to access onchain activity without locking assets.

SOL Strategies trades publicly under CSE: HODL and NASDAQ: STKE and currently reports holdings above 427,000 SOL in its treasury. Management continues to emphasize infrastructure development and service delivery linked to Solana’s long-term growth.

SOL Strategies began accumulating SOL in June 2024 after operating for years as Cypherpunk Holdings. A rebrand in September 2024 marked a clear decision to align corporate activity with Solana-based operations. Since then, the firm expanded onchain presence through validator ownership and targeted investments tied directly to network participation.

The company acquired several established validators, including Cogent, OrangeFin Ventures, and Laine. Each operation retained its identity and performance history while joining a broader operational structure. As a result, SOL Strategies increased total staked SOL under management to roughly 3.3 million, strengthening its role in network security and uptime.

Liquid staking as an extension of validator operations

Alongside validator growth, SOL Strategies widened asset exposure beyond staking alone. In June 2025, the firm purchased more than 52,000 JTO tokens and announced the creation of a reserve aimed at supporting additional Solana-based projects.

$STKESOL builds directly on existing validator and staking operations. The token pools stake across multiple validators, spreading delegation while preserving reward flow. Rather than introducing an unfamiliar product line, the company packaged internal capabilities into a format accessible to a broader user base.

Michael Hubbard, interim chief executive officer, stated that $STKESOL shows the firm’s capacity to develop technology that delivers value to users and generates revenue. He emphasized support for dozens of validators and the provision of an additional liquid staking option within a growing market segment.

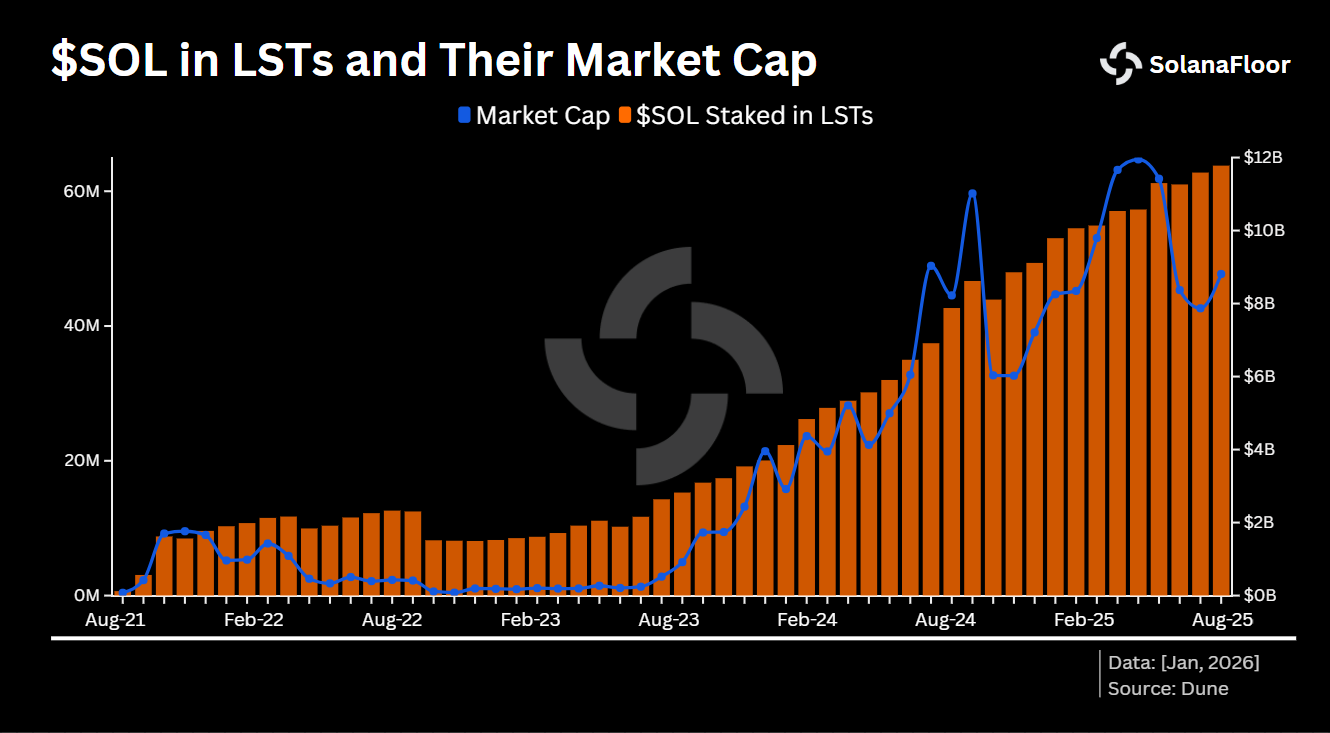

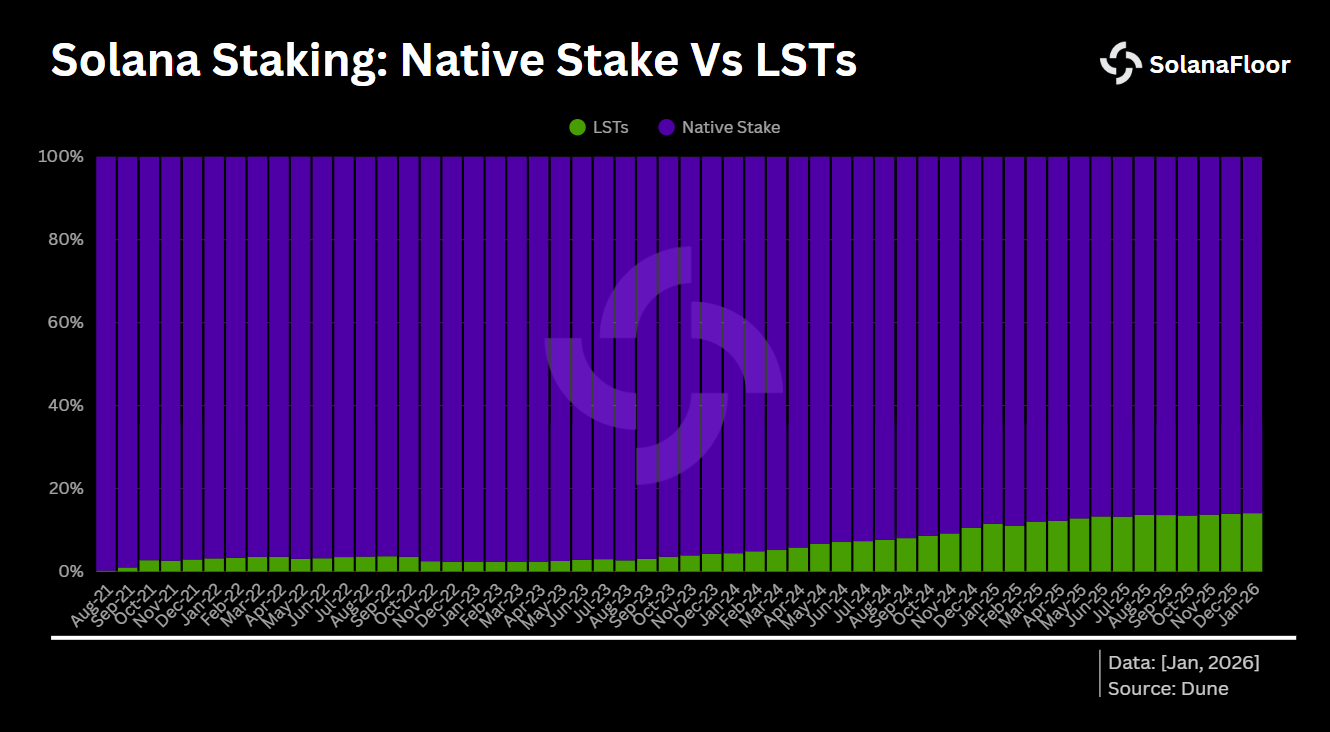

Liquid staking on Solana has expanded steadily since mid-2023. Data from SolanaFloor shows about 454 million SOL staked across the network as of early January 2026. Liquid staking tokens represent roughly 14.06% of that total, equal to 63.8 million SOL. Growth followed increased DeFi support and broader acceptance of yield-bearing tokens that remain usable.