If there’s one thing crypto whales love more than early entries, it’s timing exits – and this week, their radar is flashing red.

Over $312 million in token unlocks are set to hit the market in early November, spanning three headline projects: Ethena (ENA), Memecoin (MEME), and Movement (MOVE). Each carries its own community hype and tokenomics quirks, but to those watching closely, they represent a common story: a psychological and liquidity test for traders who think they’re ahead of the curve.

For the uninitiated, a token unlock is when a project releases previously locked tokens (usually held by founders, VCs, or early contributors) into the circulating supply. It’s meant to reward long-term believers. But in practice, unlocks often trigger the opposite: short-term sell pressure, sudden price drops, and volatile trading windows.

And right now, smart money isn’t just watching. It’s preparing.

Ethena (ENA) – The Yield Paradox

Ethena has positioned itself as a “synthetic dollar” play, combining a stablecoin model with yield-bearing mechanisms. It’s bold – and lucrative – until large holders start hedging their exposure.

This week’s $125 million unlock includes allocations for team members and private investors. While ENA’s structure rewards long-term staking, it also introduces a dilemma: when your yield is good but your token supply doubles overnight, even loyal investors may trim risk.

Historically, ENA’s smaller unlocks have coincided with brief, sharp dips followed by recovery once liquidity normalizes.

In other words, even smart projects can’t outsmart the psychology of supply.

Memecoin (MEME) – The Sentiment Swing

MEME, despite its name, has built a surprisingly disciplined ecosystem. But when community tokens unlock, emotions run high. Roughly $87 million in MEME tokens will enter circulation this week, many belonging to early backers who’ve already seen eye-watering gains.

Social chatter on X (formerly Twitter) has already shifted from “to the moon” to “time to lock profits.” For traders, that’s a signal in itself.

Data from Santiment shows that in previous MEME unlock cycles, social volume rose 40% while price action trended downward – a classic case of attention outpacing conviction.

To track such shifts, experienced investors often turn to analytical dashboards and probabilistic tools, similar to those used in provably fair gaming models. (Learn more about how transparency frameworks like these work in LuckyHat’s provably fair systems.)

The takeaway? Don’t just watch hype – measure it.

Movement (MOVE) – The Infrastructure Test

Movement’s $100 million unlock could be the stealth story of the month. As a layer-1 chain built around modular architecture, MOVE has quietly attracted developer attention, but token dynamics are less forgiving.

With less than 20% of total supply circulating pre-unlock, this week’s event effectively doubles liquidity overnight. That scale forces recalibration: market makers adjust spreads, and short-term traders rush to capitalize on volatility spikes.

For those betting on stability, MOVE may feel like a roulette spin. But to smart money, it’s a calculated probability play – one where data matters more than instinct. Analytical sites and portfolio simulators (many modeled after the transparency logic of Bitcoin Cash casinos) are increasingly used to evaluate unlock timing and liquidity risk.

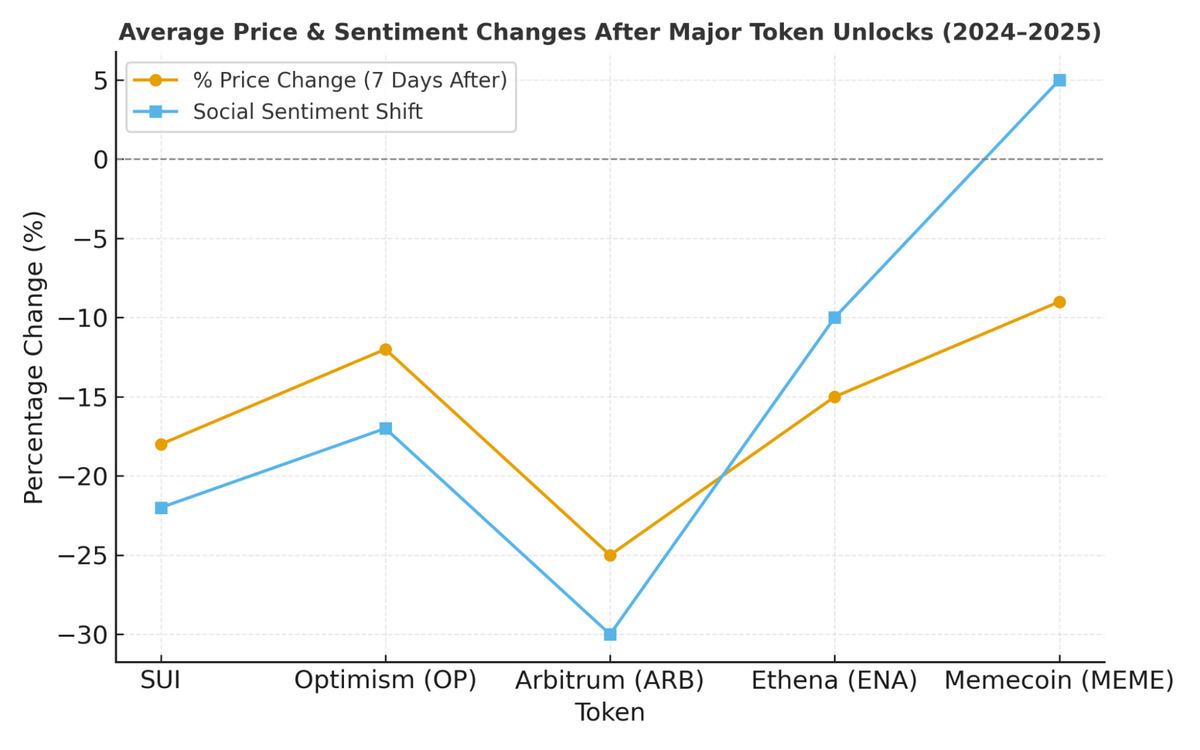

Graph: How Major Unlocks Impact Price & Sentiment

Historical unlocks typically cause 10 – 25% short-term price drops, with a noticeable decline in sentiment as holders shift from optimism to uncertainty. Smart traders don’t panic, they position early, often tracking liquidity patterns days in advance.

What Smart Money Actually Does

- Tracks Vesting Calendars: Whales monitor unlock schedules weeks ahead, using analytics dashboards to pre-empt sell walls.

- Builds Conditional Orders: Instead of panic-selling, they set staggered buy-back levels to catch volatility dips.

- Cross-References Liquidity: Unlocks in thin markets amplify movement – so liquidity data becomes critical.

- Uses Transparent Systems: Similar to provably fair casino audits, data-driven verification tools (like those highlighted at LuckyHat’s Litecoin casinos) allow traders to quantify randomness and probability – not just guess at it.

The Insider’s Edge

The real lesson isn’t about predicting which token falls harder, it’s about understanding why volatility clusters around unlocks.

Because while retail investors react to price, smart money reacts to probability. They know that every unlock is both a risk and an opportunity – a mini-market within the market.

And in crypto, the edge belongs to those who play with information, not emotion.

Bottom Line:

When the next unlock hits, don’t just watch what happens, watch who is watching. Because if smart money’s already moved, you might already be late to the table.

This article provides information about gambling platforms or casinos operating with cryptocurrencies. Crypto Economy is not affiliated with any of the mentioned services. We remind our readers that the use of crypto casinos involves inherent financial and legal risks, which may vary depending on the jurisdiction. This content is for informational purposes only and should not be interpreted as an investment or participation recommendation.