Recent volatility across major crypto assets has kept traders cautious. Both Shiba Inu (SHIB) and Ethereum (ETH) have experienced short-term price weakness, prompting market participants to reassess near-term positioning.

At the same time, Digitap ($TAP) has drawn attention following the announcement of its Solana network integration, a development focused on improving transaction speed, cost efficiency, and multi-asset support within its financial application.

Rather than reflecting speculative momentum, the market response highlights a broader shift toward platforms emphasizing operational utility and infrastructure development.

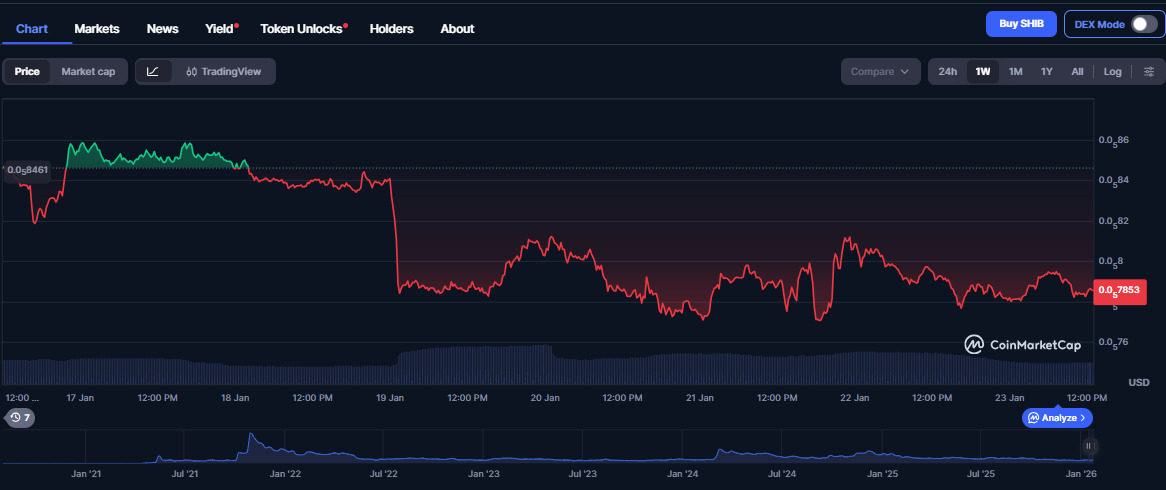

Shiba Inu Price Activity Reflects Ongoing Consolidation

Shiba Inu has faced downward pressure over the past week. Market data shows SHIB declining from approximately $0.0000085 to $0.0000075, representing a pullback of over 5% on the seven-day timeframe.

Technical Perspectives Remain Mixed

Some market commentators note that SHIB continues to trade near key technical levels, including Bollinger Band support zones. Extended consolidation phases have historically preceded volatility expansions, though outcomes remain uncertain.

Conversely, technical indicators such as MACD and momentum oscillators currently reflect caution, with sell-side pressure remaining present. These mixed signals suggest SHIB may continue ranging until broader market sentiment improves.

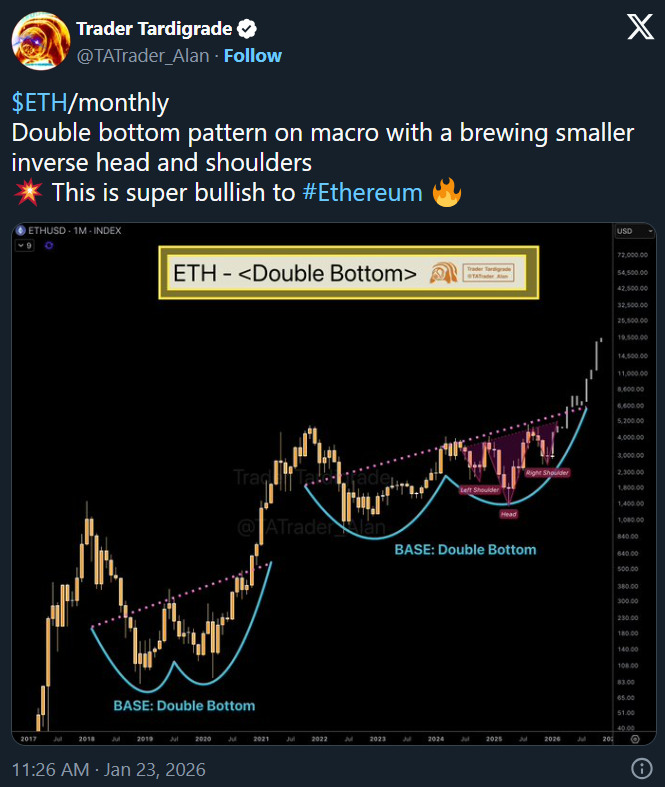

Ethereum Faces Short-Term Pressure Despite Long-Term Interest

Ethereum has also underperformed in recent sessions. Over the past week, ETH declined by more than 10%, moving from around $3,300 to near $2,900, according to market data.

Macro Patterns Versus Capital Constraints

Some analysts point to long-term chart formations suggesting potential structural recovery, while others highlight the scale of capital required for large upward moves. With Ethereum’s market capitalization already substantial, sustained price expansion would likely depend on broader institutional inflows and macroeconomic alignment rather than short-term technical signals alone.

As a result, ETH continues to attract long-term interest while facing short-term uncertainty.

Digitap Expands Platform Capabilities With Solana Integration

While major assets consolidate, Digitap has focused on platform development. The integration of Solana enables users to transact with assets such as USDC, USDT, and SOL using Solana’s high-throughput, low-fee infrastructure.

This integration enhances transaction efficiency within Digitap’s application and reflects a broader strategy to support multiple blockchain networks. Ongoing integration work involving Ethereum and Bitcoin has also been outlined, positioning the platform as chain-agnostic rather than ecosystem-dependent.

Utility-Centered Design Differentiates Digitap From Speculative Projects

Digitap positions itself as an omni-banking platform, combining digital assets and fiat functionality within a single interface. Users can manage, convert, and spend cryptocurrencies alongside traditional currencies without switching platforms.

Additional platform characteristics include:

- Access to multiple payment rails through banking partnerships

- Support for international transfers via SEPA and SWIFT

- Reduced cross-border transaction costs compared with traditional providers

The project has emphasized operational deployment over roadmap projections, with its application already live and actively used.

Token Structure Supports Platform Participation

The $TAP token functions as an internal utility asset within the Digitap ecosystem. The project has outlined mechanisms where portions of platform revenue may be used for token buybacks and supply reduction over time.

Participation metrics indicate steady interest during the presale phase, though long-term performance will depend on adoption, regulatory conditions, and broader market dynamics rather than short-term price projections.

Market Context Favors Utility-Focused Evaluation

As SHIB and ETH navigate consolidation phases, Digitap’s recent developments highlight how some investors are shifting attention toward platforms delivering active infrastructure and financial tooling.

Rather than positioning itself against established assets, Digitap’s approach reflects a different category of crypto exposure—one centered on payments, accessibility, and financial integration. This distinction is increasingly relevant as market participants evaluate crypto projects through functionality and sustainability rather than momentum alone.

Learn More About Digitap

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social Links: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.