TL;DR

- Senator Bernie Moreno says the CLARITY Act could clear Congress by April.

- The Senate Banking Committee postponed its formal markup in January.

- Coinbase withdrew support over stablecoin yield and regulator disputes.

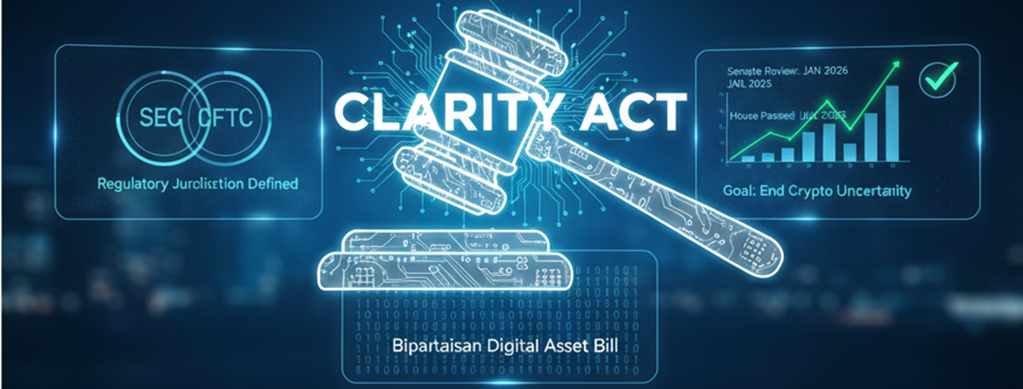

Republican Senator from Ohio Bernie Moreno told CNBC on February 18, 2026, that the Digital Asset Market Clarity Act — known as the CLARITY Act — could clear Congress “hopefully by April.” He made those comments as negotiators from the crypto industry, traditional banking, and Congress work to resolve the disagreements that have slowed the bill’s progress.

The legislative path has not been smooth. In January 2026, the Senate Banking Committee postponed its formal review of the bill. Coinbase pulled its support over disputes about stablecoin rewards and which agency would serve as the primary regulator. Even so, the Senate Agriculture Committee advanced its own version of the legislation, keeping the process alive.

The Core Dispute: Stablecoin Yields

The sharpest disagreement among the parties centers on whether stablecoins should offer yields or interest payments to users. Coinbase CEO Brian Armstrong argues that U.S. companies need that capability to stay competitive against digital currency alternatives from other countries. Traditional banks, on the other hand, worry that customer deposits could migrate toward stablecoins if those instruments offer attractive rates — shrinking the funds banks have available for lending.

Talks to resolve that sticking point gained intensity at the World Liberty Financial crypto forum, where Moreno delivered his remarks. The White House is also actively involved, with reports indicating it has convened meetings to help broker a deal between the parties.

Armstrong himself, one of the figures who previously withdrew support for the bill, now says he sees “a path forward” toward a solution that works for the crypto sector, the banking industry, and American consumers alike. An April passage date depends entirely on negotiators reaching a final agreement in the weeks ahead.

White House advisers, including Patrick Witt, stress that the delay blocks trillions of dollars in institutional capital from entering crypto markets. Brad Garlinghouse, Ripple CEO, estimates an 80–90% chance of enactment by late April if the yield issue resolves.

Prediction markets such as Polymarket and Kalshi show odds peaking near 85% earlier today before settling around 70–80% for passage before June. The White House sets March 1 as the deadline for a stablecoin yield agreement to allow the Senate Banking Committee to resume work.