TLDR:

- David Sacks, the White House “AI and Crypto Czar,” confirmed that the Senate will begin the legislative review process next month.

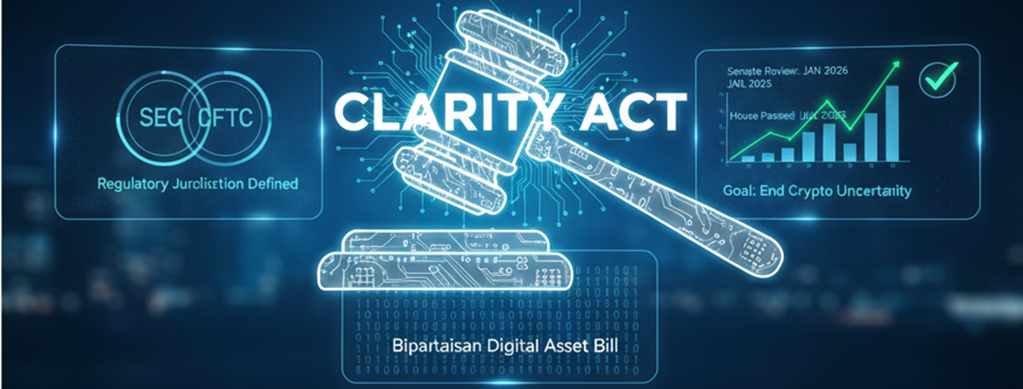

- The bill seeks to define which digital assets are securities and which are commodities, delimiting the functions of the SEC and the CFTC.

- After overcoming delays caused by the government shutdown, the law aims to eliminate regulatory uncertainty for companies like Coinbase and Ripple.

The digital asset industry in the United States is set to witness an unprecedented regulatory milestone. David Sacks, the White House AI and Crypto Czar, announced this Thursday that the Senate will review the long-awaited Crypto CLARITY Act in January 2026.

We had a great call today with Chairmen @SenatorTimScott and @JohnBoozman who confirmed that a markup for Clarity is coming in January. Thanks to their leadership, as well as @RepFrenchHill and @CongressmanGT in the House, we are closer than ever to passing the landmark crypto…

— David Sacks (@davidsacks47) December 18, 2025

Senate Banking and Agriculture Committee Chairs Tim Scott and John Boozman confirmed that the bipartisan bill will begin to take its final shape during the first month of the year, following its approval by the House of Representatives last July.

The Crypto CLARITY Act aims to establish a clear legal framework to distinguish between securities and commodities. This distinction is fundamental to ending years of technical and judicial ambiguity, clarifying the respective jurisdictions of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). By establishing precise compliance pathways, the financial ecosystem is expected to regain the confidence to innovate under more robust investor protection.

Overcoming Delays and Seeking Legislative Consensus

Although figures like Senator Cynthia Lummis expected the Crypto CLARITY Act to reach the president’s desk before the end of 2025, the historic 43-day government shutdown delayed the planned schedule.

Despite the setbacks, momentum did not stop; US regulators held strategic meetings with executives from leading companies such as Ripple, Coinbase, and Circle to ensure the project’s pillars remained a priority on the new administration’s legislative agenda.

The path to final ratification will require Senator Tim Scott to achieve a supermajority of votes to avoid parliamentary blockades. If the Senate approves amendments to the original text, the bill must return to the House of Representatives for final approval before being signed by President Donald Trump.

This coordinated movement promises to turn the Crypto CLARITY Act into the cornerstone of a new era for the digital economy in North America.