TL;DR

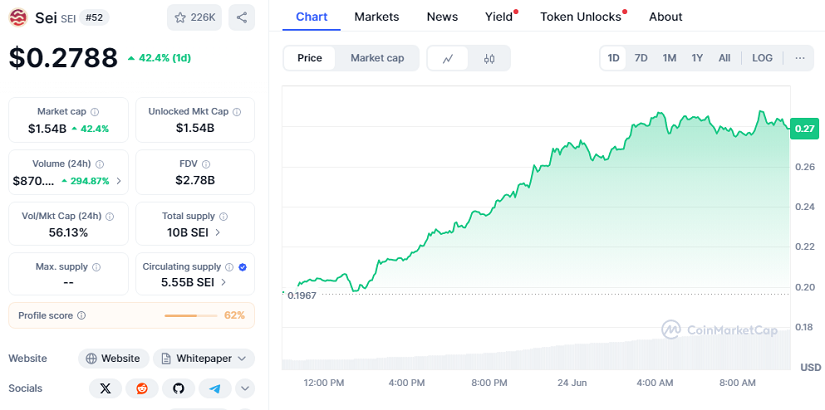

- SEI jumped over 42% in the last 24 hours, trading at $0.2788 with a market cap of $1.54 billion.

- Its DeFi total value locked (TVL) soared by 26% to $535 million, nearing its record high.

- This surge came alongside a broader market rebound fueled by macro developments, strong on-chain growth, and increasing futures interest.

The SEI token has stunned market observers with an amazing 42% daily surge, reaching $0.2788 and marking its strongest price level since early May. As of now, SEI boasts a market capitalization of $1.54 billion, with a 24-hour performance of +42.4%.

The move coincides with growing confidence in altcoins and a wider recovery across digital assets, as Bitcoin climbed past $105,000 and Ethereum, Solana, and XRP all posted important gains as well.

DeFi Momentum Strengthens SEI Fundamentals

While macro headlines like the potential Israel-Iran ceasefire supported the general risk-on mood, SEI’s explosive growth stems from internal dynamics. Its DeFi ecosystem is expanding rapidly. According to DefiLlama, SEI’s total value locked rose by 26% in the past day to hit $535 million, nearly breaking its all-time high. This represents more than a 150% increase from January, when its TVL hovered around $208 million.

This growth is led by protocols like Yei Finance, a lending platform inspired by Aave, which now holds $314 million in assets. Takara Lend, another native lending app, adds $59 million to the tally. SEI is attracting real usage, as developers and users increasingly turn to its scalable and application-specific Layer 1 infrastructure.

Derivatives Data and Stablecoin Activity Highlight Strong Market Confidence

Open interest in SEI futures contracts jumped by 84% in the last 24 hours, reflecting rising speculation and potentially new institutional exposure. At the same time, stablecoin activity on the chain has exploded. Total stablecoin supply on SEI has ballooned from just $1.2 million in March to over $225 million today. USDC alone accounts for more than 83% of that.

Revenue growth tells a similar story. Monthly income from SEI-based DeFi protocols surged from $116,000 in March to $562,000 in June, confirming robust user engagement. Traders are clearly responding: trading volume exceeded $870 million in the last 24 hours, up 295%.

Meanwhile, the crypto “Fear and Greed Index” has returned to “Neutral,” further supporting bullish sentiment. With SEI now more than doubling from its April lows, the momentum suggests this Layer 1 is capturing more than just attention, it’s capturing value.