TL;DR

- Sei Network is moving closer to institutional adoption with the launch of Monaco, a professional-grade trading layer aimed at large-scale financial activity.

- At the same time, a new ETF filing by CBOE linked to SEI signals growing interest from traditional markets.

- Despite short-term price weakness, on-chain growth and sustained capital inflows highlight Sei’s strong momentum and potential for future expansion.

Sei Network continues to position itself as a rising force in the global blockchain sector, strengthening both infrastructure and investor confidence. The latest updates point to a growing appetite from institutional players who increasingly see SEI as a project capable of bridging traditional finance with Web3 innovation.

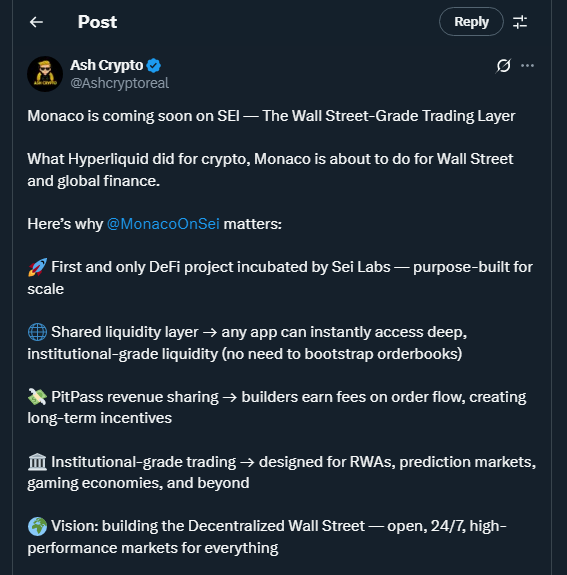

Institutional Infrastructure Gains Ground

The introduction of Monaco, a Wall Street-grade trading environment, marks a turning point for Sei. Unlike competitors that remain focused on niche DeFi solutions, Monaco is designed to handle the scale and efficiency required by traditional institutions. Its open and high-performance architecture aims to support tokenized assets as trillions of dollars migrate from legacy financial systems into blockchain-based markets.

In parallel, the Chicago Board Options Exchange (CBOE) has filed a proposal with the U.S. Securities and Exchange Commission for the Canary Staked SEI ETF. While still pending approval, this development signals increasing willingness from traditional finance to create regulated pathways into SEI exposure. Analysts see this as an important step toward legitimizing SEI within broader investment portfolios.

On-Chain Metrics Reflect Investor Confidence

Sei’s fundamentals reinforce this institutional narrative. Active addresses have grown by nearly 8,000% since launch, while Total Value Locked recently approached $626 million, showing that capital allocation within the ecosystem remains robust and consistent. These indicators suggest SEI is not only attracting speculative interest but also sustained participation from long-term investors.

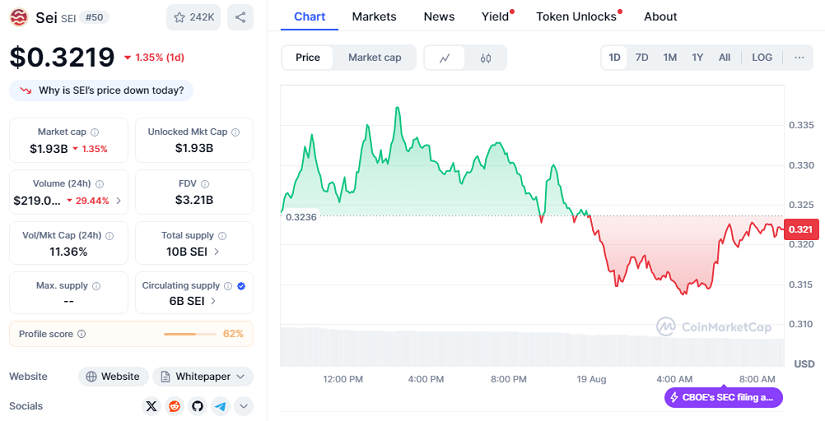

At the time of writing, SEI trades at $0.3219, marking a 1.35% decline over the last 24 hours. The market capitalization stands at $1.93 billion, with daily trading volume surpassing $219 million despite a 29.44% drop.

Many analysts still view $0.31 as a key accumulation zone, projecting a potential move toward $0.44 in the short term. Some even foresee a longer-term breakout to the $2–$3 range in the next cycle, provided SEI maintains its resilience against broader market pullbacks.

With strong technical structure, rapidly improving on-chain data, and the rollout of institutional-grade tools, Sei Network appears well-positioned to establish itself as one of the most attractive and influential blockchain projects heading into the next phase of market growth.