The United States Securities Exchange Commission (SEC) has just put forward new rules that will make it more difficult for cryptocurrency firms to serve as digital asset custodians in the future and require companies to gain or maintain registration in order to hold customer assets.

The crackdown comes after a series of failure of several high-profile crypto companies last year. In a string of recent developments, the regulator has come down heavily on the digital asset sector with SEC Chair Gary Gensler noting the rapid proliferation of cryptocurrency outfits resemble the “wild west”. He has further claimed his agency is trying to protect investors through better regulation of new digital assets.

Recently, the American regulatory agency decided to shut down crypto exchange Kraken’s staking program and forced the global exchange to pay a fine of $30 million in penalties. The SEC was also reportedly planning to sue stablecoin issuer, Paxos Trust Company over violating investor protection laws in its issue of the Binance USD (BUSD) stablecoin.

War on Crypto Intensifies

We @SECGov just proposed to expand & enhance the role of qualified custodians when registered investment advisers custody assets on behalf of investors.

Thru our rule, investors would get the time-tested protections—and qualified custodians—they deserve.

What does this mean? ⬇️ pic.twitter.com/RerUGnpArI

— Gary Gensler (@GaryGensler) February 15, 2023

According to an official press release, a five-member panel of the SEC voted 4-1 recommending sweeping changes to the “2009 Custody Rule” will apply to custodians of “all assets” including cryptocurrencies. As per the proposed rule, investment advisers have to draw up written agreements with qualified custodians such as banks, broker-dealers and trust companies to ensure a client’s assets were segregated and protected in case the custodian collapsed.

The new custody rules aim to “expand the scope”, that would require a written agreement between custodians and advisors, increasing the “surprise examination” requirements, and also enhance recordkeeping rules. Gensler’s animosity with crypto has escalated to new heights with numerous critics portrayed him as a tyrant accusing him of being aggressively anti-crypto. While proposing the new rules, the SEC Chair took a dig at crypto noting,

“Make no mistake: Today’s rule, the 2009 rule, covers a significant amount of crypto assets. […] Further, though some crypto trading and lending platforms may claim to custody investors’ crypto, that does not mean they are qualified custodians. Rather than properly segregating investors’ crypto, these platforms have commingled those assets with their own crypto or other investors’ crypto. “When these platforms go bankrupt—something we’ve seen time and again recently—investors’ assets often have become property of the failed company, leaving investors in line at the bankruptcy court.”

A Looming Threat to Crypto

The new moves poses as a grave threat to the crypto industry with Gensler intensifying several other enforcement attempts. It seems investors are digesting a number of major regulatory actions in the US as authorities look to rein in the once free-wheeling cryptocurrency industry. Ripple executive Stuart Alderoty has slammed the SEC for its anti-crypto stance citing Gensler as a “political liability”. In a statement, Vijay Ayyar, VP of corporate development and international at crypto exchange Luno said,

“We’re seeing a lot of scrutiny across various sectors in crypto in the U.S., with the two most recent areas being staking and stablecoins. This is an obvious repercussion of the fallout from FTX, Luna, and the general contagion in crypto over the last year.”

Crypto Market Posts Insane Gains

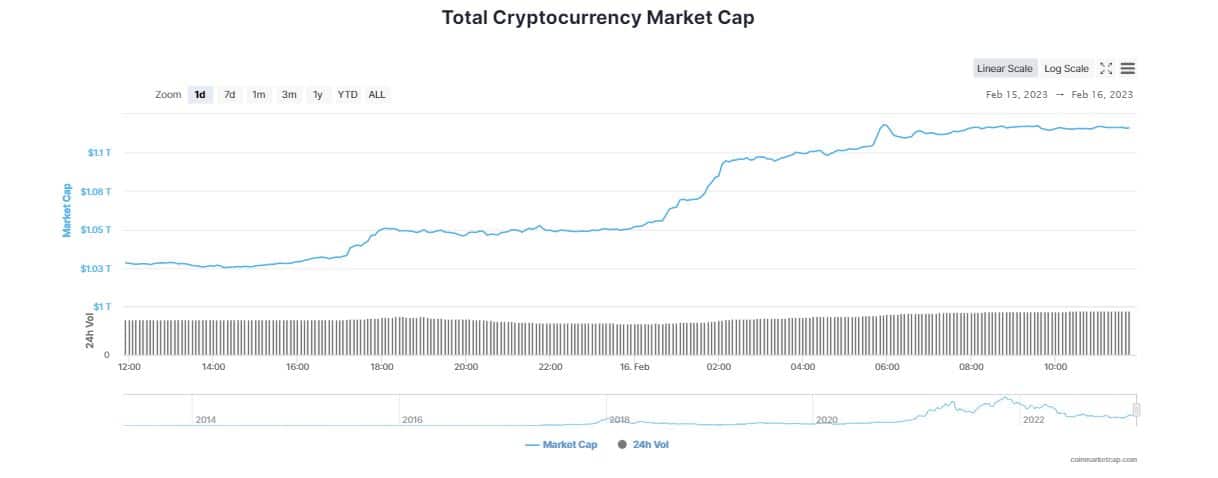

Despite the news, crypto market exploded over the past 24 hours with prices of crypto stocks and currencies swelling in tandem after the SEC proposed a rule that could squeeze digital asset platforms. According to CoinMarketCap, crypto heavyweights including, Bitcoin (BTC) and Ethereum (ETH) boomed 11.36% and 9,23% in the last 24 hours, respectively.

The global cryptocurrency market cap was trading sharply higher to $1.12 trillion mark, jumping almost 9 per cent in the last 24 hours. Meanwhile, most of the top cryptocurrencies witnessed a dramatic upswing. On February 15, Galaxy Digital Holdings CEO, Mike Novogratz, expressed there’s a chance Bitcoin (BTC) could return to $30,000 or above before the end of March.