TL;DR

- MicroStrategy now holds a total of 640,250 BTC. Its Bitcoin account is valued at $47 billion.

- The massive investment comes amid a recovery in Bitcoin’s price, which has surpassed $114,000.

- Michael Saylor maintains his firm conviction: Bitcoin is the primary long-term reserve asset.

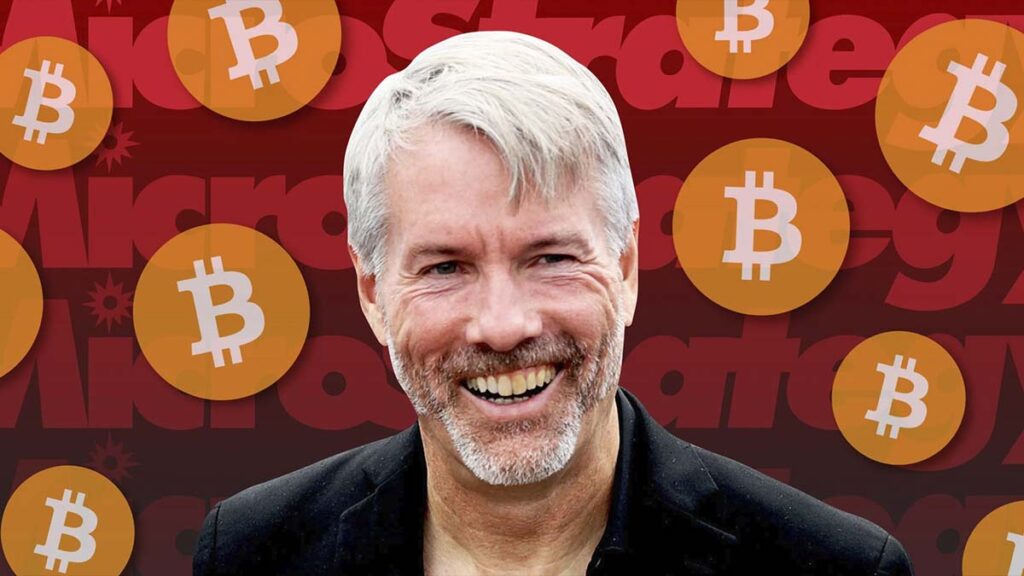

Saylor has once again demonstrated his unwavering confidence in the pioneer cryptocurrency. MicroStrategy, under the leadership of Michael Saylor, has announced another massive Bitcoin acquisition. The company has raised its total holdings to the impressive figure of 640,250 BTC.

This solidifies its position as the largest corporate holder of Bitcoin globally. This portfolio was accumulated at a total cost of approximately $47.38 billion, with an average purchase price of around $74,000 per Bitcoin.

A Purchase Taking Advantage of the Market

This latest Bitcoin purchase by MicroStrategy comes at an opportune moment, coinciding with a notable market recovery. Following a recent correction, the price of Bitcoin has rebounded, currently trading at around $114,542, an increase of 2.4% in the last 24 hours.

Experts highlight that BTC’s ability to stay above the key level of $110,000, supported by steady inflows into spot ETFs, is strengthening the confidence of both institutional and retail investors.

Michael Saylor, the firm’s executive chairman, reaffirmed his strategic vision, positioning Bitcoin as a superior reserve asset to gold and fiat currencies for hedging against inflation. “Our commitment to Bitcoin remains unchanged,” Saylor stated, emphasizing the strength of his long-term accumulation strategy.

The market’s reaction was immediate: the company’s stock (MSTR) rose to $306.85 following the announcement, indicating that shareholders support the bold strategy. The persistent purchasing of Bitcoin by MicroStrategy is seen by many as a bullish signal, suggesting that large institutions consider current price levels an attractive entry point, further consolidating corporate adoption of the digital asset.