TL;DR

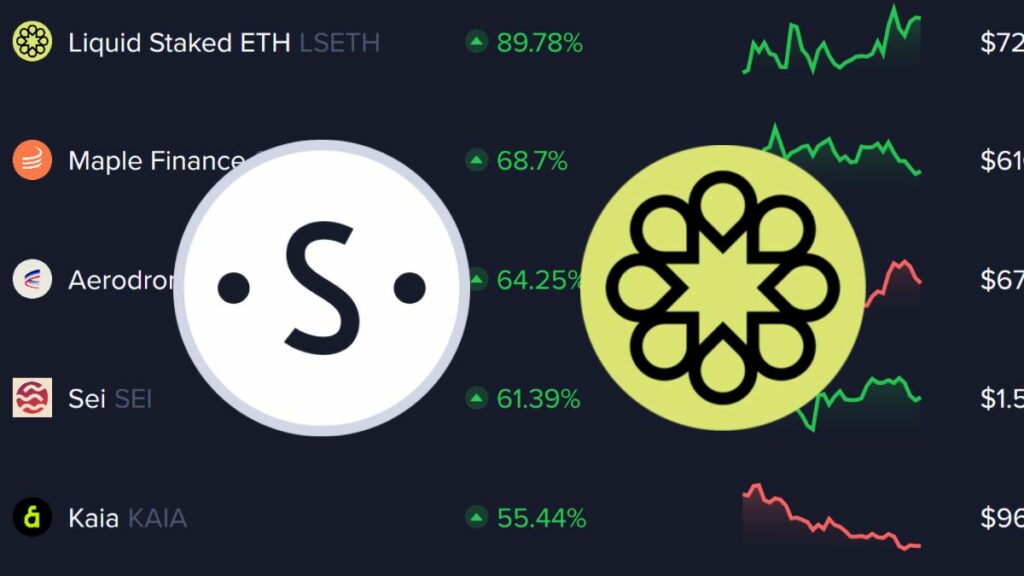

- Liquid Staked ETH led the pack with an almost 90% market-cap surge, as yield-hungry investors piled into staking derivatives.

- Mantle Staked Ether’s volume exploded over 1,600%, while OKB mentions jumped 228% and Bittensor’s developer commits spiked 3,600%, highlighting social buzz and engineering firepower.

- USD Coin onboarded 3,000% more new addresses, and GateToken saw a 300% rise in whale transfers, underscoring retail adoption and big-player accumulation.

While Bitcoin and Ethereum dominated headlines, Liquid Staked ETH quietly surged to steal the spotlight in June. Its market capitalization jumped almost 90%, driven by growing demand for staking derivatives and fresh inflows from yield-hungry investors. With a sizeable pool of ETH locked in staking contracts, LSETH’s rally reflects broader confidence in Ethereum’s move toward proof-of-stake and highlights how liquid staking tokens can deliver outsized growth even when larger coins tread water.

Volume Breakouts for Staked Tokens

Trading volume exploded for Mantle Staked Ether, rocketing over 1,600% in 30 days. This vertiginous uptick signals a shift in trader focus toward next-gen staking products and Layer 2 interoperability. As Mantle further integrates with popular wallets and DEXs, the token’s newfound liquidity has made entry and exit friction nearly vanish. The result: rapid momentum and a blueprint for how staking wrappers can leverage both yield and volume to outpace legacy assets.

Social Stars and Developer Darlings

Social chatter often foreshadows market action, and OKB saw its mention count swell by more than 228%. Traders flocked to the exchange token as its parent platform unveiled trading fee discounts and new staking tiers.

Meanwhile, Bittensor stole the developer spotlight with code commits soaring over 3,600%, underscoring an intensely productive engineering team. Together, these metrics show that community buzz and hardcore development can propel lesser-known projects into the investor limelight.

Network Growth and Whale Moves

Some tokens shine not in price but in adoption. USD Coin saw fresh addresses flood in, spiking network growth by over 3,000%, a testament to stablecoins’ enduring role as on-ramps for new crypto users.

On the other end, GateToken topped whale transactions with a 300% jump in six-figure transfers, revealing that big players are quietly stacking exchange-native tokens. This convergence of retail adoption and institutional accumulation paints a nuanced picture of June’s quiet winners.

June’s analytics-driven findings remind us that beneath the surface of blue-chip cryptos lies a vibrant ecosystem of underappreciated projects, each offering a unique narrative waiting to be uncovered.