TL;DR

- RWA becomes DeFi’s 5th-largest category with ~$17B TVL, surpassing DEXs.

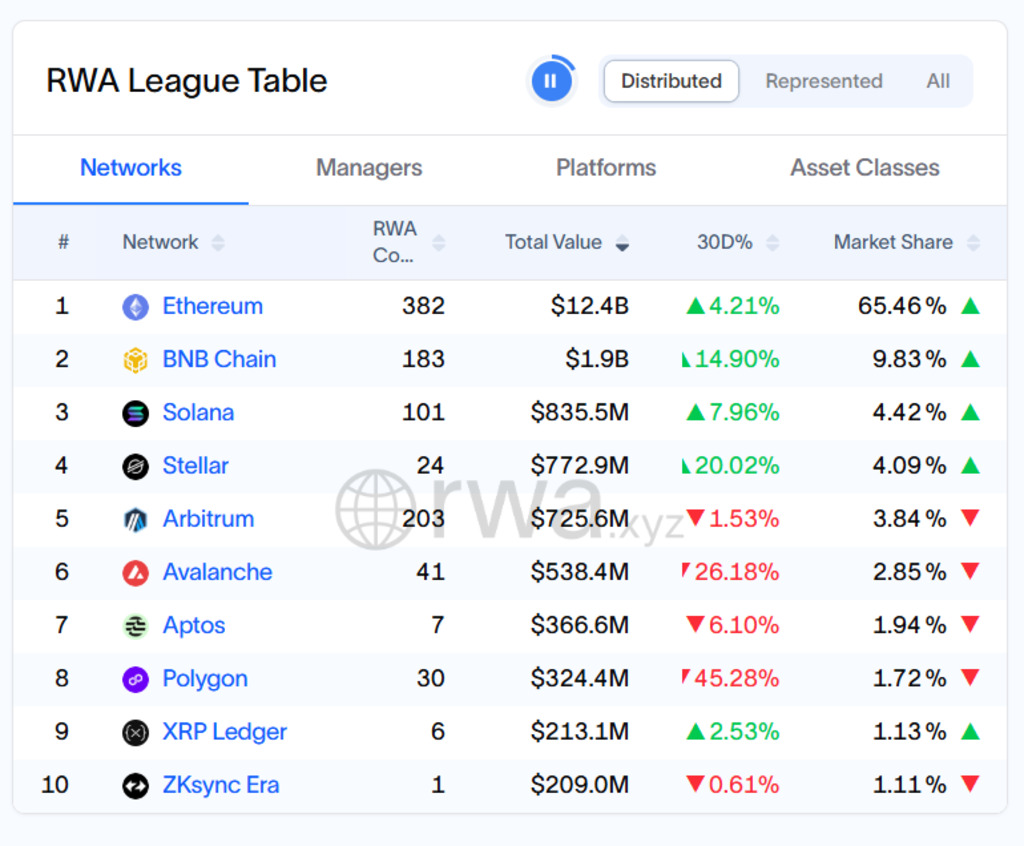

- Ethereum leads in hosting tokenized assets like US Treasuries and commodities.

- Growth is driven by institutional demand for regulated, yield-bearing instruments.

Real-world assets (RWA) close December 29 with about $17 billion in total value locked (TVL) and move into DeFi’s fifth-largest category, surpassing decentralized exchanges. Coverage from Crypto Economy points to stronger institutional interest and clearer rulebooks. Ethereum hosts most deployments, signaling a shift toward tokenized instruments with cash flows and verifiable collateral.

RWAs have now surpassed DEXs to become the fifth largest category in DeFi by TVL.

At the start of this year, they weren't even in the top 10 categories. pic.twitter.com/EDMvPRQyWo

— DefiLlama.com (@DefiLlama) December 29, 2025

RWA starts the year outside the top ten and advances steadily as tokenized U.S. Treasuries and private credit anchor yields. Treasury desks seek balance-sheet tools and find in tokenization faster settlement, 24/7 operability, and lower frictions versus traditional channels. Custodians and service providers standardize pricing, audits, and cut-off cycles, reducing operational uncertainty for allocators.

Ethereum leads RWA; attention turns from headline TVL to usage and liquidity

The main on-ramp comes from tokenized Treasuries. Products such as BlackRock USD Institutional Digital Liquidity Fund (BUIDL), Circle USYC, Franklin BENJI, and Ondo OUSG push the segment into multi-billion-dollar territory by December. Pricing feeds, custody terms, and redemption mechanics gain consistency, which helps broker-dealers and fund admins plug tokenized paper into existing workflows.

Crypto Economy analysts, including Liu, argue that constraints now sit in liquidity and integration with traditional finance, not in tokenization techniques. For 2026, evaluation shifts from sheer TVL to who controls issuance, where RWA serves as collateral, and which venues capture secondary turnover. Treasury-style assets enter lending books, repo-like arrangements, and automated risk engines across major protocols.

Commodities join the flow

Gold and silver rally into new highs and attract capital toward on-chain metal exposure. Tokenized commodities approach $4 billion in market value, led by Tether Gold (XAUT) and Paxos Gold (PAXG). Liu notes that metal strength promotes issuance, draws market-making capital, and reinforces adoption beyond yield farming, aided by clearer pricing and custody frameworks that fit institutional mandates.

Portfolio teams watch practical signals: order-book depth for secondary trading, spreads versus underlying net asset values, and collateral rotation across DeFi credit lines. Sustainable growth requires more market makers, broader credit lines, and gateways to bank custodians for primary and secondary settlement.

Protocols report higher turnover in treasury tranches, tighter premiums/discounts relative to NAV, and rising use of allowlists with KYC for qualified investors.

Key takeaways for allocators

- RWA demand leans on regulated issuance, insured custody, transparent pricing, and bridges to off-chain books.

- Ethereum retains leadership due to tool maturity, security guarantees, and broad distribution.

- Gold and silver strength validates commodity tokenization for 24/7 access and settlement, drawing liquidity toward assets with clearer fundamentals.

RWA consolidates DeFi’s turn toward backed assets under clearer oversight. If metal prices hold and treasury products scale, issuers expand float, liquidity providers follow incentives, and adoption extends past short-term yield trades.