Ripple, like the rest of the cryptocurrency markets, experienced a mixed year in 2019. On one end, there were important surges in the first half but that quickly dissipated in the second half. H2 2019 was, as observed, rough for Bitcoin and altcoins. Considering the nearly positive correlation, fizzling BTC momentum weighs negatively for altcoins including XRP.

Ripple Inc. Quarterly Sale and What It Means

Nonetheless, fundamentals were positive despite incessant criticism that Ripple Inc., the company with a majority control of XRP, can influence the price of XRP. At the moment, Ripple Inc., is implementing a decentralization strategy that saw the number of its validators shrink to 20% from over 60% in their Unique Node List (UNL) over the past three years.

For the neutral, this is remarkable, and Brad Garlinghouse is keen on further decentralizing the network and consequently making it as robust and reliable as possible.

Of note is the liquidation of their XRP through quarterly programmatic sales to institutional investors that rubbed some investors the wrong way. Many complained that the for-profit company was deliberately “dumping” and suppressing prices.

Mati Greenspan: XRP Liquidation is Bullish for XRP in the Long term

However, according to Mati Greenspan—the founder of Quantum Economics, this is net positive for price over the long haul. This sentiment was equally shared by Ripple Inc.

In a previous interview, Brad Garlinghouse the CEO, said he believe they had a solid balance sheet and will take advantage of this to support enterprises that will aid in the adoption of XRP and other services offered by the company.

XRP/USD Price Analysis

Week-to-date, XRP is one of the top performing assets. After an impressive first half of last week, XRP closed the first week of the year strongly. Versus the USD, the coin is up 10% and is at breakeven with BTC.

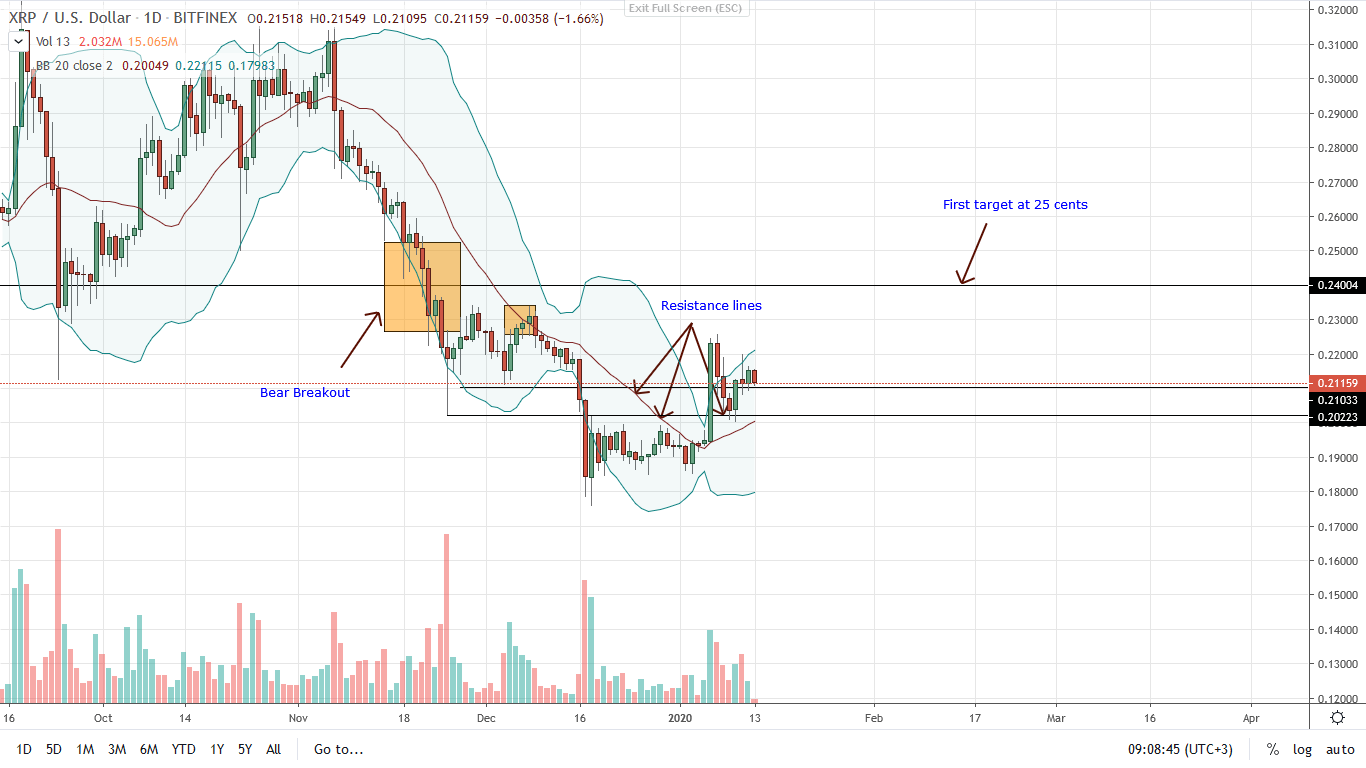

From the chart, candlestick arrangement suggests that buyers are in control. Jan 6 candlestick is particularly conspicuous and bullish. It broke through several resistance levels buoyed by high trading volumes.

Although prices cooled off, bears didn’t reverse gains. Also, prices are now trading above Dec 16 highs, as losses have been recouped. As such, odds are, bulls may build on last week’s gains as traders target the next resistance level at 25 cents and then 30 cents.

Steep losses below Jan 6 lows invalidate this price prediction and it may trigger the next wave of bears that may push XRP below 15 cents.

Chart courtesy of Trading View-Bitfinex

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.