Of MoneyGram and Progress Made in 2019

Blockchain is unique. On one end, it did disrupt the traditional way of doing things especially in the financial sector. However, something truly beautiful about Blockchain and its application is its richness in diversity.

It could be new, just 11 years in, but there are thousands of projects that base their operations on blockchain as a reliable and immutable layer. While most fashion themselves as the next big thing, ready to usurp traditional setups already in command of the majority of the space’s market share, some are tactical but firm in their approach.

One of them is Ripple Inc. Just recently, its executives announced that there are more than 300 banks and financial players leveraging its solutions for efficiency and cost reduction. MoneyGram is perhaps the most visible because of their use of xRapid and their urging of Ripple Inc., to open up more corridors.

Ripple’s Head: Utility and Adoption Paramount

But even in the midst of investors optimism, Brad Garlinghouse, the CEO of Ripple, believes that despite the proliferation of cryptocurrencies, the value of most of these cryptocurrencies will tumble down to zero for lack of adoption and utility.

In an interview with Bloomberg, he said:

“Anytime there is a new market, there are a lot of people that run into that market and try to show that they can solve a problem, they can deliver a customer need. 99% of these assets will probably goes to zero.”

XRP/USD Price Analysis

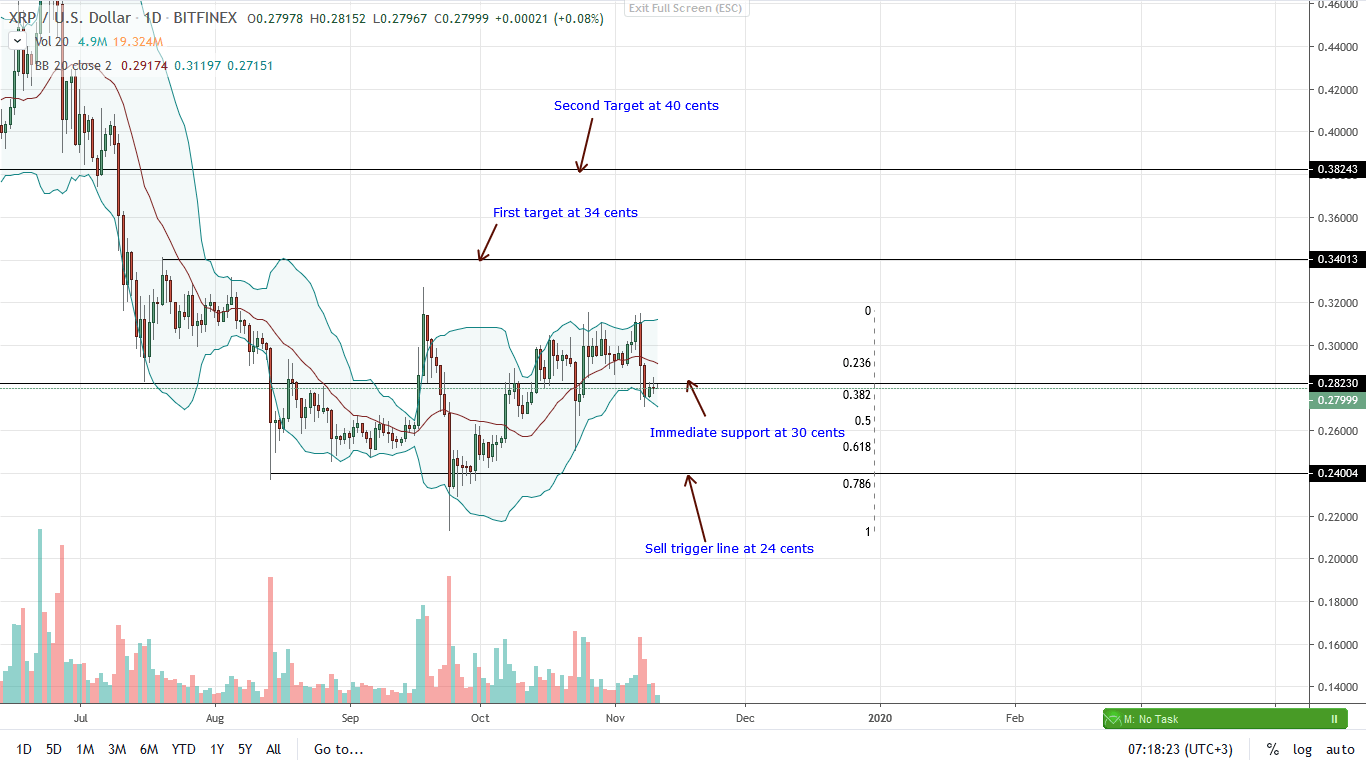

The prevailing trend could be bullish but XRP is visibly under immense liquidation pressure.

Posting huge losses in the second half of last week, it appears as if prices could drop to within the 23-25 cents support trend line.

When we paste a Fibonacci retracement tool within Sep-Oct trade range, prices are retesting the 38.2% retracement line.

However, since there is a divergence between the middle BB and the lower BB, bears are disadvantaged and likely to lose their stand in this week. Advising this view are the sharp losses of Nov 7 and the confirmation of that double bar bear reversal pattern on Nov 8 at the back of high trading volumes.

Unless otherwise there is a resurgence of bull pressure, and prices build on from Nov 9 gains, reversing the Nov 7 and 8 losses with equally high trading volumes preferably exceeding $42 million registered on Nov 7, bears are likely to press lower towards 23-25 cents zone.

Chart courtesy of TradingView – Bitfinex

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.