It’s a total lockdown. The world has been crippled by the devastating effects of coronavirus. From Spain, Italy, Iran, to Kenya, South Africa, and to Asia, governments have announced lockdowns and a global recession is looming.

Coronavirus is forcing governments to intervene

But governments are not only announcing lockdowns and other restrictive measures but there is helicopter money. Free cash/stimulus as coronavirus induces a slash in interest rates.

The US slashed theirs, and so did the Bank of England. As the economy is roiled and the stock markets slump, it is expected that many more will follow through and further inject billions to shore their core industries.

Governments Floating CBDC Ideas

There are even talks of central-banked digital currencies and in China, for example, the far-reaching consequences of covid-19 sparred by WHO finding that it is spread by hard cash would fast-track the launch of the Digital Yuan. The FED is said to be considering this too.

XRP as a Bridge

As it is XRP will be the perfect bridge. It can connect different CBDCs to Bitcoin and fiat. But XRP has more advantages.

Its ledger cannot be centralized as it lacks voting rights and staking features.

The XRPL cannot be controlled by a single entity or a cartel like how Justin Sun and Binance attempted to take over of the Steemit blockchain.

XRP/USD Price Analysis

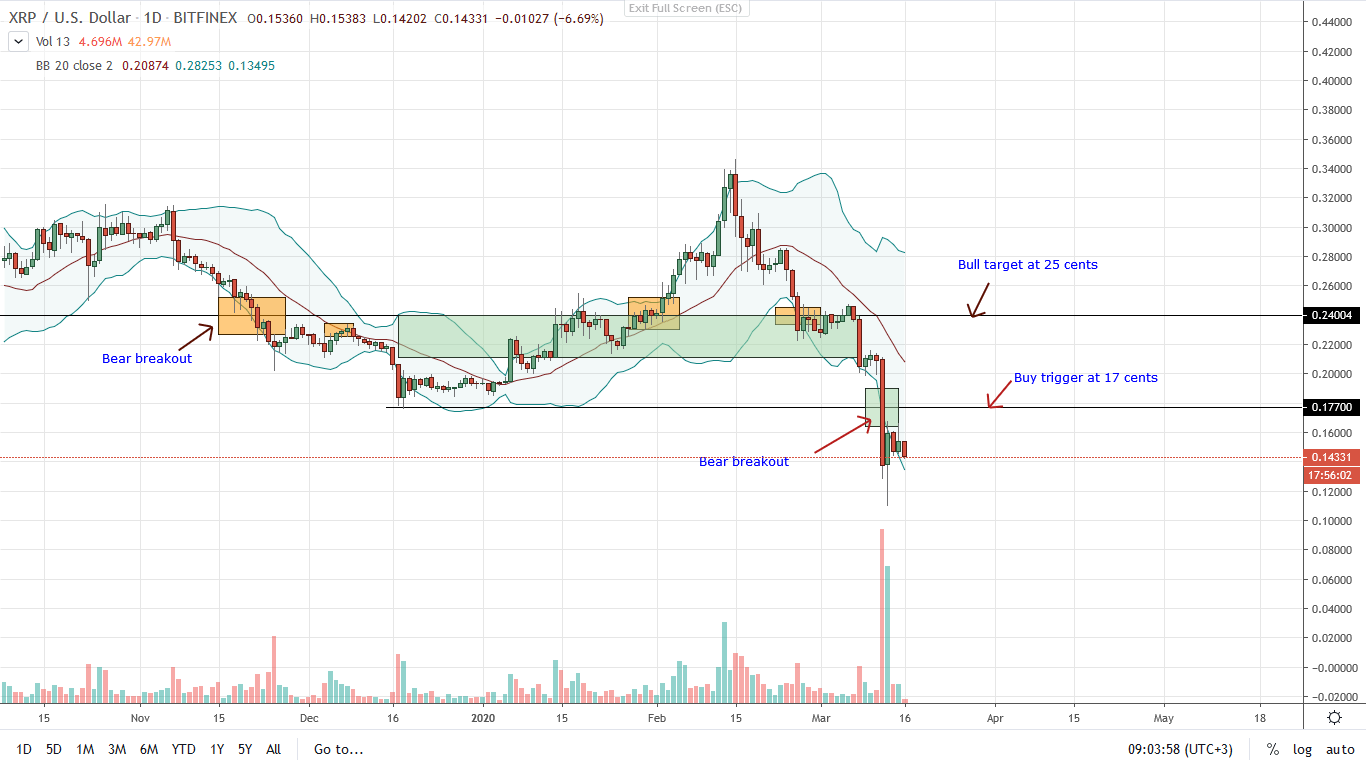

Bears are firmly in control. XRP price is down 30% week-to-date and from the daily chart, liquidation pressure is high.

Although there are hints of support following Mar 12 slid below Dec 2019 lows of 17 cents, any rejection of higher highs through this week and specifically the failure of bulls to spring back above 17 cents could trigger another wave of lower low.

With candlestick banding along the lower BB, every high should technically be a selling opportunity for derivatives traders. Any break down below Mar 12 lows of 12 cents could trigger further losses to 10 cents or 2017 lows.

On the flip side, for bulls to be in control, a definitive break above 17 cents should print at the back of high trading volumes. Then, the first target will be at 25 cents.

Chart courtesy of Trading View—Bitfinex

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.