Indeed, in the words of Mike Novogratz, the former hedge fund manager and a face synonymous with Digital Galaxy, crypto is a bid.

Mike’s fund has a close affiliation with Ripple Inc.’s CEO Brad Garlinghouse and is fund has XRP has base for simple reasons.

Incorporating XRP in processes is fast, efficient, instantaneous, and as studies have shown; cost savings. For now, XRP’s utility is in the increasing adoption of on-demand liquidity.

XRP’s Utility

The solution uses XRP and in partnership with several exchanges, corridors have been opened, enabling fast, seamless, and as aforementioned, instantaneous transfer of value from the US and forth from the Philippines, Mexico, Australia, and soon, Argentina.

This is according to the founder of Bitso, an exchange that has drastically slashed down wait time through the US-Mexico border supplementing MoneyGram, a money transfer service provider.

The daily liquidity of the US-MXN corridor is on the rise and on Feb 8, the same was observed in the US-AUD corridor where Bitcoin Markets is the facilitating exchange.

XRP Daily liquidity in the US-AUD Corridor Rising

If this is the trend, it is immediately clear that XRP has true liquidity, is most likely undervalued, and as studies recommend and actually advises money businesses services to consider integrating RippleNet, XRP may be undervalued, despite rallying near 10 cents, 2 cents shy off a critical resistance level at 30 cents.

XRP/USD Price Analysis

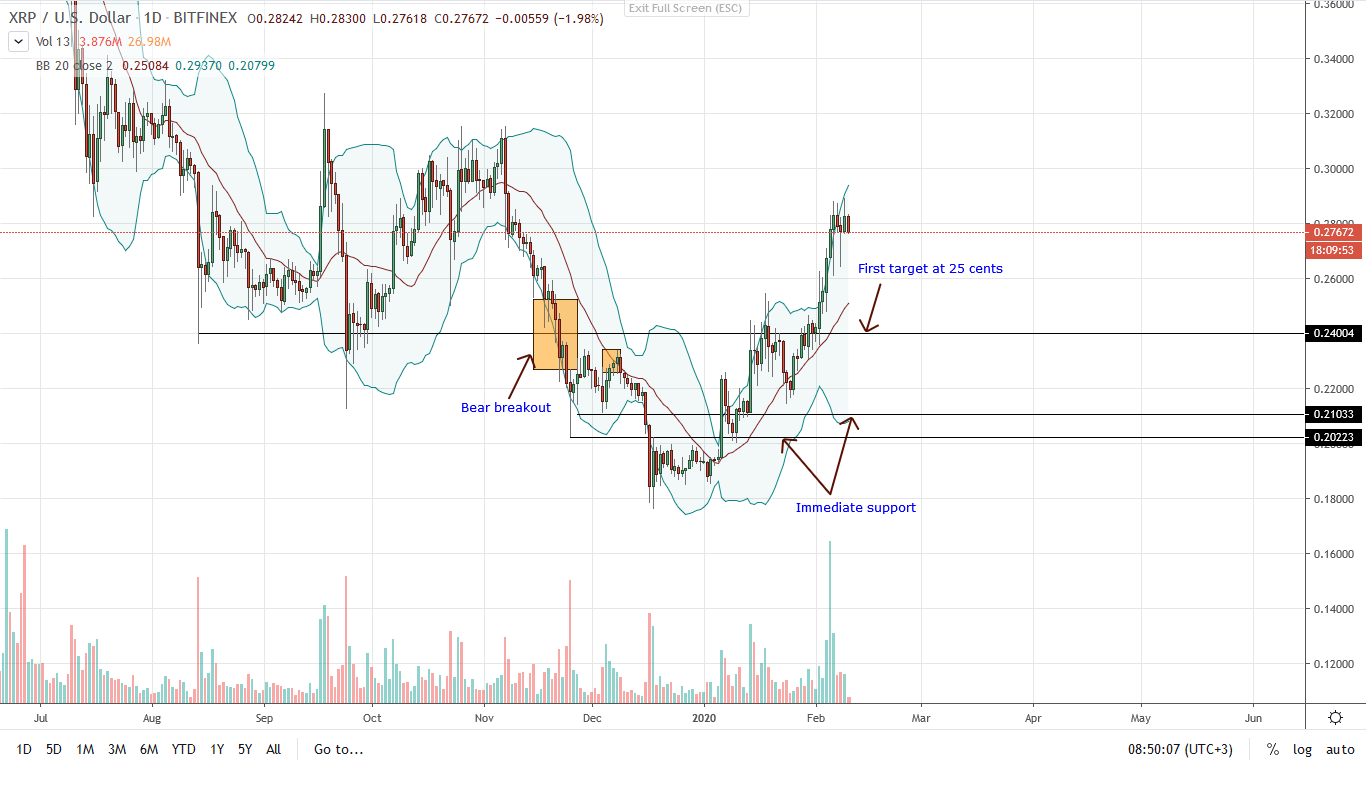

XRP prices, at the time of going to press, are stable. However, against the greenback, it appears as if the market is overheated and a contrarian move may pan out. Evidently, XRP gains have been near perpendicular, adding over 9% in less than a week.

In the daily chart, bulls are treading below 30 cents. For risk-averse traders, it is vital that there is a strong close above this mark for trend continuation. Aggressive traders can wait for a pullback for simple reasons.

Yesterday’s bar had a long upper week indicating selling pressure in lower timeframes.

Meanwhile, the move was preceded by two bear bars that moved away from the upper BB, revealing slowing momentum. Entry opportunities, should today turn bearish, will be at around 25 cents.

On the flip side, confirmation of bulls require a strong breakout above 28 cents—or last week’s highs, at the back of increasing volumes. That will trigger buyers angling for 34 cents and later 40 cents.

Chart courtesy of Trading View – Bitfinex

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.