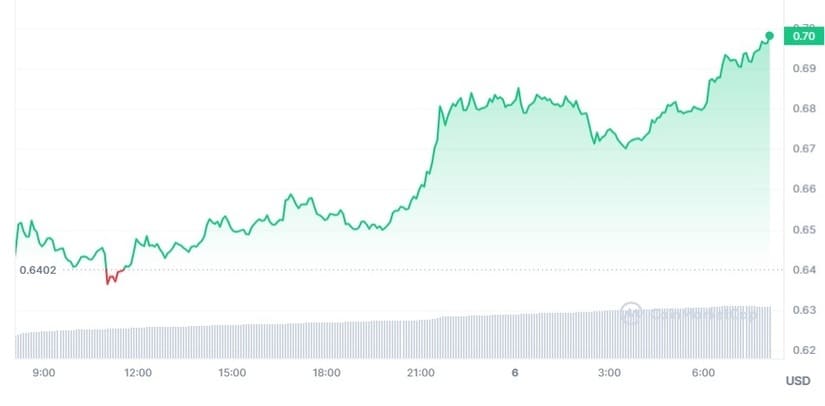

In recent times, XRP experienced a significant growth in its value compared to Bitcoin, recording a 23% increase in just one week. This led Ripple’s cryptocurrency to surpass the $0.68 mark, a level not seen since early August.

One of the reasons to consider is the accumulation of XRP in the hands of “whales.” Wallets containing between 100,000 and 1,000,000,000 XRP represent 45.8% of the total supply, suggesting significant concentration within a relatively small group of investors.

🥳 #XRPLedger is at it again, reaching a market value north of $0.68 for the first time since August 2nd. The 3-month high happened as $XRP moved up +23% against $BTC in just the past week. Wallets with 100K-1B $XRP now hold their highest level in 2023. https://t.co/v5wlgIQAhh pic.twitter.com/hvZbZ8S1UG

— Santiment (@santimentfeed) November 6, 2023

Other factors have contributed to this increase in XRP’s price. One of them is the social dominance metric, which measures market sentiment on social media.

There has been a significant increase in social media discussions related to XRP, which could reflect a growing interest or speculative enthusiasm in the cryptocurrency.

Furthermore, from a technical perspective, XRP’s price has surpassed both the 50-day and 200-day moving averages, indicating a bullish trend.

The Relative Strength Index (RSI) is also above the neutral level of 50, supporting the bullish sentiment and suggesting a possible continued increase in the short term.

There is also mention of a long-term trend cycle extending over 39 months, suggesting the possibility of a significant increase on the horizon for XRP.

While some predictions, such as a rise to $1,000, may seem very optimistic, these reflect the confidence of the Ripple community in the potential of XRP.

The last 24 hours have been exceptional for XRP. According to CoinMarketCap, it experienced a 6.7% growth in its value, going from $0.6364 to the current $0.6929. This is the highest value in the last three months.

Its 24-hour trading volume reached $2.47 billion, showing an increase of approximately 87%. Meanwhile, the market capitalization was $37.12 billion, with a 6.25% increase.

The Impact of Lawsuits, Fines, and Regulations on XRP

In the regulatory realm, the decision of the United States Securities and Exchange Commission (SEC) to drop charges against the leaders of Ripple had a positive impact on the price of XRP.

On the other hand, attorney Jeremy Hogan, known for his involvement in other cases related to XRP, expressed his opinion on the legal case between the SEC and Ripple.

Hogan suggests that the fine imposed on Ripple could be considerably lower than initially estimated.

One of the key points is the possibility that Ripple may argue that it should only return the “net profits” obtained from XRP sales instead of the total sales, which could significantly reduce the fine.

The attorney highlights the consideration of whether XRP is classified as a security or not. During the legal process, the price of XRP actually increased, which could indicate that the market does not consider it a security, a crucial point in the legal dispute.

He also raises the possibility that XRP sales made outside the United States may not be taken into account by the SEC in the penalties.

Furthermore, he points out that the SEC does not need to provide exact figures for sanctions, but can offer an estimate, and it would be Ripple’s responsibility to prove otherwise.

Ultimately, according to Hogan, the final fine for Ripple will be considerably less than the initial $770 million stipulated by the SEC, and it could even be less than $100 million if certain rumors are confirmed. This positive legal development could be key to XRP’s growth.

Lastly, the regulatory approval of XRP in Dubai is seen as an indicator of institutional acceptance that could open doors to new integrations and use cases in the financial services sector.