TL;DR

- Bitcoin retail sentiment is at its most pessimistic since early April, according to Santiment data.

- Despite current volatility, historical trends suggest such bearishness may often precede market rebounds.

- Bitcoin continues consolidating above $100,000, supported by ongoing ETF inflows and a total crypto market cap that remains above $2 trillion, signaling broader resilience across digital assets.

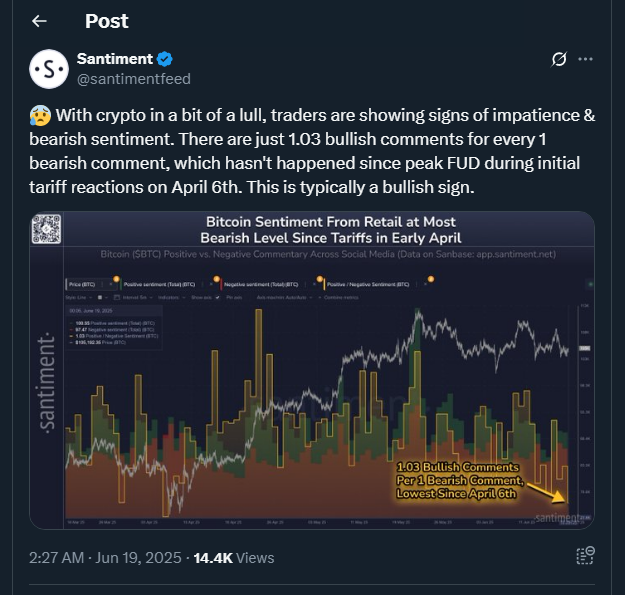

As of June 19, Bitcoin sentiment among retail investors has hit its most bearish point in over two months. According to on-chain analytics firm Santiment, the ratio of bullish to bearish commentary on social media has fallen to 1.03, a sign of growing frustration and uncertainty among traders. This marks the lowest ratio since April 6, a time defined by heavy selling pressure and anxiety over global economic shifts.

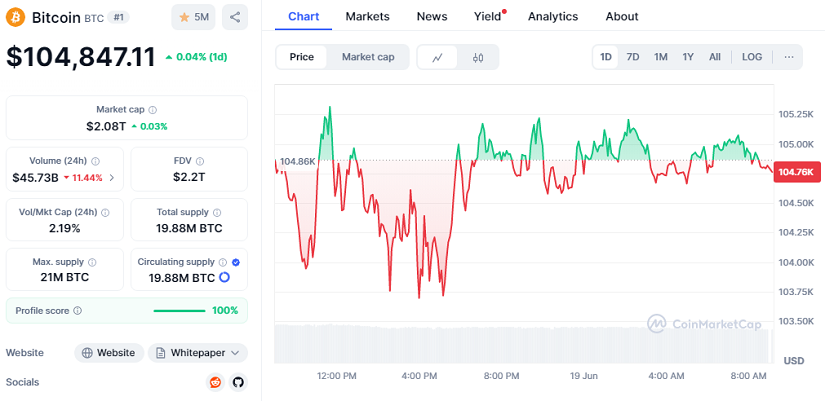

Bitcoin is currently trading at $104,847.11, showing a marginal 24-hour gain of 0.04%, while the total market capitalization for cryptocurrencies stands at $2.08 trillion. Though volatility has increased, prices have remained mostly within the $100,000 to $110,000 range, an area where substantial volume is being traded, adding a layer of support.

Past Bearish Sentiment Often Precedes Recovery

History has shown that sharp drops in trader optimism tend to signal a turning point. Previous sentiment troughs have often coincided with local bottoms in price, followed by periods of upward momentum. Santiment analysts suggest that this retail capitulation phase could indicate a potential setup for a price rebound, especially with large holders and institutional flows staying steady.

On Monday, Bitcoin attempted to retest the upper part of its range, but that move was quickly rejected. The asset now hovers around its 4-hour 200-period moving average near $104,870. This technical level, along with broader macroeconomic caution, will likely dictate short-term direction as markets await the U.S. Federal Reserve’s upcoming rate decision.

ETF Flows Remain Consistent While Broader Market Holds Firm

Despite fading enthusiasm compared to earlier in 2025, Bitcoin ETF inflows remain positive, lending steady support to prices. Ethereum, which briefly attempted a breakout last week, has returned to consolidation. Meanwhile, the broader market is maintaining strength, with total crypto capitalization holding well above the $2 trillion level.

Although the Fed is expected to keep rates unchanged, any dovish shift could provide a tailwind for risk assets like Bitcoin, especially as traditional safe havens show signs of strain. With digital assets still seen as an alternative to fiat exposure during uncertain times, current bearishness could offer long-term investors an entry point amid ongoing accumulation.