TL;DR

- The global payment industry, valued at $2.83 trillion in 2024, could be transformed by blockchain technology, according to Binance Research.

- The traditional payment system faces high costs and delays due to outdated infrastructure and the need for multiple intermediaries.

- Blockchain is fast, secure, transparent, and neutral, which could prevent geopolitical manipulations.

The global payment industry, valued at approximately $2.83 trillion in 2024, is on the brink of a potential radical transformation thanks to blockchain technology. Binance Research has released a report on how this technology could address persistent inefficiencies in the traditional payment system and revolutionize the sector.

The current payment system, still based on over 50-year-old banking infrastructure, faces several challenges, such as high costs, transaction delays, and the need for multiple intermediaries.

Each transaction can involve up to six different parties, such as card networks, issuers, and point-of-sale systems, which not only increases costs but also slows down the process. This situation is further complicated by the lack of standardization among different banks, which maintain their own ledgers, slowing down international transactions.

Blockchain presents a promising alternative to this outdated system. Blockchain and distributed ledgers can offer a uniform and global environment, accessible with just a smartphone and an internet connection.

Blockchain Must Overcome Scalability and Implementation Barriers

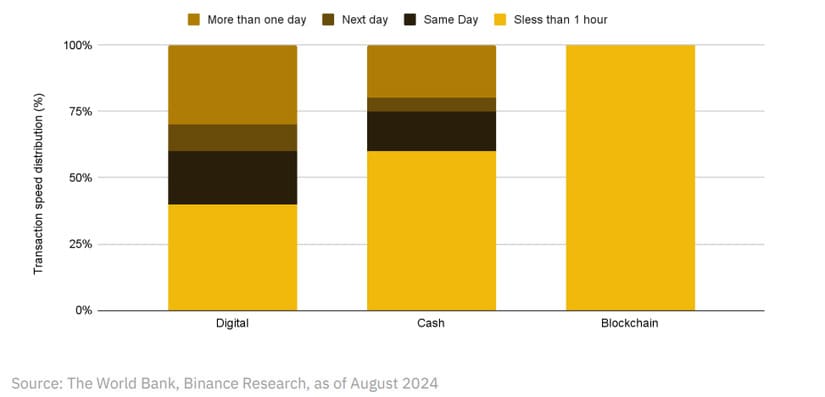

Binance Research states that this technology could facilitate near-real-time transaction settlements, something traditional solutions like Visa and Mastercard have yet to achieve efficiently. An example of this is a 2021 pilot between Visa and Crypto.com, which used USDC to facilitate international transactions in Australia, significantly reducing the time and complexity of traditional transfers.

In addition to improving transaction speed, it also promises to considerably reduce costs. Transactions on blockchain networks like Solana can cost as little as a fraction of a cent, representing a monumental fee reduction compared to traditional methods.

An Anti-Manipulation System

Transparency and security are other fundamental advantages of blockchain. Every transaction is recorded on a decentralized and immutable ledger, visible to all network participants, fostering trust and preventing fraud. Its decentralized nature prevents any single entity from controlling the network, providing a neutral and resilient payment system resistant to geopolitical manipulations.

However, blockchain technology faces significant challenges such as scalability, implementation complexities, and regulatory uncertainty. Despite these obstacles, the payment industry is expected to grow to $4.7 trillion by 2029, which could provide blockchain solutions with an opportunity to capture a significant portion of the market.