TLDR

- The USDT supply on Ethereum has nearly doubled, surpassing $102 billion since Trump’s election.

- Capital is returning to Ethereum, which is regaining ground against Tron in stablecoin activity.

- 10x Research maintains that liquidity, staking, and US policy are preparing for a bullish breakout by 2026.

A large portion of traders are watching short-term fluctuations, while meanwhile, a silent structural change is brewing in Ethereum. According to the latest analysis from the research firm 10x Research, stablecoin inflows and an increase in staking activity are laying the groundwork for the network’s next big bullish move, aiming for a significant breakout in 2026.

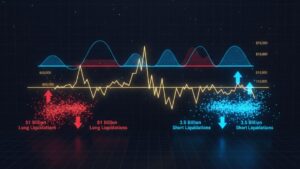

Despite the slow price performance of the market’s second-largest asset in recent months, on-chain liquidity tells a very different story. Data compiled by 10x Research reveals that the supply of Tether (USDT) within the Ethereum network has experienced an explosive increase, rising from $54 billion to over $102 billion since the presidential election of Donald Trump in the United States.

This growth represents nearly double the liquidity silently flowing into the Ethereum ecosystem, while the market’s attention remained on other assets.

Institutional capital and stablecoins return to Ethereum

This is a significant rebound in Ethereum’s liquidity, especially when compared to its rival, the Tron network. For a long time, Tron dominated stablecoin activity thanks to its lower fees; however, that trend is now reversing. The constant increase in Ethereum-based USDT suggests that capital is strategically returning to the Ethereum ecosystem, laying the groundwork for what 10x Research considers a “major recovery phase.”

Behind this flow of liquidity, the firm identifies a broader institutional and regulatory trend. The new cryptocurrency policy in the U.S. seems to favor transparent and on-chain recorded activity, a feature that directly benefits Ethereum’s strengths. In parallel, large staking providers, such as P2P Validator (which oversees more than $10 billion in assets), are facilitating and securing institutional participation in the network.

Although the price charts may seem stable, 10x Research concludes that the network’s fundamentals, liquidity, staking, and a favorable political environment are aligning. This combination is shaping the future of Ethereum 2026, setting the stage for a “massive breakout phase.”

Currently, ETH is trading around $3,580, holding above the $3,200 support level. If the recovery continues, the resistance levels to watch are $3,650, $3,710, and $3,920.