Reef announced a new integration with Chainlink. It will use Chainlink’s price feed in the cross-chain DeFi platform. Data feeds will help DeFi apps access data from multiple blockchains and trigger smart contracts using real-time data.

“The planned Chainlink integration will enable our DeFi platform to use high-quality price feeds denominated in both ETH and DOT in order to set exchange rates for atomic swaps, trigger automated portfolio management, determine lending and borrowing rates, provide valuations for automated market maker (AMM) liquidity pools, and more,” according to Reef blog post.

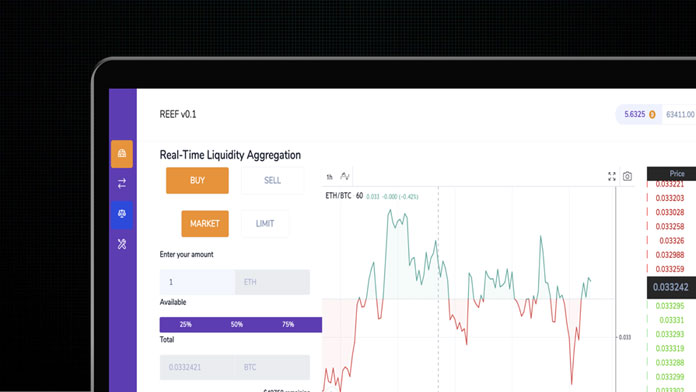

The cross-chain operating system from Reef, built on Polkadot, helps developers create products that are not limited to just one network. It offers a smart liquidity aggregator that provides access to liquidity in both centralized and decentralized exchanges. Reef needs a decentralized data source to keep the security and reliability to its platform. They have chosen Chainlink because of its decentralized infrastructure.

“The closer fair market prices are to on-chain prices, the further we can push the adoption of DeFi. Chainlink’s ability to brings high-quality data on-chain in a secure manner enables us to create a cross-chain protocol for DeFi that taps into all liquidity sources — a market first,” said CEO of Reef Finance Denko Mancheski.

Chainlink has experienced considerable growth in the past months. Many new blockchain projects have integrated Chainlink’s oracle to provide decentralized, secure data to their developers and users – Synthetix and Aave, to name a few.

The data gathering system in Chainlink’s oracle that relies on premium off-chain and on-chain aggregators has caused many projects like Reef to choose it as their underlying data provider. Sybil-resistant node operators on that network help Chainli claim ob the robust security of data. After all, decentralized nature is the most crucial benefit of Chainlink that makes it the market leader.

“Thanks to Chainlink, users will be able to confidently deposit funds into Reef and let our smart asset management tools go to work for them without having to worry about data manipulation and faulty service concerns,” added Mancheski.

If you found this article interesting, here you can find more Chainlink News