TL;DR

- Digital asset funds have hit a new milestone with $15.1 billion in year-to-date inflows, despite rising geopolitical tensions and financial market volatility.

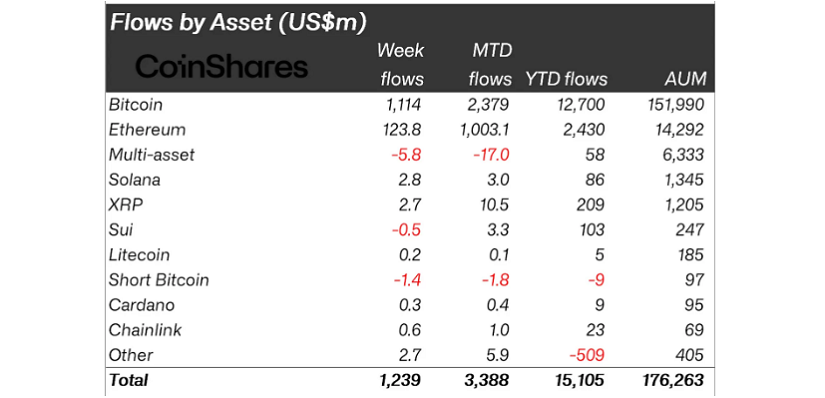

- Bitcoin led with $1.1 billion in weekly inflows, while Ethereum followed with $124 million.

- The U.S. remains the main driver of institutional demand, contributing $1.25 billion in the past week alone, even as Asia showed signs of cooling.

Investor appetite for crypto has surged to unprecedented levels, with digital asset funds attracting $1.24 billion in fresh capital last week. This marks the 10th straight week of inflows and sets a new annual record of $15.1 billion. The rally comes at a time when most risk assets are under pressure due to mounting geopolitical and economic uncertainty. Instead of retreating, crypto investors are doubling down.

Bitcoin continues to lead the charge, drawing over $1.1 billion last week, even amid short-term corrections. The buying behavior suggests that institutions are interpreting volatility as opportunity. Simultaneously, Ethereum has quietly posted its ninth consecutive week of inflows, totaling $124 million. That brings its streak to $2.2 billion, a level not seen since mid-2021.

Bitcoin And Ethereum Cement Leadership As Investors Buy The Dip

Long-Bitcoin positions dominated the inflows, while short-Bitcoin products saw outflows of $1.4 million, a further signal of strong bullish sentiment. Ethereum, still buoyed by anticipation around staking developments and regulatory clarity, remains a clear favorite for funds allocating capital beyond Bitcoin.

Other altcoins also held their ground. Solana recorded $2.78 million in inflows, and XRP followed closely with $2.69 million, reflecting a cautious yet deliberate appetite for diversification among fund managers. Though smaller in scale, these inflows underline that institutional interest is not limited to the top two assets.

U.S. Leads Global Demand While Asia Retreats From Exposure

Regionally, the U.S. has once again emerged as the dominant hub for digital asset flows. American funds attracted $1.25 billion in just one week. Canada and Germany also showed moderate strength, with $20.9 million and $10.9 million in inflows, respectively. On the other hand, Hong Kong and Switzerland experienced notable outflows of $32.6 million and $7.7 million. This divergence may reflect varying regulatory pressures or investor risk tolerance in the face of regional tensions.

Despite complex global dynamics, capital is flowing into crypto with purpose. The data reveals a market that increasingly sees digital assets not as speculative bets, but as long-term strategic plays within a shifting financial landscape.