DeFi lending platform Aave has been integrated with Rari Capital, a smart robo advisor that helps users to maximize yields, to bring more yield opportunities for Aave users.

Rari Capital announced the news in a blog post on Tuesday, September 29. Through this integration, Rari Capital will rebalance all of the stablecoins that Aave supports—Dai, USDC, USDT, sUSD, BUSD—in such a way that ensures that Aave users are constantly achieving the highest yield.

Rari Capital’s software manages all these activities, and users need nothing to do to reap the significantly higher rewards. The Rari team, about the integration, said:

“We are ecstatic to be collaborating with Aave and providing liquidity to their platform as they lay the foundation for DeFi. We are excited to bring the Aavengers onto the Rari Capital platform!”

Aave users’ funds will go to a Rari stable pool which currently holds a $5,000 deposit limit. Rari’s software will then rebalence users’ assets across different DeFi platforms so that they always receive the maximum return. According to the website, the protocol currently offers 40% annual percentage return (APR).

What is Rari Capital?

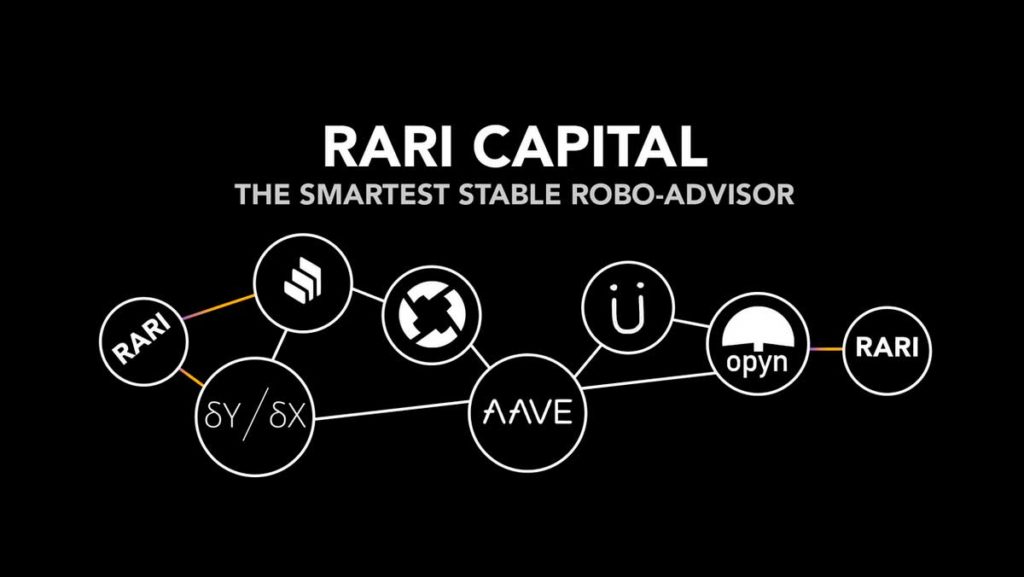

Rari Capital is am Ethereum-based smart robo advisor that ensures DeFi lovers always receive the highest yield, far beyond just lending. The platform was launched on July 14, 2020. Rari Capital has also integrated Compound Finance, dYdX, 0x, and Opyn.

Rari Capital is working on building a series of products with the goal of increasing market efficiencies within the crypto-sphere. This stable asset rebalancing is the company’s first product and in the next few weeks, the industry can expect lots of new products.

Rari features a Stable Pool where users desposit supported stablecoin assets. The funds are non-custodial and users can withdraw their assets at any time. The protocol then rebalances these assets across different DeFi lending protocols like Compund, dYdX, and 0x.

The user who deposits funds to Rari, an equivalent amount of RFT (Rari Fund Token) is minted to his account. As soon as funds are deposited, the user starts earning yield. Essentially, fund holdings and yield are split up proportionally across RFT holders by their USD balances. RFT’s value is equivalent to stablecoins deposited plus the yield accrued on them.

While withdrawing the funds from Rari, the equivalent amount of RFT is burned from the user’s account.

If you found this article interesting, here you can find more DeFi News

.