Corporate adoption of Bitcoin has reached a milestone. Publicly traded companies now hold over 1 million BTC, reflecting how some institutions are integrating it into treasury strategies and treating it as a long-term asset. This shift suggests continued institutional interest in crypto assets, though approaches and risk tolerance vary by company.

While large corporate holders such as Michael Saylor’s MicroStrategy continue adding to their positions, other market participants are focusing on which tokens are drawing attention and why.

DeepSnitch AI is one project that has been discussed in that context. The project describes an AI-driven platform intended to provide market-monitoring and analysis tools for crypto traders.

Public companies hit 1M Bitcoin

Corporate Bitcoin treasury adoption has reached a milestone, with listed companies now holding over 1 million BTC. Data from BitcoinTreasuries.net confirmed that the combined holdings of 184 firms stood at 1,000,698 BTC. The current amount of Bitcoin quoted here is worth more than $111 billion at current prices.

Michael Saylor’s MicroStrategy continues to lead the group, with about 636,505 BTC on its books. Mining firm MARA Holdings is the second-largest holder, maintaining 52,477 BTC after adding 705 BTC in August.

A new number of entrants is changing the rankings. XXI, led by Jack Mallers, has accumulated 43,514 BTC, while the Bitcoin Standard Treasury Company holds 30,021 BTC. Other top players include Bullish exchange with 24,000 BTC and Metaplanet of Japan with 20,000 BTC. Companies like Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase round out the top ten.

Separately, some individual investors look beyond large-cap assets for earlier-stage projects or smaller networks, which can also carry materially higher risk and uncertainty.

Tokens in focus as Bitcoin adoption increases

-

DeepSnitch AI (DSNT)

DeepSnitch AI is a crypto project that, according to its own materials, is building a platform based on five AI “agents” intended to help monitor activity in Web3 markets and surface insights. As with similar products, the practical usefulness and performance of any trading tools would depend on implementation, market conditions, and user behavior.

The project is also running a token sale. Project materials state that DSNT was priced at $0.01634 at the time of writing and that it had raised more than $182k in an initial stage; these figures are not independently verified here.

Comparisons to past outsized returns in meme coins are not predictive, and outcomes for any new token can differ significantly based on liquidity, market structure, and broader risk sentiment.

Polygon (POL)

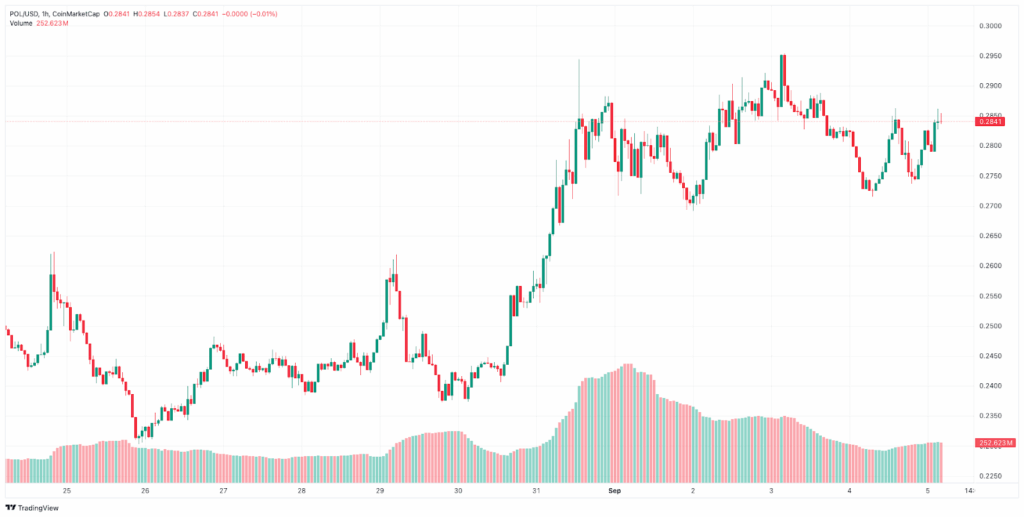

POL (formerly MATIC) is another token that some traders are closely watching. It has seen a price increase in the last seven days, rising by over 10%. Performance can change quickly, and short timeframes may not reflect longer-term trends.

The recent activity followed Polygon’s official upgrade from MATIC to POL, with the transition finalized on September 3. This enables native staking on Ethereum and changes the network’s economic model. The article also notes trading volume moving past $631 million during the migration amid heightened market interest.

Algorand (ALGO)

Algorand has struggled over the past week, with an over 8% decline while the overall market gained. Observers have cited factors such as ecosystem growth concerns and competition from other smart contract platforms, though drivers can be difficult to isolate.

Key technical indicators show continued volatility. ALGO’s 50-day SMA sits at $0.26, while its 200-day SMA rests lower at $0.22. Whether the token consolidates or breaks out depends on broader market conditions and token-specific developments.

Despite this, some analysts remain cautiously optimistic. According to current projections, Algorand could increase to $0.35 by December 2025, though projections are speculative and do not guarantee future performance.

The bottom line

Public-company Bitcoin holdings have continued to grow, underscoring the role BTC can play in some corporate treasury strategies. In parallel, market attention often shifts among large-cap tokens and earlier-stage projects, each with different risk profiles.

Projects such as DeepSnitch AI have drawn interest largely due to their stated focus on AI-enabled market tools and their token-sale fundraising. As with any token-related initiative, readers may want to evaluate disclosures, product readiness, liquidity constraints, and the risk of loss.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.

FAQs

What do people mean when they ask “what crypto to buy now”?

It typically refers to a search for tokens with catalysts or narratives that are currently attracting attention. Any assessment should consider risks, liquidity, and the possibility of loss.

Why are public companies buying so much Bitcoin?

Some companies describe BTC as a hedge or a long-term treasury asset, and holdings across public firms have surpassed 1M BTC based on BitcoinTreasuries.net data. Regulatory and market factors may also influence institutional participation, though these vary across jurisdictions and over time.

Is POL a good investment?

POL’s upgrade and the move to enable native staking on Ethereum have been cited as developments to watch. Whether it is suitable depends on an investor’s objectives and risk tolerance.

Will Algorand recover?

Recovery depends on market conditions and ecosystem execution. Some third-party forecasts speculate on higher prices by late 2025, but such projections are uncertain and should not be treated as guarantees.

Where can I find information about DeepSnitch AI’s token sale?

The project publishes participation details on its website; readers should review terms and risk disclosures carefully.

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.