Four days ago, the Bitcoin price sunk to $30k, shedding $10k, reinforcing “analysts” belief that the crypto market had peaked. This came is after three weeks of higher highs when the coin’s valuation more than doubled after breaching $20k.

It turns out that may be the shortest bear market in history.

As of writing on Jan 15, the Bitcoin price is back to near early last week’s highs. Bulls look likely to continue December 2020 gains reading from participation levels.

Jack Lauds Bitcoin

At over $37.5k, buyers are in the driving seat, coming at a time when Jack Dorsey, the CEO of Twitter, admits that tech companies have too much power.

It follows President Trump’s banning. He’s accused of inciting violence that led to the storming of the Capitol. Jack lauds Bitcoin’s architecture. He posted, saying:

“The reason I have so much passion for Bitcoin is largely because of the model it demonstrates: a foundational internet technology that is not controlled or influenced by any single individual or entity. This is what the internet wants to be, and over time, more of it will be.”

Miami Considering Bitcoin and Crypto to Attract Tech Giants

Meanwhile, the Mayor of Miami, Francis Suarez, is now considering embracing cryptocurrencies, specifically Bitcoin, to attract tech giants. Accordingly, he may even channel some of the government’s funds into cryptocurrencies, Fox Business reports.

The mayor might now consider allowing individuals and businesses to remit their taxes and fees to the city using Bitcoin. He desires Miami to be the” most crypto-forward and technological city” in the United States.

Bitcoin Price Prediction

The BTC/USD price is in an uptrend. Week-to-date, the coin is still four percent but stable on the last day. However, it trails ETH, shedding six percent on the last day.

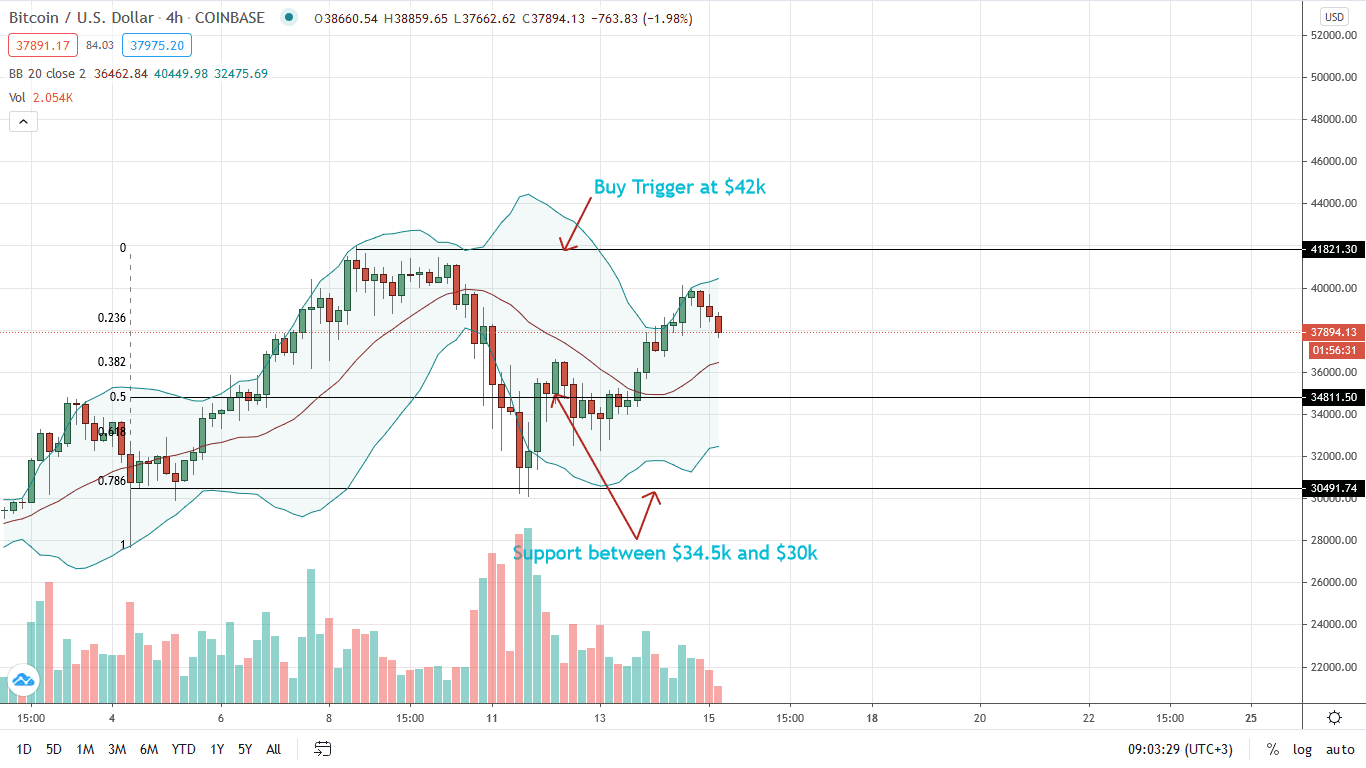

Despite the pullback, buyers are firm in a bullish continuation pattern. Although the mid-term trend depends on the rapidity of the breakout above $42k, aggressive traders can, in the meantime, aim at $42k, buying dips in lower time frames.

The 4-HR chart shows the BTC price found support at the 78.6 percent Fibonacci retracement level based on the Jan 2021 trade range. Correcting an under-valuation of Jan 11, bulls are driving prices back to around an all-time high.

Immediate supports will be at $34.5k—the 50 percent Fibonacci retracement level. Technically, a pullback can provide an opportunity for risk-off traders to buy the dips with targets as aforementioned.

A high-volume breakout above $42k opens up the BTC/USD price to $50k. On the flip side, deeper losses below $34k may attract bears aiming at $30k.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news