Crypto news turned sharply negative after Powell signaled that December Rate Cuts are “not a foregone conclusion.” The Fed delivered a 0.25% cut, the tone stayed hawkish, and risk assets sold off. Because of this bearish crypto news cycle, traders are asking now whether more rate cuts are coming or if Powell just reset expectations.

While the general market scrambles to reorient, analysts note that payments-focused plays like Remittix are still drawing major attention from investors.

Bitcoin: Range at Risk as Powell Cools Risk

BTC slipped back toward $110,000 as Powell downplayed near-term rate cuts. This news came as a surprise to many investors who were expecting something different, and as a result BTC price has dropped back towards the $110,000 level.

Recent crypto news shows that Bitcoin is trying very hard to defend the $110,000–$120,000 range, with investors fearing that a dip below that support could trigger another sell-off. A sustained close under $110,000 opens $105,000, while reclaiming $118,000 would calm nerves.

Ethereum: Relief Cut, Hawkish Message

Bitcoin was not the only major token affected by Powell’s December rate cuts prediction. Analysts report that since the report went live, the Ethereum price has dropped from above $4000 and is now trading around the $3,800 price level, which represents a decline of about 2.7%.

Ethereum holders will be buoyed by the fact that the token appears to be holding strong above $3800, and this baseline could form the foundation for a bullish price recovery. Experts also note that Ethereum’s on-chain activity is steady, but leverage has thinned. If funding normalizes and spot demand returns, $4,200 is back in play; lose $3,700 and momentum fades.

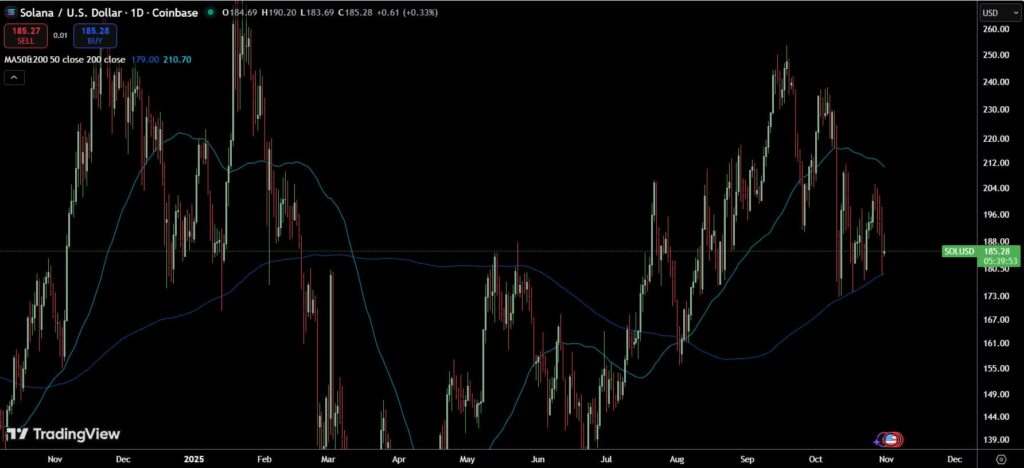

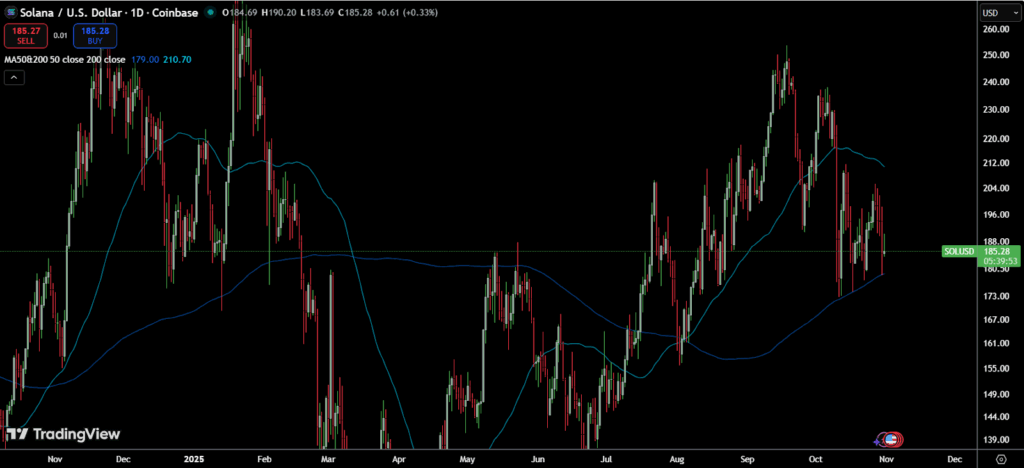

Solana: Strong Story, Weak Tape

Solana fell about 6% as traders marked down odds of quick rate cuts after Powell’s remarks. Solana price fell from above $200 to the $185 price level, but experts report that it is already showing strong signs of recovery. Analysts suggest that Solana will need a major catalyst to augment its efforts to resist trading lower and resume the upward momentum; otherwise, a slide all the way down to $175 is possible.

Remittix Proves That Utility Still Matters When Macro Wobbles

While the general crypto struggles continue, Remittix, a new PayFi solution on Ethereum, has taken the entire market by surprise. Unlike other tokens that experienced a decline after Powell’s announcement, Remittix actually continues to grow strongly, with the cross-border payment solution attracting major investor attention from all quarters.

Already, Remittix has successfully secured over $27.7 million in private funding, and guaranteed listings on BitMart and LBANK ensure that liquidity inflow into the project is not going to stop anytime soon.

Why Investors Love Remittix:

- Fully audited and verified by CertiK

- Full team KYC completed.

- Strong growth focus, highlighted by the recent release of the Remittix wallet for beta testing by the community

- Global adoption potential with direct crypto-to-fiat conversion support already live in over 30 countries

Meanwhile, an active $250,000 giveaway plus a 15 percent USDT referral reward that is claimable daily through the dashboard keeps engagement high. The recent crypto news shock came from Powell’s signal that rate cuts are not guaranteed in December. Until data swing dovish again, majors will trade the range. BTC needs $110,000+, ETH needs $3.75,000+, and Solana needs $190+ to steady.

In parallel, utility names with cash-flow-like use cases like Remittix continue to dominate investor attention with incredible performances and returns.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.