TL;DR

- Polyhedra’s ZKJ token plunged 80% in 24 hours due to a liquidity crisis linked to massive withdrawals in its KOGE pair.

- Binance updated its Alpha Points program rules to reduce concentration risks.

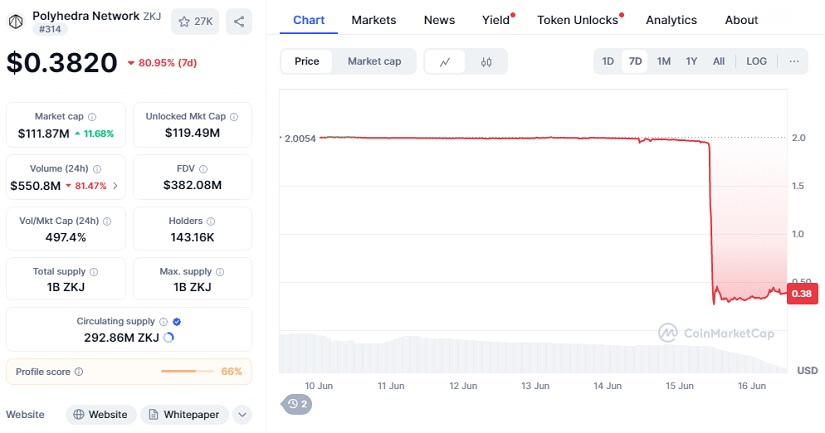

- Currently, ZKJ trades near $0.38 with a market cap of $111.87 million, facing a bearish short-term technical outlook.

Polyhedra Network, one of the emerging projects in the crypto ecosystem, experienced a challenging day as its token ZKJ plummeted 80% in value within just 24 hours. The price hit historic lows of $0.26 following an unusual wave of sell-offs and liquidity withdrawals, especially on the ZKJ/KOGE trading pair, which shared incentives as part of Binance’s Alpha Points program. This sudden liquidity drop triggered a cascade of liquidations, significantly impacting multiple traders with losses reaching millions of dollars and shaking investor confidence across the board.

In terms of volume, daily activity fell by 61%, settling around $1.23 billion, reflecting the market’s volatility and nervous sentiment. The drop coincides with international geopolitical tensions affecting risk appetite, but on-chain data indicates coordinated movements among large wallets, raising suspicions of manipulation or value extraction strategies designed to exploit market weaknesses.

Strategic Moves and Regulatory Changes

Binance quickly responded to the incident by announcing an update to its Alpha Points rules, excluding trading volume between Alpha tokens like ZKJ and KOGE starting June 17, 2025. This measure aims to prevent risk concentration and promote a more balanced environment for market participants. Meanwhile, the imminent release of over 15 million ZKJ tokens is also increasing short-term selling pressure, adding further complexity to the token’s recovery prospects.

Short- and Mid-Term Outlook

The technical outlook for ZKJ remains uncertain. Indicators suggest the price could continue to decline, possibly falling below $0.25. However, a moderate recovery might occur if liquidity returns and market conditions stabilize, potentially settling within a range of $0.30 to $0.40.

Polyhedra assures that its core technology remains strong and that it is reviewing the episode to reinforce the network and prevent future vulnerabilities. This event also invites reflection on risk management within decentralized ecosystems and the influence large players can exert on market dynamics.

Currently, ZKJ trades around $0.3820 with a market capitalization near $111.87 million, marking a significant drop from its all-time high of $9.56 in March 2024. How this situation unfolds will be crucial to assess Polyhedra’s resilience and future within the crypto space.