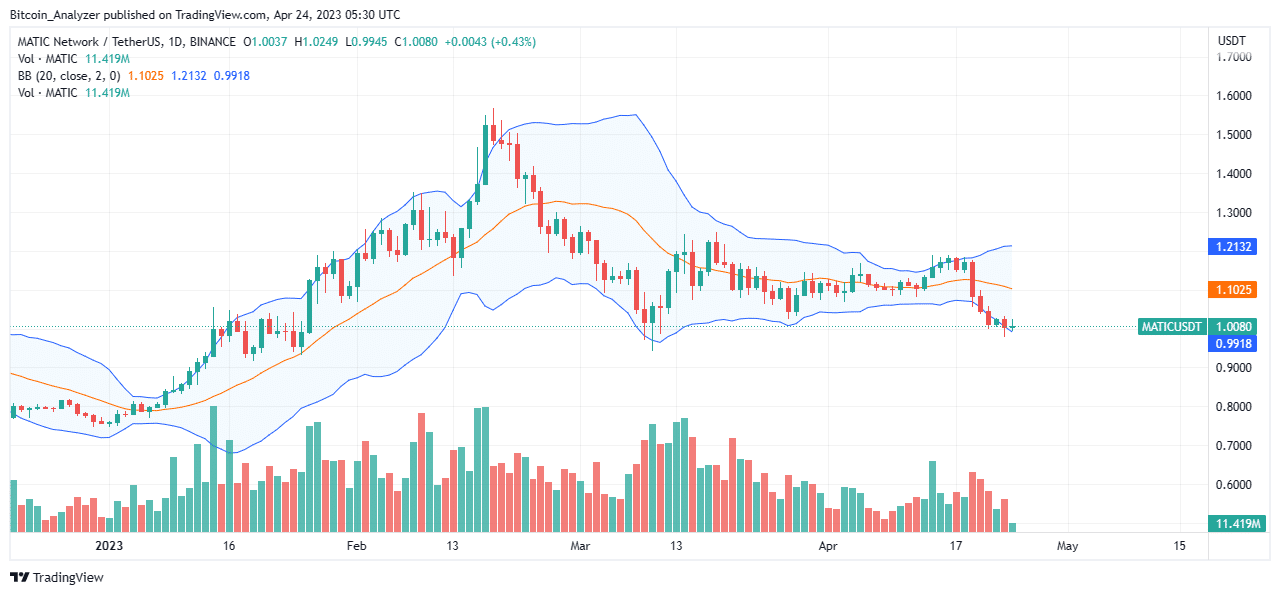

The dump of Polygon prices has been faster than anticipated. MATIC is down 16% from April highs but 35% from Q1 2023 peaks. At this pace, there are concerns that MATIC could unwind gains of January and February 2023, placing more pressure on holders.

The development comes amid solid performance in Bitcoin and altcoins, including Ethereum, from mid-March 2023. Unlike most assets that posted a ballpark 30% growth, MATIC rose a paltry 20%, trailing the markets.

As it is, the token is down below the consolidation of late March 2023 and on the cusp of breaking even lower. This could extend the losses of April 19, pouring cold water on bulls’ attempts to plug the bleed and turn MATIC’s fortunes around.

On-Chain Activity Dropping Despite Rising NFT Volumes

The contraction of MATIC prices is amid spiking non-fungible tokens (NFTs) sales.

Records show that Polygon only trails Ethereum on activity, a huge endorsement on the platform.

Notably, Polygon has outperformed Solana, BNB Chain, and Immutable X, a specialized Ethereum layer-2 for NFTS.

We've seen Polygon in the #2 spot over a 24 hour period…

Polygon is now #2 in NFT sales volume over the last 7 days. pic.twitter.com/M22jOzXjZX

— Narb (@NarbTrading) April 20, 2023

Even with expanding NFT activity, general network activity has also declined over the past few months.

To illustrate, on-chain trackers show that Polygon’s activity dropped from 2.9 million to 2.4 million last month.

During this time, unique addresses fell from 435,200 to 294,000. This could reflect user engagement with dapps and general interest in the scalable Ethereum sidechain.

Polygon Price Analysis

MATIC prices are correcting from Q1 2023 highs, falling 35%. Bears remain in charge as trading volumes and participation also fall.

As it is, the coin is below critical support levels following the confirmation of sellers on April 19. The wide-ranging bear bar triggered the current selloff, anchoring the current trend.

Local resistance lies at $1.05, while losses below March 2022 lows at around $0.97 may open up more opportunities for MATIC sellers.

Traders can wait for confirmation below March 2023 lows before loading, targeting $0.76 or December 2022 lows.

Conservative traders waiting for a strong recovery after the extended 2022 crypto winter will only engage once there is a solid breakout above April highs at around $1.20.

Accompanying volumes must preferably be higher than average. This would likely lift MATIC towards Q1 2023 highs at $1.56 in a bullish continuation formation.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Polygon News.