TL;DR

- Plasma’s Foundation: Plasma XPL has evolved from a strong launch into a stablecoin-focused Layer 1 with unique features like gas-free transfers and BTC integration.

- Forecast Spectrum: Price predictions from 2025–2030 range widely, from sub-$1 bearish scenarios to bullish targets above $20, reflecting both volatility and growth potential.

- Long-Term Stakes: Success depends on adoption, TVL expansion, and ecosystem resilience, making XPL a high-risk, high-reward play in the crypto landscape.

Plasma XPL, the Bitfinex-backed stablecoin Layer 1, has quickly established itself as a contender in the blockchain arena. Launching at $1.00 and surging to early highs above $1.45, the project has already attracted billions in stablecoin inflows and secured partnerships with leading DeFi protocols. This rapid momentum has positioned XPL as a network to watch, with traders and developers alike questioning how far it can scale in the years ahead.

Built for Stablecoin Payments

Unlike general-purpose blockchains, Plasma was designed specifically for global stablecoin transactions. Its architecture introduces zero-fee USDT transfers, a native Bitcoin bridge that integrates BTC into smart contracts, and support for custom gas tokens. These features aim to streamline payments while expanding the utility of stablecoins across decentralized applications.

Consensus and Compatibility

At the heart of Plasma lies PlasmaBFT, a consensus mechanism engineered for speed and reliability. This system ensures rapid transaction finality and supports the high throughput required for payment-focused ecosystems. Importantly, the network is fully EVM-compatible, allowing developers to deploy Ethereum-based smart contracts with minimal friction. By combining scalability with compatibility, Plasma lowers the barriers for adoption and innovation.

Flexible Gas and Developer Tools

One of Plasma’s standout features is its built-in paymaster smart contract. This tool enables applications to register ERC-20 tokens, including stablecoins, as gas payment options. Users can therefore cover transaction fees directly in assets they already hold, reducing friction and enhancing usability. For developers, this flexibility opens new possibilities for designing user-friendly applications.

The Role of XPL

XPL, the native token of Plasma, powers the ecosystem. It is used for gas fees, validator staking, and network security. Validators earn rewards for supporting the chain, with dishonest behavior penalized through reward slashing rather than stake loss. Additionally, XPL holders can delegate tokens to validators, participating in consensus and sharing rewards without running infrastructure.

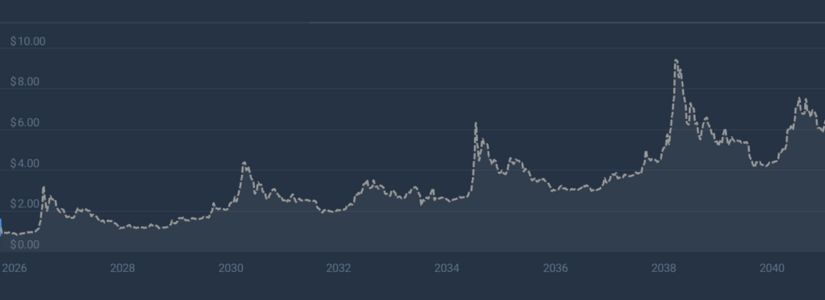

Plasma XPL 2025 to 2030 Price Prediction

Technical Analysis and Trading Ranges for 2025

According to projections from CoinCodex, Plasma XPL could experience relatively modest price action in 2025. The platform anticipates that XPL will trade within a channel ranging from $0.92 to $1.32, with an average annualized price of $1.03. This outlook suggests that while the token may not deliver explosive growth in the short term.

Bitget, however, presents a more dynamic perspective on Plasma XPL’s 2025 trajectory, emphasizing the influence of market sentiment and hype. Analysts suggest that the token’s performance will depend heavily on how well the market absorbs the initial excitement surrounding Plasma’s launch. Forecasts vary, with one scenario projecting a year-end range between $1.64 and $1.74, averaging near $1.68.

Youtubers Price Prediction for Plasma

Crypto Empire, a well-known YouTube channel about everything crypto, has shared a video breaking down every aspect of Plasma and its native token XPL. They’ve also provided several price prediction scenarios for the last few months of 2025.

Risks, Volatility, and Market Challenges in 2026

DigitalCoinPrice projects a steady but meaningful climb for Plasma XPL by the end of 2026, with the token potentially breaking through the $3.31 barrier. Their forecast suggests that the lowest trading levels could remain between $2.74 and $3.31, while the most likely outcome is a stable price near $3.26. This outlook reflects a scenario where Plasma consolidates its role as a payment-focused Layer 1.

Other predictions, however, envision a broader range of possibilities shaped by supply unlocks and the expansion of stablecoin infrastructure. Their base scenario assumes Plasma could capture a 10% share of the USDT market, pushing valuations toward $10 billion. In this case, XPL’s price could fluctuate between $2.50 and $4.80, with the $2.00 level emerging as strong support.

Bearish Forecasts and Downside Risks in 2027

CoinDataFlow’s experimental model paints a cautious picture for Plasma XPL in 2027, forecasting a potential decline of -31.42% from earlier levels. According to this outlook, the token could trade within a narrow band between $0.87 and $0.36, even in the best-case scenario. Such a projection underscores the risks of volatility.

On the other hand, a more optimistic narrative emerges from projections tied to ecosystem growth and real-world adoption. Analysts suggest that 2027 could mark a turning point as Plasma transitions from speculative hype to deeper utility. The anticipated launch of Plasma One and the integration of tokenized equities are expected to drive demand, with forecasts placing XPL in a much higher range between $4.00 and $6.80.

Trading Bands and Potential ROI in 2028

Forecasts for 2028 suggest that Plasma XPL could deliver moderate but meaningful returns for investors. According to projections, the token is expected to trade within a channel between $1.29 and $1.86, with an average annualized price of $1.39. This performance would represent a potential return on investment of 44.67%.

Other predictions believe that by 2028, the network will have had several years to prove whether its gas-free transfers and developer-friendly features can sustain long-term adoption. If user activity expands and the developer community continues to build, XPL could climb into the $3.50 to $4.50 range, with some optimistic models extending as high as $5.50.

Expected Price Range for 2029

Forecasts for 2029 suggest that Plasma XPL could enter a phase of significant growth, with analysts pointing to the possibility of new highs in both price and market capitalization. Projections indicate that XPL may surpass $5.84 during the year, with estimates placing its maximum value at $5.84 and its minimum near $4.91.

At the same time, experimental simulations present a more cautious but still optimistic scenario. These models forecast that Plasma XPL could rise by 290.14% in 2029, reaching $4.99 in the best case. The projected trading range spans from $4.99 down to $1.58, highlighting the potential for volatility even amid growth.

Adoption Milestones and Ecosystem Expansion by 2030

Projections for 2030 suggest that Plasma XPL could deliver substantial returns compared to its earlier trading history. Analysts anticipate that the token will move within a channel between $2.65 and $5.53, with an average annualized price of $3.51. This performance would represent a potential return on investment of 324.63%.

More ambitious forecasts envision 2030 as a defining year for Plasma’s role in the blockchain economy. If TVL surpasses $10 billion and adoption accelerates in emerging markets, Plasma XPL could target highs of $24.00, with an average trading range between $15.00 and $18.50. Analysts also point to structural support near $10.00, suggesting that even in periods of correction, the token may retain significant value.

Conclusion

Plasma XPL’s trajectory from its launch to long-term forecasts illustrates both the promise and uncertainty that define emerging blockchain ecosystems. As a Bitfinex-backed Layer 1 built for stablecoin payments, Plasma has already demonstrated strong momentum with innovative features such as gas-free transfers, a native Bitcoin bridge, and flexible developer tools.

The Price Predictions published in this article are based on estimates made by industry professionals, they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.